Insider-Owned Growth Leaders On The Japanese Exchange In July 2024

As Japan's stock markets hit all-time highs in July 2024, driven by a weakening yen and robust wage growth, investors are keenly observing trends that could influence their portfolios. In this context, companies with high insider ownership often signal strong confidence in the business’s prospects, potentially making them attractive options amidst the broader market dynamics.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.4% | 26.9% |

Hottolink (TSE:3680) | 27% | 57.4% |

Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 42.3% |

Medley (TSE:4480) | 34% | 28.7% |

Micronics Japan (TSE:6871) | 15.3% | 39.8% |

Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

ExaWizards (TSE:4259) | 21.9% | 91.1% |

Astroscale Holdings (TSE:186A) | 20.9% | 90% |

Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

freee K.K (TSE:4478) | 23.9% | 72.9% |

Here's a peek at a few of the choices from the screener.

SHIFT

Simply Wall St Growth Rating: ★★★★★★

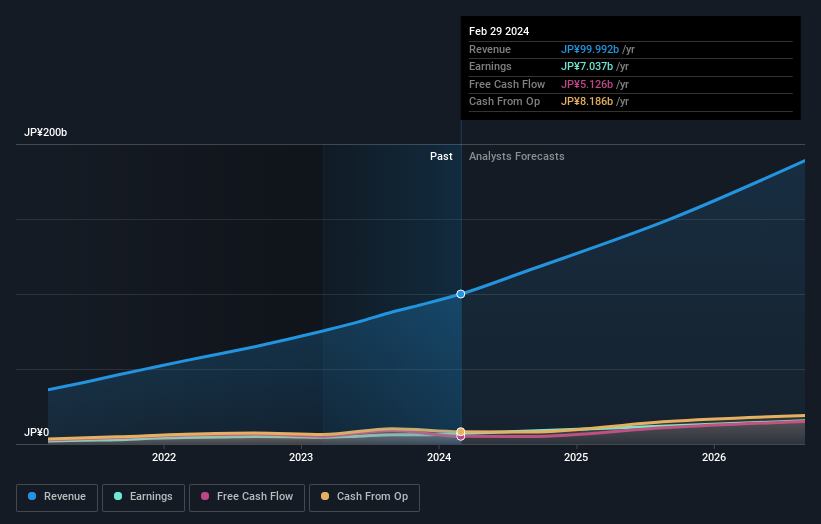

Overview: SHIFT Inc., operating in Japan, specializes in providing software quality assurance and testing solutions, with a market capitalization of approximately ¥271.53 billion.

Operations: The company specializes in software quality assurance and testing solutions.

Insider Ownership: 35.4%

SHIFT, a Japanese company, is poised for significant growth with its earnings expected to increase by 26.94% annually. This growth rate surpasses the broader Japanese market's forecast of 8.9%. Additionally, SHIFT's revenue is also set to rise at 21.5% per year, outpacing the market projection of 4.3%. Despite these promising forecasts and trading at a value considered 25.9% below its fair value, the company faces challenges with a highly volatile share price over recent months.

Dive into the specifics of SHIFT here with our thorough growth forecast report.

Upon reviewing our latest valuation report, SHIFT's share price might be too optimistic.

PARK24

Simply Wall St Growth Rating: ★★★★☆☆

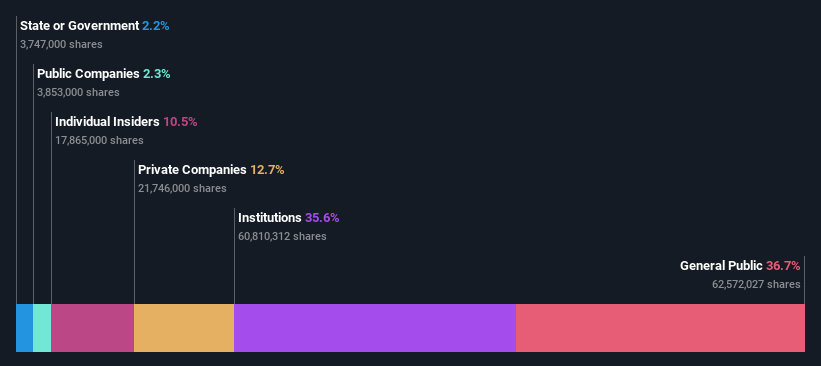

Overview: PARK24 Co., Ltd. specializes in operating and managing parking facilities both in Japan and internationally, with a market capitalization of approximately ¥270.22 billion.

Operations: The company generates its revenue primarily from the operation and management of parking facilities across domestic and international markets.

Insider Ownership: 10.5%

PARK24, a Japanese firm, is trading at 14.7% below its estimated fair value and shows promising growth prospects with earnings expected to increase by 12.9% annually, outperforming the Japanese market forecast of 8.9%. Despite a high level of debt, the company's return on equity is anticipated to reach a robust 25.6% in three years. However, its revenue growth at 5.8% per year lags behind more aggressive growth benchmarks but still exceeds the broader market's 4.3%.

SaizeriyaLtd

Simply Wall St Growth Rating: ★★★★☆☆

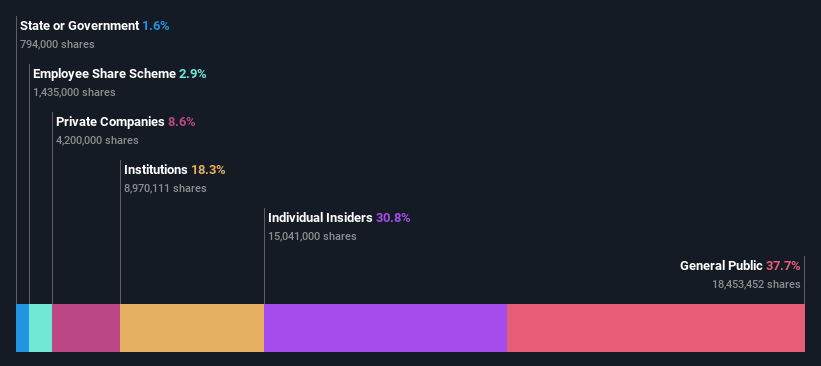

Overview: Saizeriya Co., Ltd. operates a chain of Italian-themed restaurants across Japan, Australia, and Asia, with a market capitalization of approximately ¥280.54 billion.

Operations: The company generates its revenue primarily from its Italian-themed dining establishments located across Japan, Australia, and Asia.

Insider Ownership: 30.2%

Saizeriya Ltd., a Japanese dining chain, demonstrates a robust earnings forecast with an expected annual growth of 23.8%, significantly outpacing the broader Japanese market's 8.9%. While its revenue growth is modest at 6.9% annually, it still exceeds the market average of 4.3%. Despite this, analysts predict a substantial potential stock price increase of 25.6%. However, its return on equity is projected to remain low at 10.7%, and the stock has experienced high volatility recently.

Turning Ideas Into Actions

Access the full spectrum of 101 Fast Growing Japanese Companies With High Insider Ownership by clicking on this link.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:3697TSE:4666 and TSE:7581.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance