Industrial Packaging Stocks Q1 Highlights: Berry Global Group (NYSE:BERY)

As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at industrial packaging stocks, starting with Berry Global Group (NYSE:BERY).

Industrial packaging companies have built competitive advantages from economies of scale that lead to advantaged purchasing and capital investments that are difficult and expensive to replicate. Recently, eco-friendly packaging and conservation are driving customers preferences and innovation. For example, plastic is not as desirable a material as it once was. Despite being integral to consumer goods ranging from beer to toothpaste to laundry detergent, these companies are still at the whim of the macro, especially consumer health and consumer willingness to spend.

The 8 industrial packaging stocks we track reported a weaker Q1; on average, revenues missed analyst consensus estimates by 2.2%. while next quarter's revenue guidance was 2.1% below consensus. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and while some of the industrial packaging stocks have fared somewhat better than others, they collectively declined, with share prices falling 4.1% on average since the previous earnings results.

Berry Global Group (NYSE:BERY)

Founded as Imperial Plastics, Berry Global (NYSE: BERY) is a manufacturer and marketer of plastic packaging products, including containers, bottles, and prescription packaging.

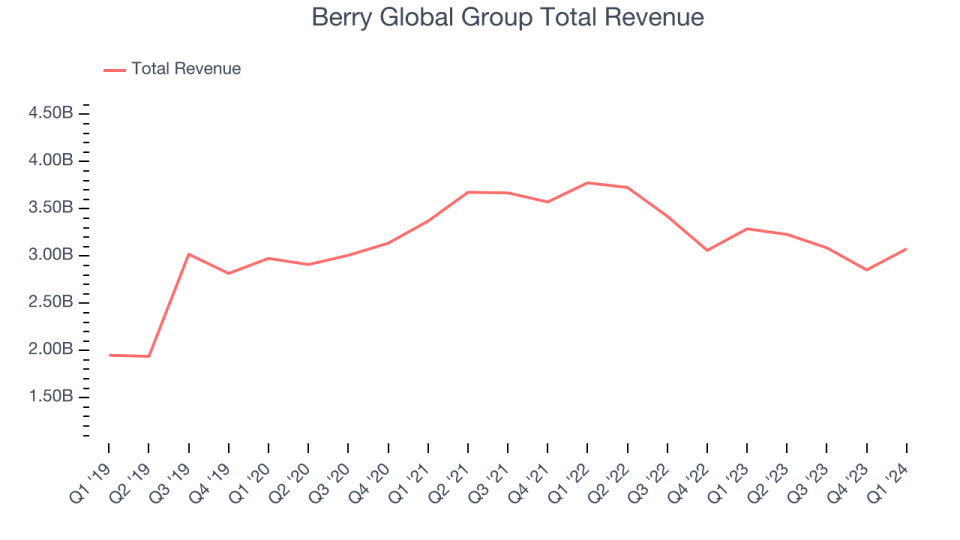

Berry Global Group reported revenues of $3.08 billion, down 6.4% year on year, falling short of analysts' expectations by 2.1%. It was a weak quarter for the company, with a miss of analysts' organic revenue estimates.

“This announcement is the culmination of a comprehensive review to determine the highest value alternative for Berry shareholders. We believe these two businesses can drive significant value for their respective stakeholders with more focused portfolios, positioning each for greater success. Berry will now become a pure-play leading supplier of innovative, sustainable global packaging solutions and we believe this focus will result in an even more predictable, stable earnings and growth profile for Berry. This proposed transaction is a significant step in the optimization of our portfolio and allows Berry’s management team to be one hundred percent laser-focused on driving consistent long-term growth with a more simplified and aligned portfolio,” stated Kevin Kwilinski, Berry’s CEO.

The stock is down 4.1% since the results and currently trades at $58.72.

Read our full report on Berry Global Group here, it's free.

Best Q1: Sealed Air (NYSE:SEE)

Founded in 1960, Sealed Air Corporation (NYSE: SEE) specializes in the development and production of protective and food packaging solutions, serving a variety of industries.

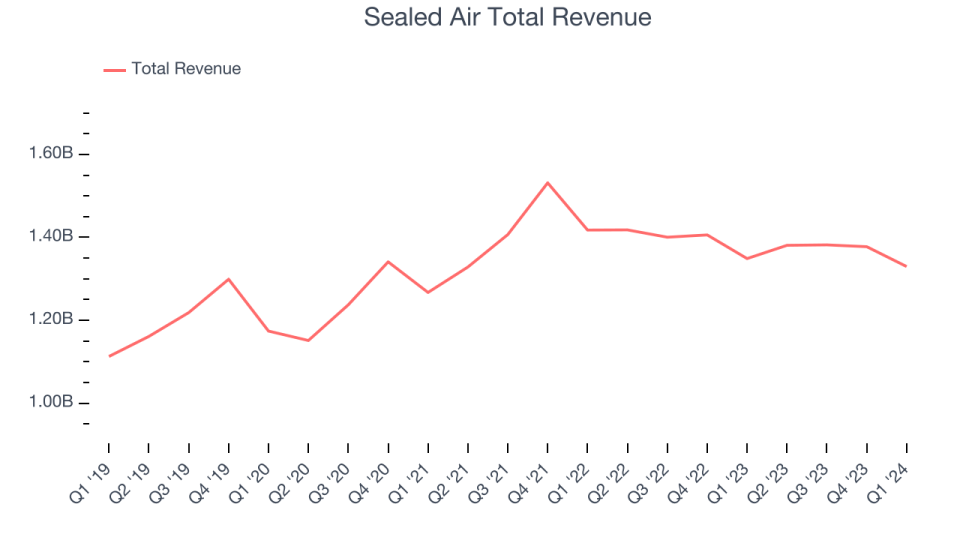

Sealed Air reported revenues of $1.33 billion, down 1.4% year on year, outperforming analysts' expectations by 3.8%. It was a very strong quarter for the company, with an impressive beat of analysts' volume and earnings estimates.

Sealed Air scored the biggest analyst estimates beat among its peers. The stock is up 6.4% since the results and currently trades at $34.12.

Is now the time to buy Sealed Air? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Silgan Holdings (NYSE:SLGN)

Established in 1987, Silgan Holdings (NYSE:SLGN) is a supplier of rigid packaging for consumer goods products, specializing in metal containers, closures, and plastic packaging.

Silgan Holdings reported revenues of $1.32 billion, down 7.1% year on year, falling short of analysts' expectations by 4.1%. It was a weak quarter for the company, with a miss of analysts' organic revenue estimates.

The stock is down 10.4% since the results and currently trades at $41.81.

Read our full analysis of Silgan Holdings's results here.

Crown Holdings (NYSE:CCK)

Formerly Crown Cork & Seal, Crown Holdings (NYSE:CCK) produces packaging products for consumer marketing companies, including food, beverage, household, and industrial products.

Crown Holdings reported revenues of $2.78 billion, down 6.4% year on year, falling short of analysts' expectations by 5.1%. It was a weak quarter for the company, with a miss of analysts' revenue estimates.

The stock is down 9.7% since the results and currently trades at $73.22.

Read our full, actionable report on Crown Holdings here, it's free.

Packaging Corporation of America (NYSE:PKG)

Founded in 1959, Packaging Corporation of America (NYSE: PKG) produces containerboard and corrugated packaging products, also offering displays and protective packaging solutions.

Packaging Corporation of America reported revenues of $1.98 billion, flat year on year, surpassing analysts' expectations by 3.7%. It was a strong quarter for the company, with an impressive beat of analysts' volume estimates and a narrow beat of analysts' earnings estimates.

The stock is down 1.2% since the results and currently trades at $177.

Read our full, actionable report on Packaging Corporation of America here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance