Insider-Owned Growth Stocks On The Rise In US June 2024

As of June 2024, the U.S. stock market presents a mixed landscape, with the Nasdaq experiencing a pullback due to a slump in semiconductor stocks, while the Dow Jones Industrial Average shows resilience with notable gains. This varied market environment underscores the importance of considering companies with high insider ownership, which can signal strong confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Celsius Holdings (NasdaqCM:CELH) | 10.5% | 21.5% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.9% | 84.1% |

BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 101.9% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

Let's review some notable picks from our screened stocks.

TeraWulf

Simply Wall St Growth Rating: ★★★★★☆

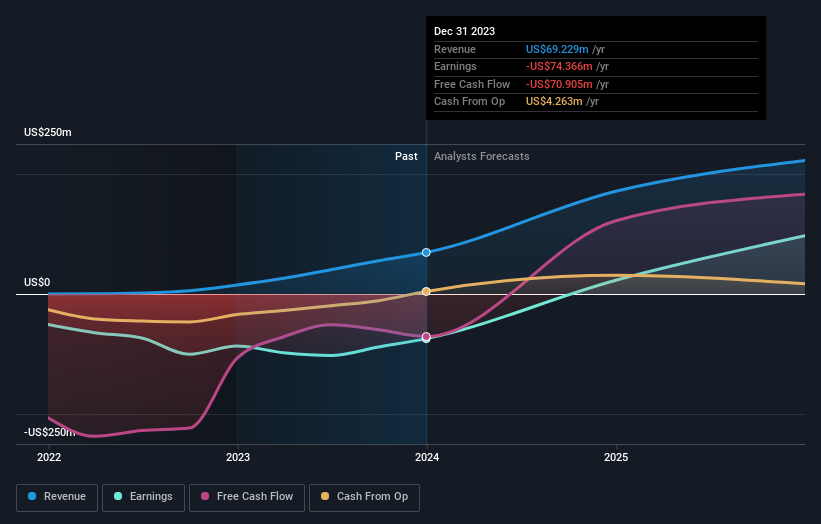

Overview: TeraWulf Inc., along with its subsidiaries, functions as a digital asset technology company in the United States, with a market capitalization of approximately $1.51 billion.

Operations: The company generates its revenue primarily through digital currency mining, totaling approximately $100.13 million.

Insider Ownership: 18.8%

TeraWulf, characterized by high insider ownership, showcases a compelling growth narrative with its revenue increasing by 280% over the past year and projected annual revenue growth of 44.2%. Despite recent operational advancements, including significant bitcoin production post-halving and a substantial reduction in net loss from US$26.26 million to US$9.61 million year-over-year, challenges persist such as share dilution and a highly volatile share price. The company's strategic debt repayment and insider transactions further paint a mixed financial health picture.

Take a closer look at TeraWulf's potential here in our earnings growth report.

Upon reviewing our latest valuation report, TeraWulf's share price might be too optimistic.

GEN Restaurant Group

Simply Wall St Growth Rating: ★★★★☆☆

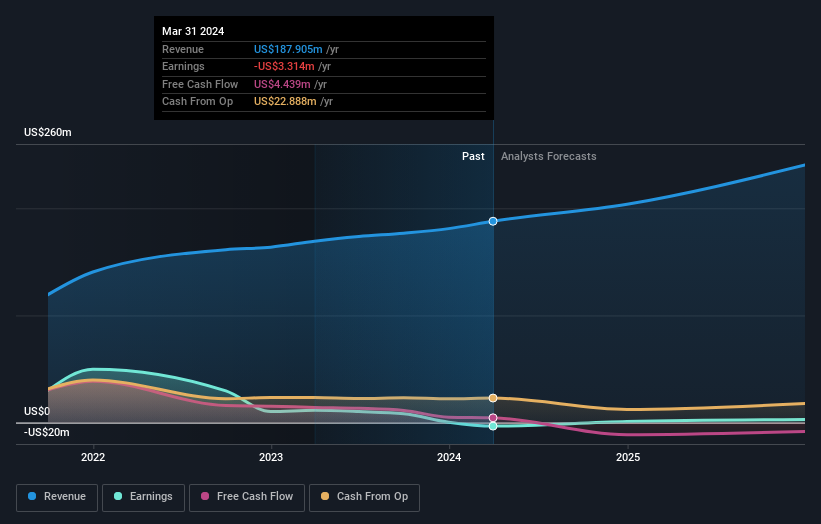

Overview: GEN Restaurant Group, Inc. operates a chain of restaurants across California, Arizona, Hawaii, Nevada, Texas, New York, and Florida with a market capitalization of approximately $321.40 million.

Operations: The company generates its revenue primarily from its restaurant operations, totaling $187.91 million.

Insider Ownership: 10.8%

GEN Restaurant Group, with significant insider ownership, is navigating a complex growth trajectory. Recently launching a premium menu to potentially boost revenue, the company reported a sales increase to US$50.76 million from US$43.86 million year-over-year in Q1 2024. However, net income dropped to US$0.496 million from US$4.13 million, reflecting potential cost challenges amid expansion efforts. Analysts forecast robust earnings growth and an expected profit within three years, suggesting a recovery path despite current volatility and modest insider buying activity.

Dingdong (Cayman)

Simply Wall St Growth Rating: ★★★★☆☆

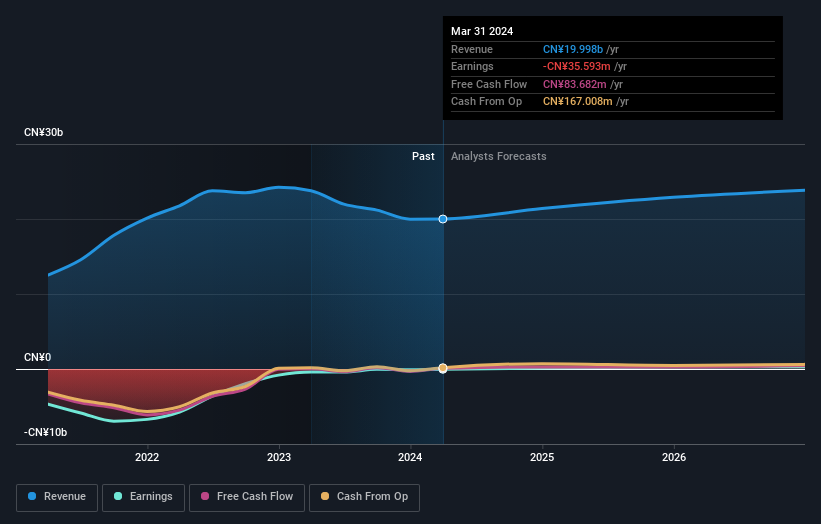

Overview: Dingdong (Cayman) Limited, an e-commerce company based in China, has a market capitalization of approximately $412.91 million.

Operations: The company generates CN¥19.998 billion from its online retail operations.

Insider Ownership: 28.7%

Dingdong (Cayman) Limited, a company with high insider ownership, has shown promising financial improvements with its first quarter revenue rising to CNY 5.02 billion and transitioning from a net loss to a profit of CNY 10.02 million. Despite slower than market average revenue growth at 6.6% annually, earnings are expected to surge by approximately 73.61% per year. The firm anticipates considerable growth in the upcoming quarters and aims for GAAP profits throughout 2024, reflecting potential operational efficiency and market adaptation.

Seize The Opportunity

Get an in-depth perspective on all 184 Fast Growing US Companies With High Insider Ownership by using our screener here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqCM:WULF NasdaqGM:GENK and NYSE:DDL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance