How Innovative is Appian?

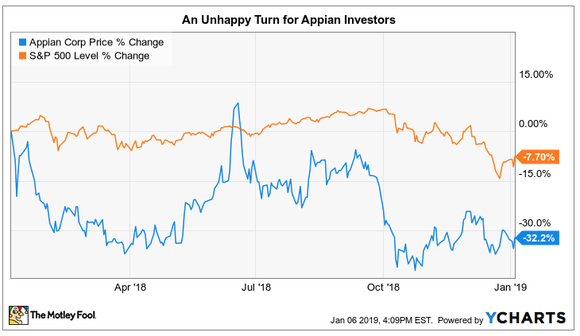

Organic innovation is hard enough. Creating products that help usher in entirely new categories is rare. The most innovative companies do both to disrupt incumbents and unleash massive wealth for early investors. Is Appian (NASDAQ: APPN), which 20 years ago helped pioneer effective visual software programming, that sort of multibagger in the making? Not if you're looking at returns over the past year.

Source: YCharts. Appian stock has underperformed over the past year.

Talk about an ugly chart. And yet total revenue was up 36% to $217.1 million over the trailing 12 months ended on Sept. 30. Why should you care about that? Because analysts are calling for Appian to generate $222.2 million in revenue for all of 2018. A mere 10% year-over-year bump in Q4 revenue would allow the company to hit that mark.

The last time Appian's top line grew that slowly was the first quarter of fiscal 2017,when professional services still accounted for the majority of its revenue. Today long-term subscriptions are driving growth. Anyone poking around Appian's roster of customer success stories using its "low-code" visual programming platform won't be surprised by that. Customers who try Appian tend to love it and stick with it.

Regardless, there are sure to be bumps for Appian investors along the road to greater returns. Competition is just one of the potential stumbling blocks. Analyst firm Gartner (NYSE: IT) identifies 18 companies besides Appian operating in the Intelligent Business Process Management marketplace with Pegasystems (NASDAQ: PEGA) ranked as a visionary leader and Appian as Gartner's choice for tops in execution.

Ambitious, effective innovation will be required for continued gains in this tough category, so it's worth understanding how effective Appian's R&D efforts have been to date, and whether we have reason to expect even better results in the future. Let's go under the hood and apply my four-question test.

Innovation isn't just about bright ideas. Source: Getty Images.

Revisiting the innovation test

You may remember that I created the innovation test as a means of understanding the quality of engineering efforts when making a complex product with rule-breaking potential. Here are the four core categories and the questions within:

1. Organic growth: Does the company have internally developed products? What are they, and when were they released?

2. R&D output: Is overall revenue growing faster than R&D investment over the period when these products were released? By how much?

3. Pricing power: Is gross margin expanding?

4. Pipeline: Can you point to evidence of new products being developed? How soon will they be released?

"Version 1.0" of the test was serviceable enough, featuring just yes-or-no answers. But then a closer look at some other companies revealed a flaw: What if some attributes are more valuable than others?

Fool CEO Tom Gardner put that question to me. Since it's generally good for job security to listen when the chief executive speaks, version 2.0 of the innovation test includes a sliding-scale scoring system -- here's how it works:

+2 for a yes to question 1, +1 if the company has acquired a significant portion of its growth yet managed to still integrate and create winning products (think Disney and Salesforce), and 0 if you can't identify sources of organic growth.

+1 or +0 for question 2. There are different reasons why R&D would outpace revenue growth for a time, but it's better if we leverage from experiments.

+1 or +0 for question 3. Since gross margin reflects a degree of pricing power, we prefer to see innovation lead to demand, which in turn leads to pricing power.

+1 or -1 for question 4. Innovators always have new products in the pipeline.

In tweaking, I'm placing a bit more emphasis on organic growth and penalizing "one-hit wonders" that have a great product but nothing in the pipeline.

Survey says?

Now, on to our quiz. Here's how Appian rates as an innovator:

Does Appian have internally developed products? What are they? When were they released?

Yes (plus 2). Appian's core platform for low-code development was 100% developed in-house. The company hasn't made any acquisitions since opening for business in 1999. Mainly the company focuses on delighting customers and is adding capabilities slowly. But its overall solution to customer problems is comprehensive enough that only Pegasystems rates as more visionary in the most recently available Gartner Magic Quadrant for low-code platforms.

Is subscription revenue growing faster than investment in R&D over the period when these products were released? By how much?

No (plus 0). R&D spend is up 206.7% from 2014 through the trailing 12 months. The good news? Appian is trending well, with revenue up 143.9% over the same period. I also like that investment dollars seem to be put to good use with the change in deferred revenue rising rapidly over the past three years. Subscriptions are driving that growth and should lead to substantial free cash flow over time. (Subscription revenue jumped 42% year over year to $29.4 million in the third quarter. Total revenue rose 23% to $54.9 million over the same period. Subscriptions accounted for 53.6% of revenue in Q3.)

Is gross margin expanding?

Mostly (plus 0.5). While Appian's overall gross margin is up 380 basis points since the end of the 2014 fiscal year -- a meaningful sum -- the gross margin metric tends to bounce around from year to year and is down over the trailing 12 months when compared to fiscal 2017. Half credit is appropriate here.

Can you point to evidence of new products being developed? How soon will they be released?

Yes (plus 1). A key benefit of Appian's business is that once they build a solution for a customer -- an automated business process -- the company can sell a generic version of that same process as a product for a new deployment with a new customer, tailoring accordingly. This is why, at the Appian website, you have the option to explore 14 different types of low-code solutions for different markets and problems.

With 3.5 out of the maximum 5 points, it's clear to me that Appian is an underappreciated innovator with room to grow, which improves the odds of the stock's beating the market by a wide margin in the years to come.

More From The Motley Fool

Tim Beyers owns shares of Appian. The Motley Fool owns shares of and recommends Appian. The Motley Fool recommends Gartner and Pegasystems. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance