Insider-Owned Growth Leaders On The Japanese Exchange For July 2024

As Japan's stock markets experienced notable gains this week, with the Nikkei 225 Index climbing by 2.6% and the TOPIX Index increasing by 3.1%, investors are closely observing trends that could influence their strategies. In this context, companies with high insider ownership can be particularly appealing, as they often signal strong confidence from those most familiar with the company's potential and challenges.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.4% | 27% |

Micronics Japan (TSE:6871) | 15.3% | 39.8% |

Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

Hottolink (TSE:3680) | 27% | 57.4% |

Medley (TSE:4480) | 34% | 28.7% |

Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 44.6% |

ExaWizards (TSE:4259) | 21.9% | 91.1% |

Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

AeroEdge (TSE:7409) | 10.7% | 28.5% |

freee K.K (TSE:4478) | 23.9% | 72.9% |

Let's dive into some prime choices out of from the screener.

Kasumigaseki CapitalLtd

Simply Wall St Growth Rating: ★★★★★★

Overview: Kasumigaseki Capital Ltd operates primarily in the real estate consulting sector in Japan, with a market capitalization of approximately ¥159.01 billion.

Operations: The firm primarily generates its income from real estate consulting services across Japan.

Insider Ownership: 34.8%

Return On Equity Forecast: 37% (2027 estimate)

Kasumigaseki Capital Ltd. is poised for robust growth, with earnings expected to increase by 44.65% annually, significantly outpacing the Japanese market's average. Despite a highly volatile share price and shareholder dilution over the past year, the company maintains high-quality earnings and a strong forecasted Return on Equity of 36.7%. However, its debt is poorly covered by operating cash flow, presenting potential financial challenges. The stock currently trades at 58.5% below its estimated fair value, suggesting a potentially undervalued opportunity amidst these risks.

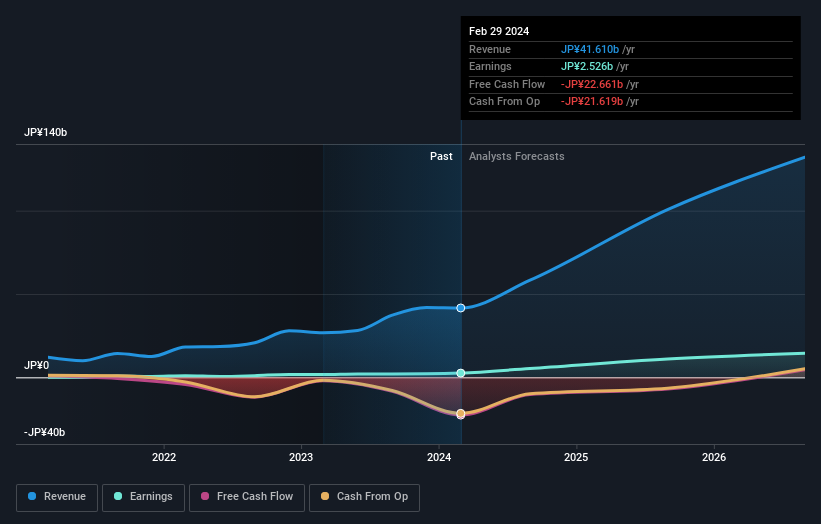

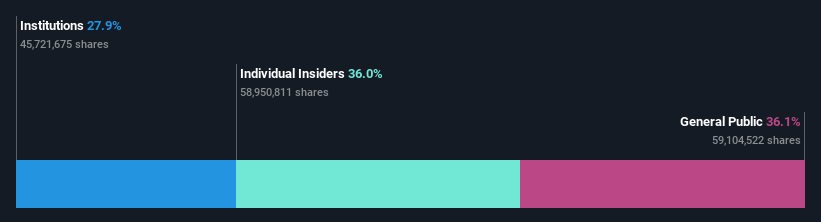

Mercari

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mercari, Inc. operates a marketplace application for buying and selling goods, serving both Japan and the United States, with a market capitalization of approximately ¥367.24 billion.

Operations: The company's revenue is generated primarily through its marketplace applications active in both Japan and the U.S.

Insider Ownership: 36%

Return On Equity Forecast: 23% (2027 estimate)

Mercari, Inc. is experiencing substantial growth with earnings and revenue both forecasted to outpace the Japanese market. Over the past year, earnings surged by 222.8%, and looking ahead, annual earnings are expected to grow by 18.9% and revenue by 9.7%. Despite this positive trajectory, growth rates are below the significant threshold of 20% per year. Recently, Mercari provided an optimistic financial outlook for FY2024, expecting revenues around JP¥190 billion and a profit of JP¥12 billion.

Dive into the specifics of Mercari here with our thorough growth forecast report.

Upon reviewing our latest valuation report, Mercari's share price might be too optimistic.

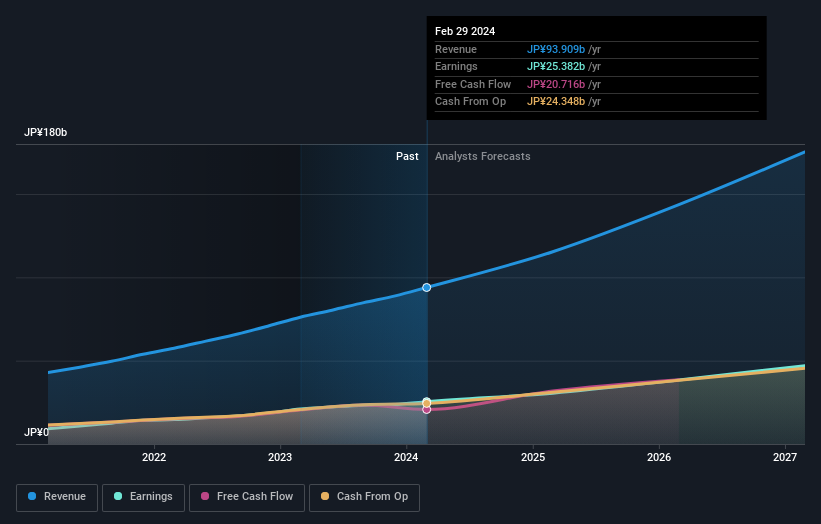

BayCurrent Consulting

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BayCurrent Consulting, Inc., a company based in Japan, offers consulting services and has a market capitalization of approximately ¥549.99 billion.

Operations: This firm primarily generates its income from consulting services within Japan.

Insider Ownership: 13.9%

Return On Equity Forecast: 33% (2027 estimate)

BayCurrent Consulting, with its recent share repurchase initiative, spent ¥3.60 billion to buy back 1.2 million shares, signaling a strategy to enhance shareholder value and improve capital efficiency. Despite a highly volatile share price in recent months, the company's revenue and earnings growth forecasts outpace the Japanese market averages at 18.3% and 18.4% respectively per year. However, these figures are slightly below the significant growth benchmark of 20%. Moreover, BayCurrent's Return on Equity is expected to be strong at 33.4% in three years, reflecting high-quality earnings and financial health.

Summing It All Up

Embark on your investment journey to our 98 Fast Growing Japanese Companies With High Insider Ownership selection here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:3498 TSE:4385 and TSE:6532.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance