Insider Sell: EVP William Bastek Divests 1,612 Shares of The Home Depot Inc

The Home Depot Inc (NYSE:HD), a leading player in the home improvement retail industry, has witnessed an insider sell that has caught the attention of market watchers. On November 28, 2023, William Bastek, the Executive Vice President of Merchandising, sold 1,612 shares of the company. This transaction has prompted investors and analysts to delve deeper into the implications of such insider activity and its potential impact on the stock's performance.

Who is William Bastek of The Home Depot Inc?

William Bastek serves as the Executive Vice President of Merchandising at The Home Depot Inc. In his role, Bastek is responsible for overseeing the company's product selection, vendor negotiations, and inventory management strategies. His decisions directly influence the company's product offerings and can have a significant impact on sales and customer satisfaction. Bastek's insider position provides him with a comprehensive understanding of the company's operations and market position, making his trading activities particularly noteworthy to investors.

The Home Depot Inc's Business Description

The Home Depot Inc is a household name in the home improvement sector, operating as a retailer of building materials, home improvement products, lawn and garden products, and related services. With its headquarters in Atlanta, Georgia, the company has established a vast network of warehouse-style stores across the United States, Canada, and Mexico. The Home Depot caters to both do-it-yourself (DIY) customers and professional contractors, offering a wide array of products and services to support construction, renovation, and maintenance projects. The company's success is built on its commitment to providing high-quality products, competitive pricing, and exceptional customer service.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

The recent sale by EVP William Bastek of 1,612 shares has raised questions about the insider's confidence in the company's future performance. Over the past year, Bastek has sold a total of 1,612 shares and has not made any purchases. This one-sided transaction pattern could suggest that the insider perceives the stock to be fully valued or potentially overvalued at current levels.

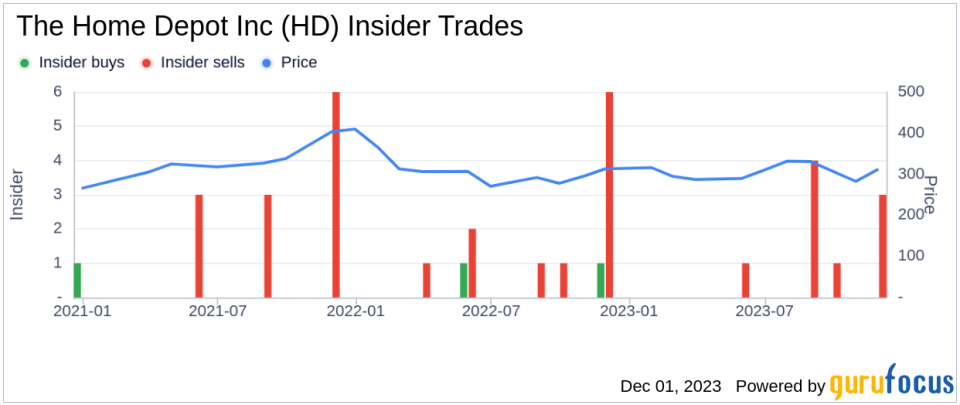

The insider transaction history for The Home Depot Inc shows a lack of insider buying over the past year, with zero insider buys recorded. On the other hand, there have been nine insider sells during the same period. This trend may indicate that insiders, including Bastek, are taking advantage of the stock's price to realize gains or reallocate their investment portfolios.

On the day of Bastek's recent sell, shares of The Home Depot Inc were trading at $313.9, giving the company a substantial market cap of $313,557.242 million. The stock's price-earnings ratio stands at 20.22, which is higher than the industry median of 16.91 but lower than the company's historical median price-earnings ratio. This suggests that while the stock is trading at a premium compared to the industry, it may still be reasonably valued in the context of its own trading history.

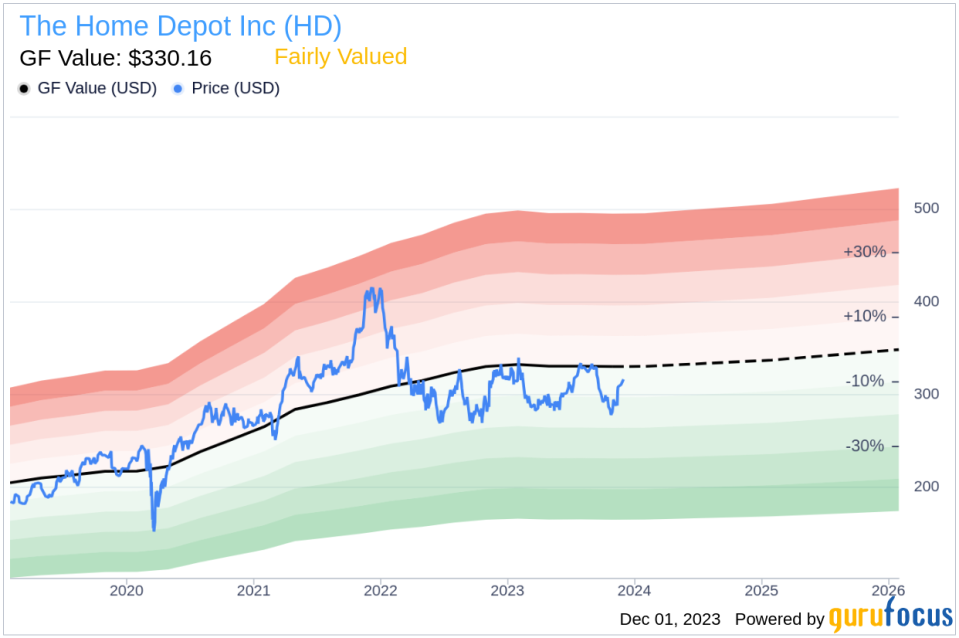

The Home Depot Inc's price-to-GF-Value ratio of 0.95, based on a trading price of $313.9 and a GuruFocus Value of $330.16, indicates that the stock is Fairly Valued. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

The insider trend image above reflects the recent selling activity and the absence of buying among insiders, which could be interpreted as a cautious signal by some market participants. However, it is essential to consider that insider sells can be motivated by various personal financial needs or portfolio strategies and do not always indicate a lack of confidence in the company's prospects.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value. The proximity of the stock's price to the GF Value suggests that the market is currently pricing The Home Depot Inc's shares in line with their fair value, considering the company's historical performance and future growth expectations.

Conclusion

In conclusion, the insider sell by EVP William Bastek may prompt investors to scrutinize The Home Depot Inc's stock valuation and future outlook. While the insider's sell activity and the broader trend of insider sells over the past year could be seen as a cautious indicator, the stock's current valuation metrics and GF Value alignment suggest that it is fairly priced. Investors should consider the broader market conditions, the company's strategic initiatives, and their investment objectives when interpreting insider trading patterns and making investment decisions.

It is also important to note that insider trading is just one of many factors that can influence a stock's performance. Comprehensive analysis, including financial performance, competitive landscape, and macroeconomic trends, should be part of an investor's due diligence process. As always, investors are encouraged to conduct their research and consult with financial advisors before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance