Insider Sale: CFO Sheri Savage Sells Shares of Ultra Clean Holdings Inc (UCTT)

On July 8, 2024, Sheri Savage, Chief Financial Officer of Ultra Clean Holdings Inc (NASDAQ:UCTT), sold 10,079 shares of the company. The transaction was documented in a recent SEC Filing. Following this sale, the insider now owns 52,575 shares of Ultra Clean Holdings Inc.

Ultra Clean Holdings Inc specializes in the design, manufacture, and support of precision cleaning systems and components for the semiconductor industry. The company plays a crucial role in the production of integrated circuits and other semiconductor devices.

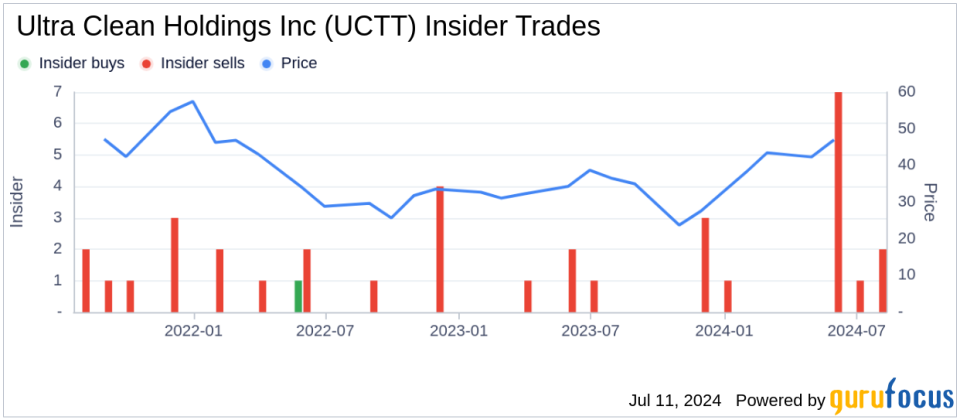

Over the past year, Sheri Savage has sold a total of 37,788 shares and has not purchased any shares. This recent transaction is part of a broader trend observed within the company, where there have been 14 insider sells and no insider buys over the past year.

Shares of Ultra Clean Holdings Inc were trading at $54.18 on the day of the sale. The company has a market cap of approximately $2.474 billion.

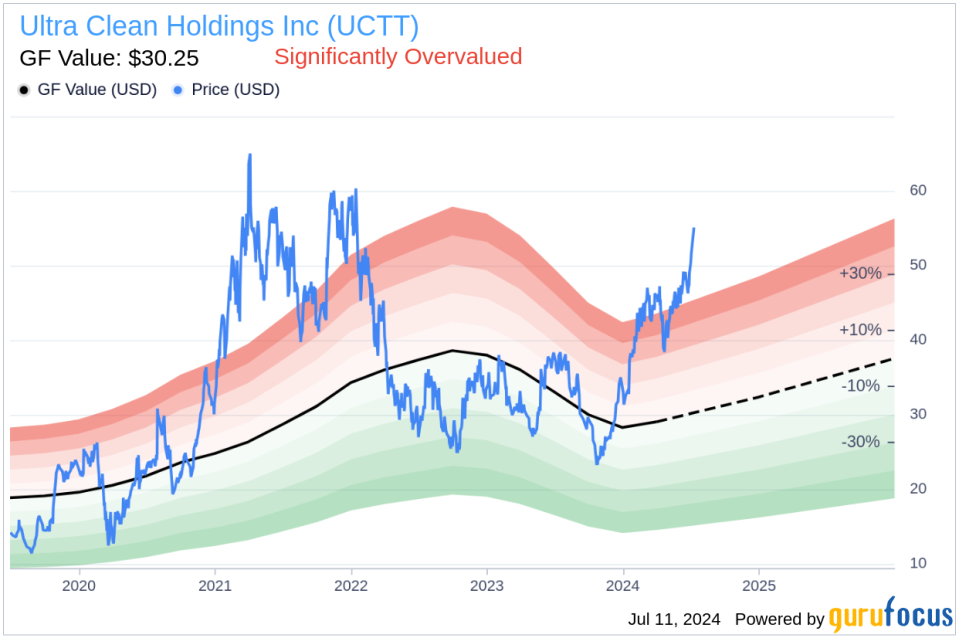

According to the GF Value, the intrinsic value of the stock is estimated at $30.25, which suggests that the stock is significantly overvalued with a price-to-GF-Value ratio of 1.79. The GF Value is calculated based on historical multiples such as price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow, adjusted for the companys past performance and expected future business results.

The insider transaction trend for Ultra Clean Holdings Inc is visualized in the above image, highlighting the recent activities of insiders within the company.

The GF Value chart provides a visual representation of the stock's valuation compared to its intrinsic value, indicating that the stock is currently trading above its estimated fair value.

This sale by the insider could be of interest to current and potential investors, providing insight into insider confidence and valuation perspectives at Ultra Clean Holdings Inc.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance