Insiders are Scooping Up Shares of These 3 Companies

Investors closely monitor insider buys, as they can deliver a positive message to shareholders, reflecting overall business confidence.

Of course, many strict rules apply to insiders.

Insiders can’t trade based on material nonpublic information, they must pre-clear all trades, and all transactions of the company’s stock must occur during the Window Period.

In addition, insiders have a longer holding period than most, a critical aspect that investors should be aware of.

Three companies – Salesforce CRM, Illinois Tool Works ITW, and RH RH – have all seen recent insider activity. For those interested in trading like the insiders, let’s take a closer look at each.

Salesforce Director Dives in

Salesforce is the leading provider of on-demand Customer Relationship Management (CRM) software in critical operations. A director recently made a splash, acquiring roughly 2k shares at a total transaction value of just under $500k.

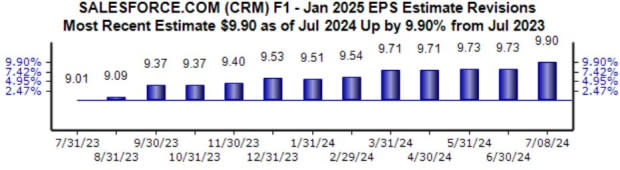

The company’s earnings outlook for its current fiscal year has shifted considerably bullish, up nearly 10% over the last year to $9.90 per share. CRM’s high-growth nature is expected to continue, with the estimate suggesting a 20% year-over-year climb.

Image Source: Zacks Investment Research

Illinois Tool Works Keeps Rewarding Shareholders

Illinois Tool Works is a global manufacturer of a diversified range of industrial products and equipment. A director recently bought 775 shares at a total cost of just above $185k. Shares have struggled year-to-date, losing roughly 10% despite posting better-than-expected results.

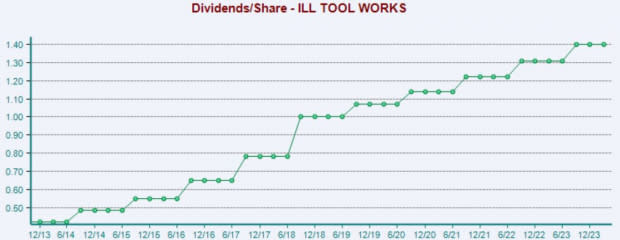

Shares could interest income-focused investors, currently yielding a solid 2.4% annually paired with a sustainable payout ratio sitting at 57% of the company’s earnings. The company has long displayed a shareholder-friendly nature, currently sporting a 6.7% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

RH CEO Steps Up

RH curates design, taste, and style in the luxury lifestyle market. The CEO recently made a notable purchase, scooping up 34.2K shares with a total transaction value of roughly $7.3 million.

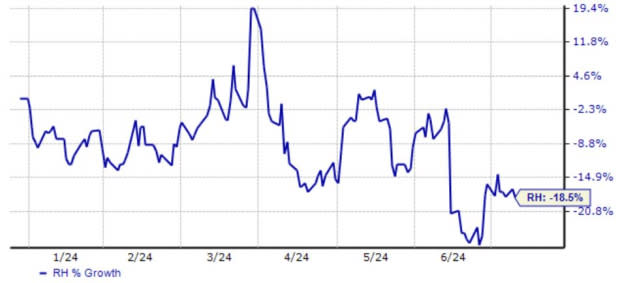

Shares have had a rough showing in 2024, losing nearly 19% and widely underperforming relative to the general market. Nonetheless, the recent news of the insider buy perked shares up, with the purchase reflecting confidence in the company’s outlook.

Image Source: Zacks Investment Research

Bottom Line

Many investors closely monitor insider buys, as they can provide a high level of confidence and conviction.

And recently, all three companies above – Salesforce CRM, Illinois Tool Works ITW, and RH RH – have seen recent insider activity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Illinois Tool Works Inc. (ITW) : Free Stock Analysis Report

Salesforce Inc. (CRM) : Free Stock Analysis Report

RH (RH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance