Indian Exchange Growth Stocks With High Insider Ownership And Up To 72% Earnings Growth

The Indian market has shown robust growth, with the Industrials sector gaining 3.6% over the last week and the overall market surging 41% in the past year. In this thriving environment, stocks with high insider ownership and strong earnings growth potential stand out as particularly compelling opportunities for investors.

Top 10 Growth Companies With High Insider Ownership In India

Name | Insider Ownership | Earnings Growth |

Pitti Engineering (BSE:513519) | 33.6% | 36.5% |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 36.5% |

Triveni Turbine (BSE:533655) | 28.6% | 21.1% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Dixon Technologies (India) (NSEI:DIXON) | 25% | 27% |

Jupiter Wagons (NSEI:JWL) | 11.1% | 25.8% |

Paisalo Digital (BSE:532900) | 16.3% | 27.8% |

MTAR Technologies (NSEI:MTARTECH) | 38.4% | 41.7% |

Steel Strips Wheels (BSE:513262) | 35.9% | 26.5% |

Kirloskar Pneumatic (BSE:505283) | 30.7% | 27.7% |

Here's a peek at a few of the choices from the screener.

Arvind Fashions

Simply Wall St Growth Rating: ★★★★☆☆

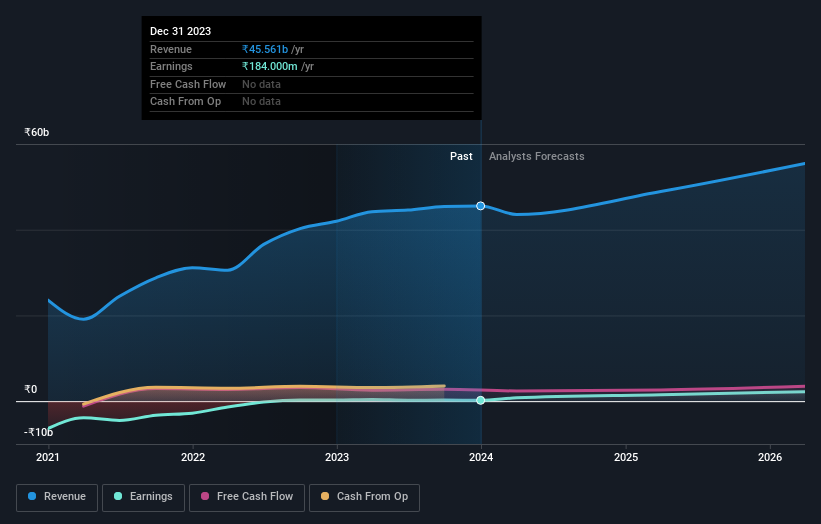

Overview: Arvind Fashions Limited operates in India, specializing in the retail of garments, cosmetics, and accessories with a market capitalization of approximately ₹61.80 billion.

Operations: The company's revenue from branded apparel, including garments and accessories, totals approximately ₹45.56 billion.

Insider Ownership: 13.7%

Earnings Growth Forecast: 72.7% p.a.

Arvind Fashions is poised for significant growth, with earnings expected to increase by 72.7% annually over the next three years, outpacing the broader Indian market's forecast of 17% per year. Despite trading at a good value relative to its peers and industry expectations, the company faces challenges with low profit margins—currently at 0.4%, down from 0.6% last year—and interest payments that are not well covered by earnings. Analysts predict a potential price increase of 22.8%.

Mrs. Bectors Food Specialities

Simply Wall St Growth Rating: ★★★★☆☆

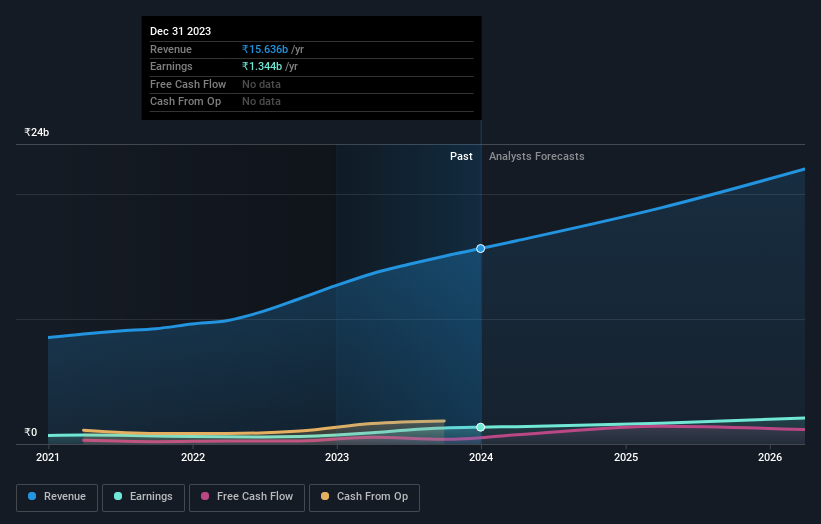

Overview: Mrs. Bectors Food Specialities Limited, with a market capitalization of ₹76.21 billion, operates in India where it manufactures and distributes a diverse range of food products.

Operations: The company generates ₹15.64 billion in revenue from its food products segment.

Insider Ownership: 36.2%

Earnings Growth Forecast: 20% p.a.

Mrs. Bectors Food Specialities demonstrates a robust growth trajectory with a forecasted annual earnings increase of 20%, surpassing the Indian market's average of 17%. Despite slower revenue growth projections at 15.4% compared to the more aggressive market benchmarks, its recent earnings surged by 85.1% over the past year, highlighting significant operational improvements. Frequent shareholder and analyst calls suggest active engagement and transparency with investors, reinforcing confidence in management amidst this growth phase.

Five-Star Business Finance

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Five-Star Business Finance Limited, operating as a non-banking financial company in India, has a market capitalization of approximately ₹224.56 billion.

Operations: The company generates revenue primarily from MSME loans, housing loans, and property loans, totaling approximately ₹16.59 billion.

Insider Ownership: 19.7%

Earnings Growth Forecast: 19.3% p.a.

Five-Star Business Finance Limited has shown strong financial performance, with a significant increase in annual revenue to INR 21.95 billion and net income to INR 8.36 billion. Despite recent board resignations, the company's earnings growth outpaces the market, forecasted at 19.3% per year compared to the Indian market's 17%. However, its debt is not well covered by operating cash flow, posing potential risks. The firm's price-to-earnings ratio stands favorably at 26.9x against the broader Indian market average of 31.3x.

Next Steps

Embark on your investment journey to our 88 Fast Growing Indian Companies With High Insider Ownership selection here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NSEI:ARVINDFASNNSEI:BECTORFOODNSEI:FIVESTAR and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance