How Important Was Sentiment In Driving OrganiGram Holdings’s (CVE:OGI) Fantastic 1069% Share Price Gain?

Generally speaking, investors are inspired to be stock pickers by the potential to find the big winners. Not every pick can be a winner, but when you pick the right stock, you can win big. Take, for example, the OrganiGram Holdings Inc. (CVE:OGI) share price, which skyrocketed 1069% over three years. It’s also good to see the share price up 93% over the last quarter.

Anyone who held for that rewarding ride would probably be keen to talk about it.

Check out our latest analysis for OrganiGram Holdings

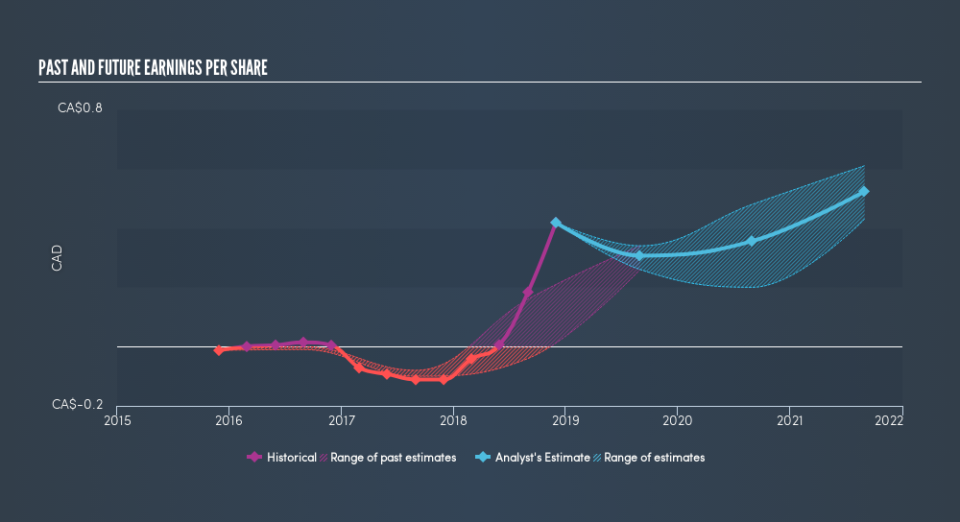

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it’s a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During three years of share price growth, OrganiGram Holdings moved from a loss to profitability. Given the importance of this milestone, it’s not overly surprising that the share price has increased strongly.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We’re pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It’s always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on OrganiGram Holdings’s earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Pleasingly, OrganiGram Holdings’s total shareholder return last year was 109%. The TSR has been even better over three years, coming in at 127% per year. If you would like to research OrganiGram Holdings in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance