Insider-Owned Growth Leaders On The Indian Exchange For May 2024

The Indian market has experienced a notable upswing over the past year, increasing by 39%, despite a recent 1.5% dip in the last week. In this context, stocks with high insider ownership can be particularly compelling, as they often indicate strong confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In India

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 29.0% |

Pitti Engineering (BSE:513519) | 33.6% | 36.5% |

Triveni Turbine (BSE:533655) | 28.6% | 21.1% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Dixon Technologies (India) (NSEI:DIXON) | 25% | 26.7% |

Jupiter Wagons (NSEI:JWL) | 11.1% | 25.8% |

Paisalo Digital (BSE:532900) | 16.3% | 27.8% |

MTAR Technologies (NSEI:MTARTECH) | 38.4% | 41.7% |

Aether Industries (NSEI:AETHER) | 31.1% | 40.5% |

Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 35.5% |

Let's take a closer look at a couple of our picks from the screened companies.

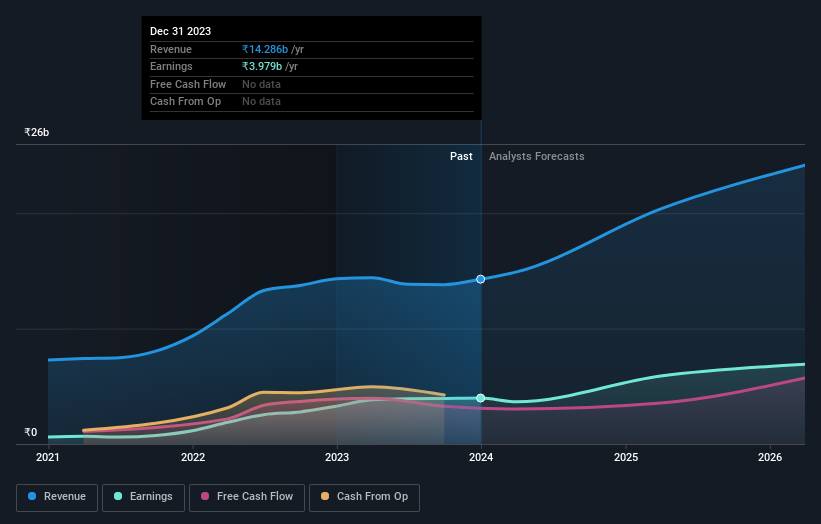

Archean Chemical Industries

Simply Wall St Growth Rating: ★★★★★★

Overview: Archean Chemical Industries Limited, which operates both in India and internationally, specializes in the manufacture and sale of specialty marine chemicals, with a market capitalization of approximately ₹79.69 billion.

Operations: The company generates ₹14.29 billion in revenue from its specialty marine chemicals segment.

Insider Ownership: 22.9%

Archean Chemical Industries, a growth-focused company in India with high insider ownership, is trading at 28% below its estimated fair value. The company's revenue and earnings are expected to grow significantly, outpacing the Indian market average with annual revenue and profit growth forecasts of 25% and 29%, respectively. However, recent financial results show a decline in both quarterly and annual net income compared to the previous year, alongside an unstable dividend track record. This juxtaposition highlights potential concerns amidst its growth trajectory.

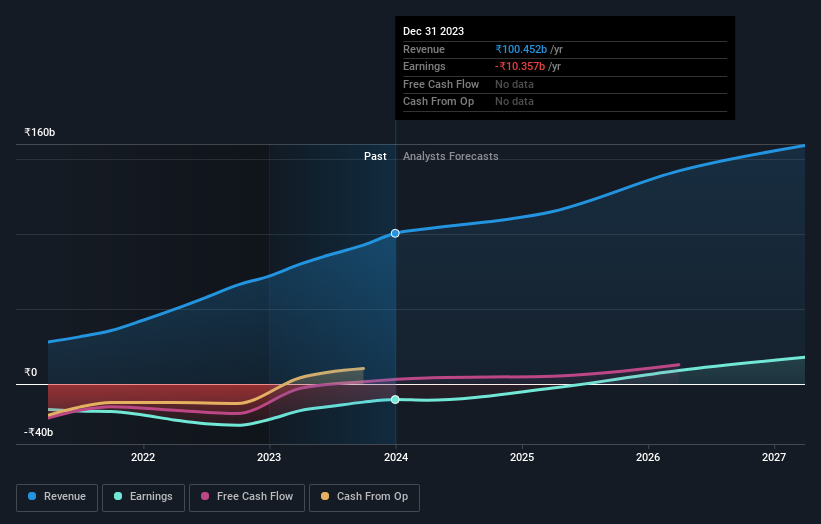

One97 Communications

Simply Wall St Growth Rating: ★★★★☆☆

Overview: One97 Communications Limited, operating under the brand name Paytm, offers payment, commerce and cloud, and financial services in India with a market capitalization of approximately ₹216.20 billion.

Operations: The company generates ₹10.05 billion in revenue from its data processing segment.

Insider Ownership: 19.5%

One97 Communications, recognized for its growth potential in India, is projected to see significant earnings expansion at an annual rate of 55.99%. Despite this promising outlook, the company's return on equity is expected to remain low at 3.8% over the next three years. Recent executive changes, including the resignation of key personnel like Bhavesh Gupta and Praveen Sharma, coupled with board restructuring to include seasoned professionals from diverse backgrounds such as banking and public administration, underscore a period of organizational transformation which could impact performance.

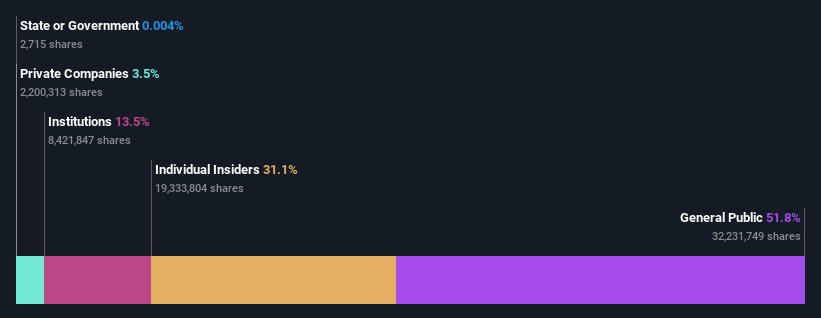

VA Tech Wabag

Simply Wall St Growth Rating: ★★★★☆☆

Overview: VA Tech Wabag Limited operates in the water treatment industry, focusing on the design, supply, installation, construction, and operational management of various water facilities globally, with a market capitalization of approximately ₹58.82 billion.

Operations: The company generates revenue primarily through the construction and maintenance of water treatment plants, totaling ₹28.49 billion.

Insider Ownership: 31.1%

VA Tech Wabag, despite a highly volatile share price recently, shows promising growth with earnings expected to rise by 42.67% annually. This outpaces the broader Indian market's forecast of 17.1%. However, profit margins have declined from last year's 5.8% to 2.2%, reflecting challenges in maintaining profitability amid growth. Recent board meetings focused on shareholder agreements suggest strategic initiatives that might influence future performance, aligning with its high insider ownership structure which typically signals strong vested interests in company success.

Taking Advantage

Access the full spectrum of 87 Fast Growing Indian Companies With High Insider Ownership by clicking on this link.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NSEI:ACINSEI:PAYTM and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance