Inca Minerals (ASX:ICG) jumps 11% this week, taking three-year gains to 116%

By buying an index fund, you can roughly match the market return with ease. But many of us dare to dream of bigger returns, and build a portfolio ourselves. For example, the Inca Minerals Limited (ASX:ICG) share price is up 94% in the last three years, clearly besting the market return of around 25% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 41% in the last year.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

See our latest analysis for Inca Minerals

We don't think Inca Minerals' revenue of AU$2,968,688 is enough to establish significant demand. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). It seems likely some shareholders believe that Inca Minerals will find or develop a valuable new mine before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Inca Minerals has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

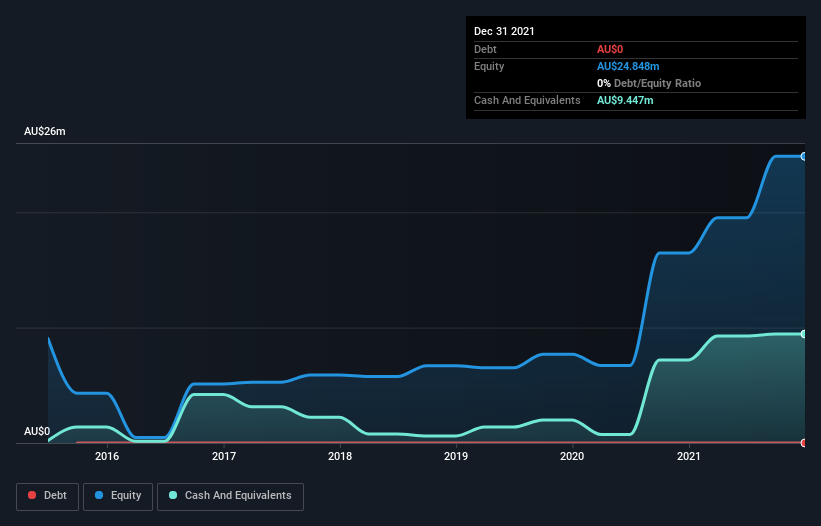

Inca Minerals had cash in excess of all liabilities of AU$9.1m when it last reported (December 2021). That's not too bad but management may have to think about raising capital or taking on debt, unless the company is close to breaking even. Given the share price has increased by a solid 102% per year, over 3 years , it's fair to say investors remain excited about the future, despite the potential need for cash. You can click on the image below to see (in greater detail) how Inca Minerals' cash levels have changed over time.

Of course, the truth is that it is hard to value companies without much revenue or profit. One thing you can do is check if company insiders are buying shares. It's often positive if so, assuming the buying is sustained and meaningful. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Inca Minerals' total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Inca Minerals hasn't been paying dividends, but its TSR of 116% exceeds its share price return of 94%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's good to see that Inca Minerals has rewarded shareholders with a total shareholder return of 41% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 11% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 5 warning signs for Inca Minerals you should be aware of, and 1 of them doesn't sit too well with us.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance