Insider Sale: EVP & Chief Commercial Officer Ban Teh Sells Shares of Seagate Technology ...

On May 14, 2024, Ban Teh, Executive Vice President & Chief Commercial Officer of Seagate Technology Holdings PLC (NASDAQ:STX), sold 9,703 shares of the company. The transaction was executed at a price of $95 per share, resulting in a total amount of $921,785. The sale was officially filed with the SEC, and the details can be viewed through this SEC Filing.

Seagate Technology Holdings PLC (NASDAQ:STX) is a global leader in data storage solutions. The company designs, manufactures, and markets a broad range of hard disk drives, solid state drives, and solid state hybrid drives. Seagate's products are used in a variety of applications including enterprise servers, mainframes, and workstations; desktop and notebook computers; and consumer devices such as digital video recorders, personal data backup systems, portable external storage systems, and digital media systems.

Over the past year, Ban Teh has sold a total of 32,703 shares of Seagate Technology Holdings PLC (NASDAQ:STX) and has not purchased any shares. This recent transaction follows a pattern observed in the insider transaction history for the company, which shows no insider buys and 22 insider sells over the past year.

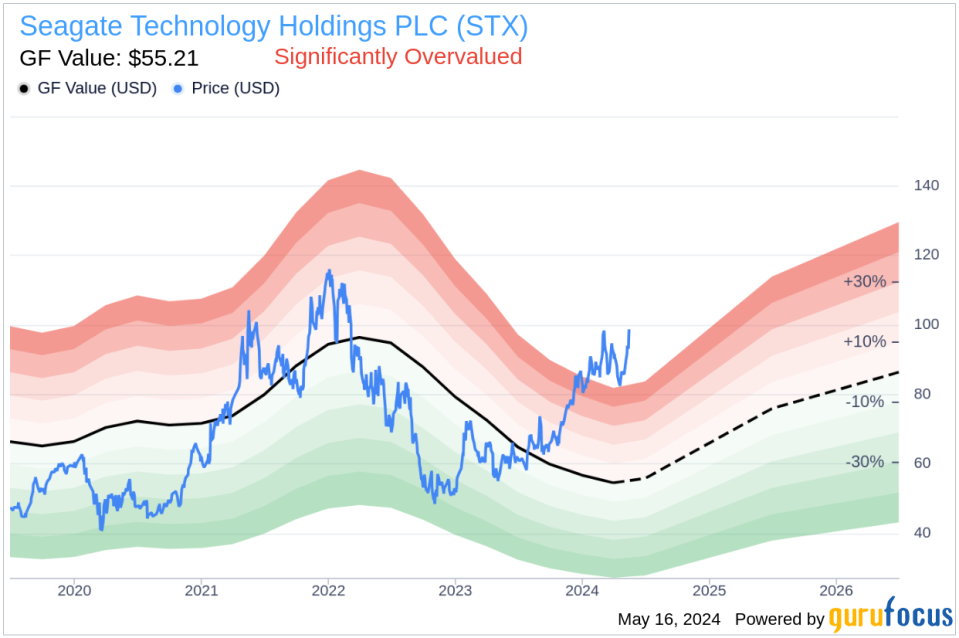

As of the latest transaction, Seagate Technology Holdings PLC (NASDAQ:STX) has a market cap of approximately $20.73 billion. The stock's price of $95 on the day of the insider's recent sale compares to a GuruFocus Value (GF Value) of $55.21, indicating a price-to-GF Value ratio of 1.72. According to GuruFocus, this suggests that the stock is Significantly Overvalued.

The GF Value is calculated based on historical multiples such as price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow, adjusted by a GuruFocus factor based on the company's past returns and growth, and future business performance estimates from Morningstar analysts.

This sale by the insider might be of interest to current and potential investors, providing insight into the insider's perspective on the stock's current valuation and future prospects.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance