India ETFs: A Train Wreck Awaits

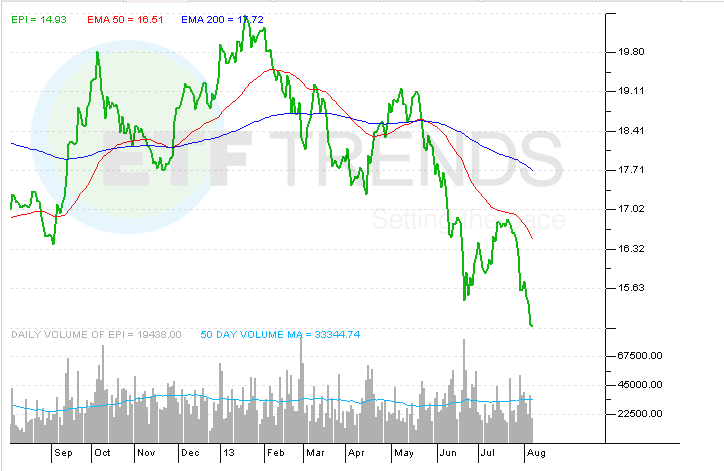

Exchange traded funds offering exposure to India, Asia’s third-largest economy, have taken a pounding this year. The average return for the WisdomTree India Earnings ETF (EPI) and the iShares India 50 ETF (INDY) is anything but average as the two are off 22.65 and 16.9%, respectively, year-to-date.

The situation is no better, actually it is worse, with small-cap funds. The Market Vectors India Small-Cap ETF (SCIF) has plunged 46% this year. Even with the benefit a July 1 1-for-4 reverse split, SCIF has continued tumbling. The ETF closed around $29.40 that day, but closed below $25 Wednesday. [Market Vectors to Reverse Split 7 ETFs]

India’s plunging rupee is one catalyst that has plagued the country’s equities and ETFs. The rupee has touched a series of record lows against the dollar. Earlier this week, the rupee pared its losses, though only slightly, on speculation India’s central bank sold dollars to stem the currency’s decline. On Tuesday, former IMF economist Raghuram Rajan was appointed the new chief of the Reserve Bank of India. [Rupee ETF up Slightly After New RBI Chief Named]

Rajan has his work cut out. With degrees from the Massachusetts Institute of Technology and some of India’s top universities, Rajan has the pedigree to lead a major central bank and he will need all that training and then some as he looks to revive a fallen star of an economy that has disappointed investors for all of 2013.

Market observers are not too optimistic. “When an emerging market currency does not respond positively to policy liquidity tightening, the market is in deep trouble. Therefore, further price weakness in the currency could plausibly drive further weakness in the equity market,” said Nicholas Ferres, investment director, global asset allocation at Eastspring Investments, in an interview with CNBC.

Ferres did not hold back in his assessment of Indian equities, saying “Indian equities may be a slow moving train wreck that is close to derailment,” according to CNBC. Last week, Goldman Sachs lowered its rating on Indian equities to underweight, saying there have recently been no signs of increased investment demand in India.

Slack growth, the falling rupee and a widening current account deficit are among the factors that prompted foreign investors to sell nearly $3 billion in Indian shares combined in June and July. India has trade deficits with China, Switzerland, Saudi Arabia, Iraq, Kuwait, Qatar, Venezuela, Nigeria, Australia, and Indonesia, among dozens of others. [India ETF Lowest Since 2009 on Falling Rupee]

As for Rajan, investors will want to see the new RBI chief do his best Ben Bernanke impression and so quickly. EPI, the largest India ETF, is trading at its lowest levels in more than four years and if the fund falls below $14, it will mark the first time it has done so since May 2009.

WisdomTree India Earnings ETF

ETF Trends editorial team contributed to this post.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.

Yahoo Finance

Yahoo Finance