Insider-Owned TSX Growth Companies To Watch In May 2024

Amid moderating inflation and a bullish stock market trajectory, Canada's economic landscape appears increasingly favorable as we approach May 2024. This backdrop sets an intriguing stage for growth companies on the TSX, particularly those with high insider ownership, which often signals strong confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

goeasy (TSX:GSY) | 21.7% | 15.9% |

Payfare (TSX:PAY) | 15% | 57.7% |

Aritzia (TSX:ATZ) | 19% | 51.6% |

Allied Gold (TSX:AAUC) | 22.4% | 68.1% |

ROK Resources (TSXV:ROK) | 16.6% | 135.9% |

Aya Gold & Silver (TSX:AYA) | 10.2% | 51.6% |

Artemis Gold (TSXV:ARTG) | 31.8% | 45.6% |

Ivanhoe Mines (TSX:IVN) | 13.1% | 38% |

Almonty Industries (TSX:AII) | 12.4% | 82.1% |

UGE International (TSXV:UGE) | 35.4% | 63.5% |

We'll examine a selection from our screener results.

Aya Gold & Silver

Simply Wall St Growth Rating: ★★★★★☆

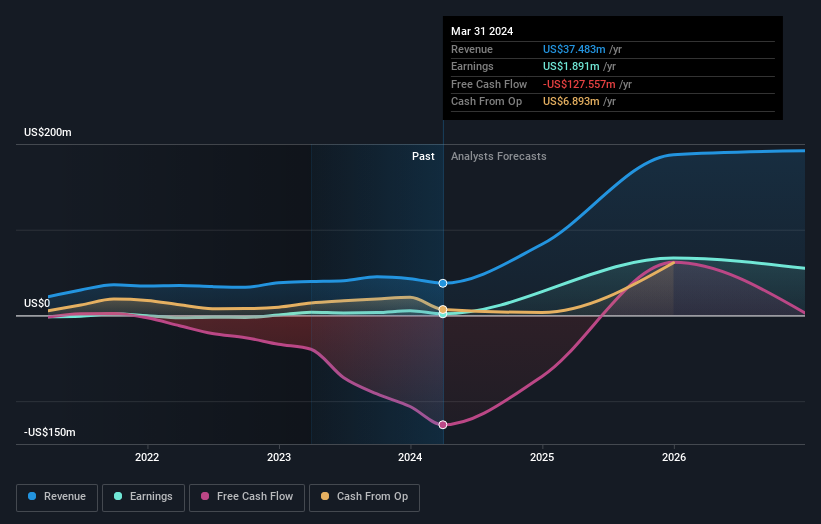

Overview: Aya Gold & Silver Inc. is a company focused on the exploration, evaluation, and development of precious metals projects in Morocco, with a market capitalization of approximately CA$2.01 billion.

Operations: The company is primarily engaged in precious metals projects in Morocco, with a market capitalization of approximately CA$2.01 billion.

Insider Ownership: 10.2%

Earnings Growth Forecast: 51.6% p.a.

Aya Gold & Silver Inc., a Canadian growth company with high insider ownership, faced a challenging first quarter in 2024, reporting a net loss of US$2.54 million and reduced sales of US$5.08 million compared to the previous year. Despite recent setbacks, including decreased silver production and earnings per share losses, Aya demonstrated potential growth through significant exploration advancements at its Boumadine project in Morocco. The company secured rights to additional exploration permits and reported promising high-grade drill results, extending the mineralized trend by 800m and showing continuity in all directions. These developments suggest potential for resource expansion and long-term value creation despite current financial fluctuations.

Colliers International Group

Simply Wall St Growth Rating: ★★★★☆☆

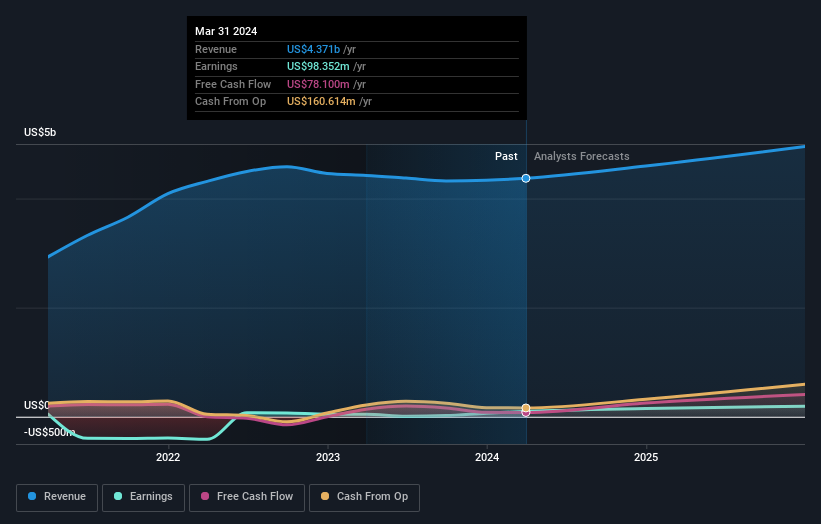

Overview: Colliers International Group Inc. operates as a global provider of commercial real estate professional and investment management services, with a market capitalization of approximately CA$7.92 billion.

Operations: The company generates revenue from various regions with CA$2.53 billion from the Americas, CA$616.58 million from the Asia Pacific, CA$489.23 million through investment management services, and CA$730.10 million from Europe, the Middle East & Africa (EMEA).

Insider Ownership: 14.2%

Earnings Growth Forecast: 36% p.a.

Colliers International Group, a growth company with high insider ownership in Canada, has shown resilience and potential for expansion. Recently, the firm reported a significant turnaround with first-quarter sales reaching US$1.002 billion and net income of US$12.66 million, recovering from a previous net loss. The company is optimistic about its revenue growth, projecting an increase of 5% to 10% for 2024. This financial improvement aligns with their strategic moves including a successful follow-on equity offering raising US$300 million and ongoing search for acquisitions to fuel further growth.

Ivanhoe Mines

Simply Wall St Growth Rating: ★★★★★☆

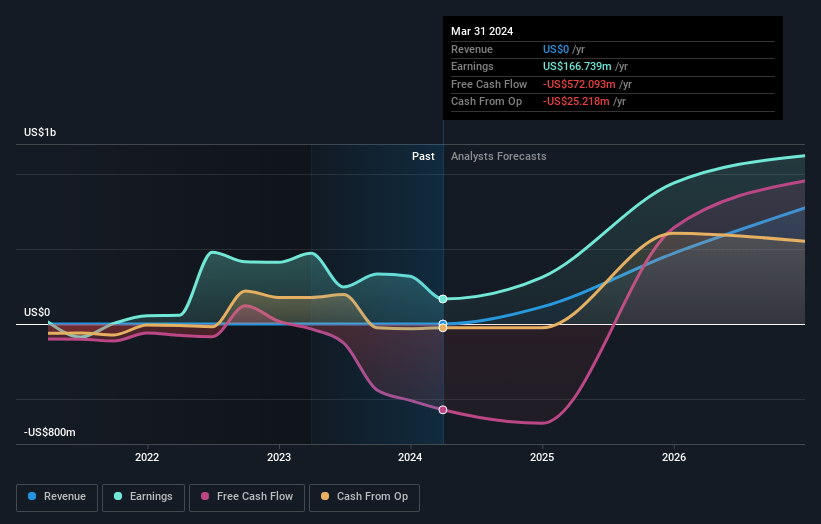

Overview: Ivanhoe Mines Ltd. specializes in the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market capitalization of approximately CA$26.77 billion.

Operations: The company primarily focuses on the extraction and processing of minerals and precious metals in Africa.

Insider Ownership: 13.1%

Earnings Growth Forecast: 38% p.a.

Ivanhoe Mines, actively pursuing mergers and acquisitions, is positioning itself as a potential acquirer rather than a target. This strategy is underscored by its commitment to expanding copper production in the Western Forelands. Despite recent financial setbacks with a first-quarter net loss of US$65.55 million, Ivanhoe maintains robust growth forecasts with expected significant earnings growth and revenue expansion outpacing the Canadian market average. The company's insider transactions show more buying than selling activity over the past three months, aligning interests with shareholder value creation.

Make It Happen

Dive into all 33 of the Fast Growing TSX Companies With High Insider Ownership we have identified here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSX:AYA TSX:CIGI and TSX:IVN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance