Trump and Democrats align more closely on student debt than they think

“A rose by any other name would smell as sweet” cooed Juliet Capulet to her beloved Romeo Montague, in an oft-quoted expression of how the names of things do not always reflect what they really are.

So it is with income share agreements, or ISAs — a new way to finance college, where students are only obliged to pay an affordable percentage of their income after they graduate, instead of a fixed-debt obligation. While the concept of ISAs seems to have support among Republicans and Democrats, its very name is prompting partisan sword-fighting to match the blood feud between the Montagues and Capulets in Shakespeare’s famed play.

A replacement for America’s disastrous loan system

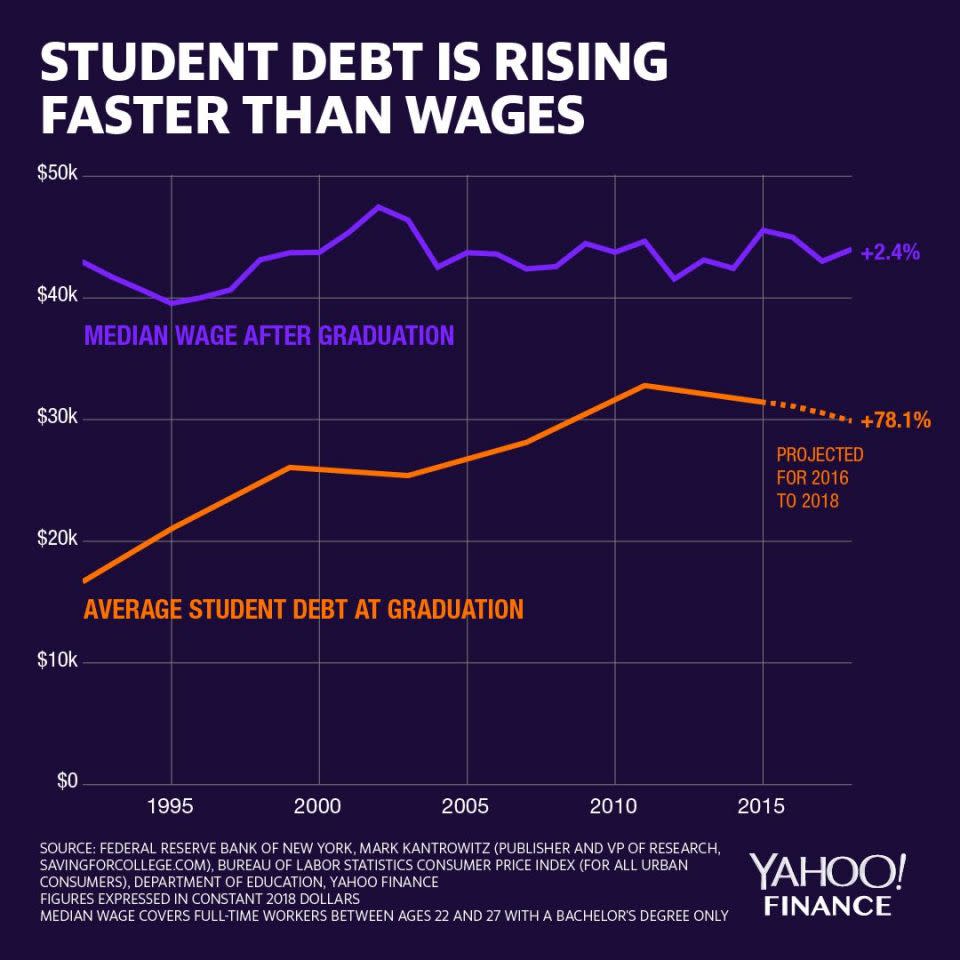

The main point of contention seems to be around investor-funded ISAs where Democrats like Senator Elizabeth Warren are understandably concerned that Wall Street sharpies will take advantage of vulnerable kids. Republicans, in contrast, like encouraging market-based solutions to rising student debt obligations and think the risk of abuse can be mitigated with appropriate consumer protections. While I tend to think that properly regulated private ISAs have a role in funding college, particularly at the graduate level, their greater value lies as a government program to replace our disastrous federal student loan system.

Here there appears to be some agreement among Democrats and Republicans, though they may be too busy sharpening their rapiers to notice. For the past several years, policy makers have been inching toward an ISA model without acknowledging it. The government now offers no fewer than five plans as an alternative to the standard 10-year loan, where repayments are based on a percentage of income. But the programs are so complex and administratively cumbersome, many students have been unable to fully realize their potential benefits. And because of poor design, they primarily benefit higher-earning graduate and professional students, while lower-earning students still struggle.

Importantly, borrowers still have a debt obligation. They must pay interest accruing on unpaid principal. If their income-based payment is insufficient to cover that interest, their principal balance actually gets bigger. This is called negative amortization, and it’s usually viewed as an abusive practice among private lenders. What’s more, though payment obligations terminate after 10 to 25 years, depending on the plan, forgiveness of unpaid principal is taxed at that point. So as principal balances build, so does the whopping tax bill borrowers receive at the end of the repayment period.

Contrast this to a true ISA where the student simply contractually commits to pay an affordable percentage of his income for a certain period of years, typically subject to a cap of around 1.5 to 2 times the amount originally financed. No principal. No interest. So no negative amortization and no huge tax bill at the end of the term. Why, oh why can’t Congress simply transition to this pure ISA model and relieve students of the financial stress caused by current income-driven options?

The closest Congress has come so far is the Public Service Loan Forgiveness Program (PSLF). Created under the George W. Bush Administration, the program was designed to draw young people to public service and is limited to those employed by government or nonprofits. It requires individuals so employed to pay 10% of income above 150% of the poverty level for 120 months. At the end of those payments, all outstanding debt is forgiven, and the forgiveness is not subject to tax.

Though there have been many issues with PSLF’s administrative complexity, in concept, it has bipartisan appeal. President Donald Trump has pointed to it as a model for his own proposal to create a single income-driven repayment plan for all undergraduates, though he would require 15 years of payments, not 10, and raise payments to 12.5%. (He would have a 30-year repayment period for graduate and professional students who typically have much larger loan balances.) Democrats have shot back that he is trying to eliminate PLSF, while he says he is trying to expand it.

But why not let all undergraduates students have the same benefits afforded to public service employees after 15 years of payments? As one who has spent most of my career in government, I value public service. But we also need young people starting businesses or working in manufacturing, technology, energy, transportation, and a host of other sectors. In a compromise, Congress should consider extending PSLF to all undergraduates, lengthen the payment term to 15 years, but keep payments at the current 10%. Congress should also ensure there is no risk of negative amortization or taxation of principal forgiveness to make this single repayment option reflect a true ISA. Here are three additional enhancements that could do a better job of protecting both students and taxpayers:

Impose some common-sense caps on the total amount taxpayers will finance: Though undergraduate student borrowing is subject to annual caps, other loan programs available to parents and graduates allow them to borrow freely, the only limits being the “cost of attendance” set by the college. This creates perverse incentives for schools to market expensive graduate programs to students with the promise that their debt will eventually be forgiven. This is one of the reasons why costs surrounding PSLF and other income-driven programs are escalating. While I want all students to be able to pursue their dreams, there has to be a limit on what taxpayers will finance. Instead of paying for expensive graduate programs, public resources would be better spent on increased Pell grant funding for low-income kids going to college or vocational schools.

Make colleges have some skin in the game: Consistent with the need to impose more accountability on institutions of higher education, require that colleges fund part of the ISA. If their students graduate and get jobs, they will earn that money back. If not, they absorb the loss.

Let high earners pay a bit more: One advantage of ISAs is that they allow some level of cross-subsidization with high earners paying a bit more than lower earners in dollar terms, but everyone paying the same rate that is tied to an affordable percentage of income. However, current income-driven plans, including PSLF, cap monthly payments to whatever the payment would be on a 10-year amortizing loan. This is a highly regressive feature, leading to low earners with the same level of borrowing actually paying a higher percentage of their income than wealthier graduates do.

Finally, let’s have a new name for this new method of financing since “ISA” has become such a hot button. How about Repay on Shared Earnings or ROSE? This more affordable option would smell much sweeter than the current program which, with $1.5 trillion in student debt outstanding, has become positively odiferous. And as student nonpayment rates and projected taxpayer losses continue to mount, it is probably as doomed as Romeo and Juliet’s romance.

Sheila Bair is the former Chair of the FDIC and has held senior appointments in both Republican and Democrat Administrations. She currently serves as a board member or advisor to a several companies and is a founding board member of the Volcker Alliance, a nonprofit established to rebuild trust in government.

Read more:

Why the Fed should oversee Facebook’s Libra

How regulators can stop leveraged lending from becoming the new subprime

The $1.4 trillion student loan market faces a huge issue — transparency

Former FDIC Chair: The Fed needs to hit pause on rate hikes

America has left the door wide open for bailouts

Vulnerability in America’s lower income brackets poses a risk to the economy

China thinks long-term on financial stability — so should we

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance