Insider Sell: CEO Rosty Raykov Sells 88,583 Shares of Fennec Pharmaceuticals Inc (FENC)

Fennec Pharmaceuticals Inc (NASDAQ:FENC), a biopharmaceutical company focused on the development of PEDMARK for the prevention of platinum-induced ototoxicity in pediatric cancer patients, has reported a significant insider sell transaction. According to a recent SEC Filing, the company's Chief Executive Officer, Rosty Raykov, sold 88,583 shares of the company on April 5, 2024.

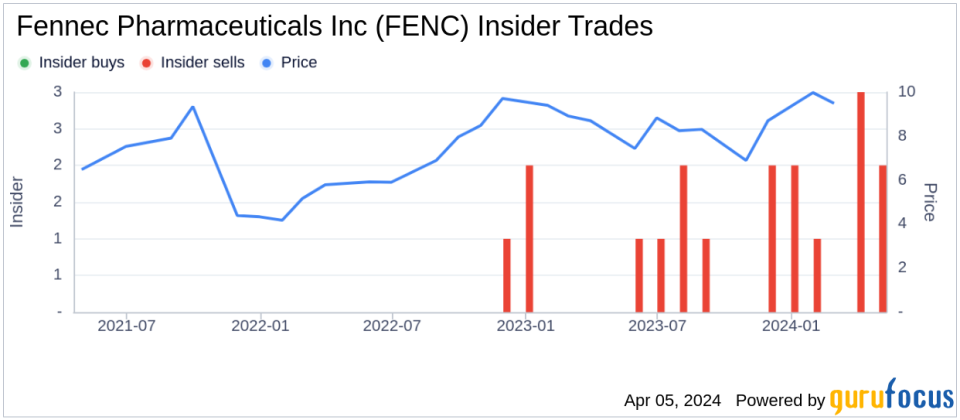

Over the past year, the insider has sold a total of 157,867 shares of Fennec Pharmaceuticals Inc and has not made any purchases of the stock. This latest transaction continues a trend of insider sells at the company, with a total of 15 insider sells and no insider buys occurring over the past year.

On the date of the reported sell, shares of Fennec Pharmaceuticals Inc were trading at $10.82 each, placing the company's market cap at approximately $294.225 million.

The insider transaction history for Fennec Pharmaceuticals Inc suggests a pattern of insider sales that could be of interest to investors monitoring insider behaviors. However, it is important to consider these transactions in the broader context of the company's performance, market conditions, and individual circumstances of the insider.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance