Insider Buying: President & CEO Campbell Douglas W. Jr. ...

America's Car-Mart Inc (NASDAQ:CRMT), a prominent automotive retailer in the United States specializing in the "Buy Here/Pay Here" segment of the used car market, has witnessed a notable insider transaction. President & CEO Campbell Douglas W. Jr. has increased his stake in the company by purchasing 3,229 shares. This transaction took place on April 8, 2024, as reported in the SEC Filing.Over the past year, the insider has executed a total of 3,229 share purchases and has not sold any shares. This recent acquisition further aligns the President & CEO's interests with those of shareholders and could be interpreted as a sign of confidence in the company's future prospects.

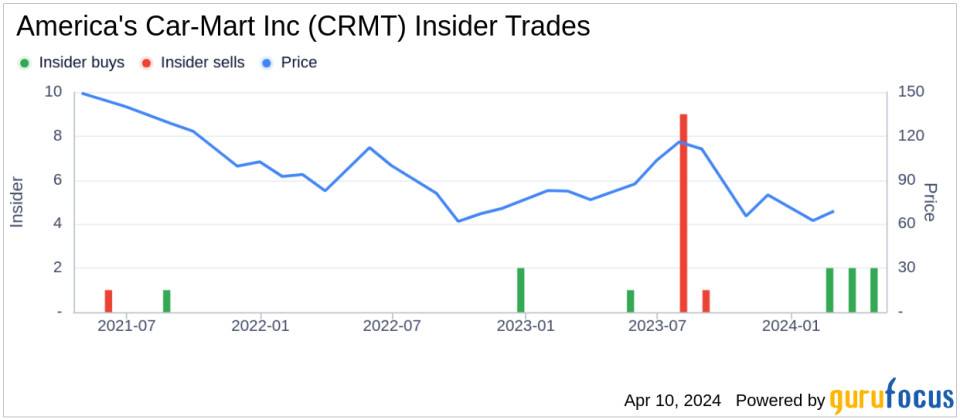

Insider Trends

The insider transaction history at America's Car-Mart Inc reveals a pattern of insider activity. In the past year, there have been 7 insider buys and 10 insider sells. This activity provides a glimpse into the sentiment of those with intimate knowledge of the company.

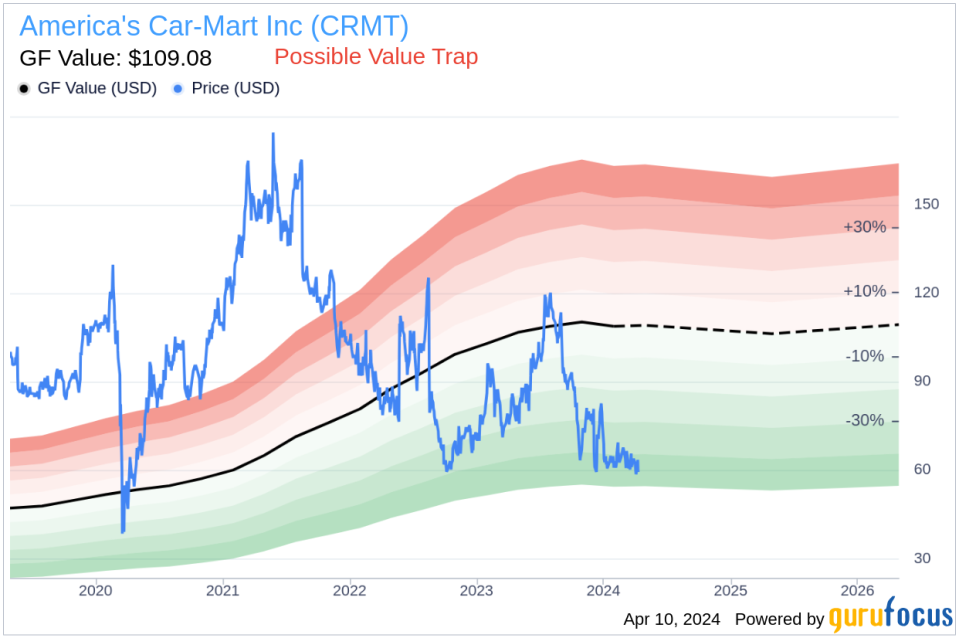

Valuation and Market Cap

On the date of the insider's recent purchase, shares of America's Car-Mart Inc were trading at $61.62, resulting in a market capitalization of $379.56 million.The stock's valuation, when compared to the GuruFocus Value (GF Value) of $109.08, indicates a price-to-GF-Value ratio of 0.56. This suggests that the stock is currently positioned as a Possible Value Trap, Think Twice, according to the GF Value metric.

The GF Value is a proprietary intrinsic value estimate from GuruFocus, which is derived from historical trading multiples such as the price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow. It also incorporates a GuruFocus adjustment factor based on the company's historical returns and growth, as well as future business performance estimates provided by Morningstar analysts.America's Car-Mart Inc operates automotive dealerships in the United States and is known for providing financing to customers who typically have limited access to traditional credit resources. The company's business model focuses on selling quality used vehicles and providing financing for substantially all of its customers.The recent insider buying activity at America's Car-Mart Inc, particularly by the President & CEO, may offer insights into the company's valuation and the sentiment of its leadership. Investors and analysts often monitor insider transactions as they can provide valuable context for a company's financial health and future direction.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance