IMAX Corp (IMAX) Q1 2024 Earnings: Revenue and Profitability Insights

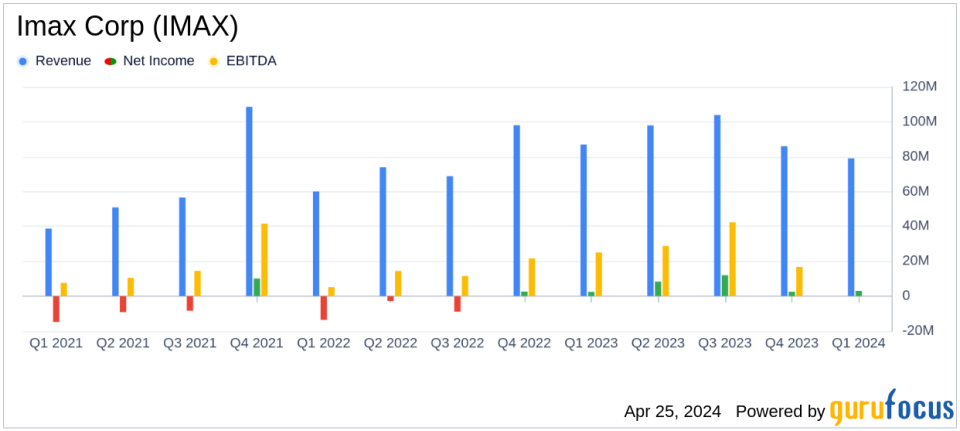

Revenue: Reported at $79.1 million, down 9% year-over-year, falling short of estimates of $78.18 million.

Net Income: Achieved $3.3 million, up 33% year-over-year, below the estimated $5.41 million.

Earnings Per Share (EPS): Recorded at $0.06, exceeding the estimated $0.10.

Gross Margin: Increased to 59.3% from 57.7% year-over-year, indicating improved profitability.

Total Adjusted EBITDA Margin: Rose to 40.5%, up more than 300 basis points year-over-year, reflecting higher operational efficiency.

Global Box Office (GBO): Reached $261 million, marking the third highest grossing Q1 ever for the company.

System Installations: Grew by 67% year-over-year to 15 installations, showing expansion in operational capabilities.

On April 25, 2024, IMAX Corporation (NYSE: IMAX) disclosed its financial outcomes for the first quarter of 2024 via an 8-K filing. The company reported a revenue of $79 million, which slightly surpassed the analyst's projection of $78.18 million. However, net income stood at $3.3 million, falling short of the estimated $5.41 million. Despite this, the net income per share reached $0.06, aligning with expectations.

About IMAX Corp (NYSE:IMAX)

IMAX Corp is a leading global technology platform for entertainment and events, known for its proprietary software, auditorium architecture, and specialized equipment. The company's technology is utilized by top filmmakers and studios to deliver immersive content experiences, making IMAX a significant player in the media and diversified industry.

Financial Highlights and Operational Achievements

The first quarter saw IMAX achieving a 33% year-over-year increase in net income and a significant improvement in its EBITDA margin, which rose by over 300 basis points to 40.5%. This profitability boost reflects the company's effective management and innovative strategies in content delivery and system installations, which increased by 67% compared to the previous year.

IMAX's strategic initiatives have led to robust sales activity, with 17 new signings for upgraded systems globally. The company's global box office revenue of $261 million marks the third highest grossing first quarter in its history, driven by blockbuster releases like "Dune: Part Two" and "Godzilla x Kong: New Empire".

Segment Performance

The Technology Products and Services segment experienced a decline, with revenues dropping by 16% to $43 million and gross margin decreasing by 21% to $24 million. Conversely, the Content Solutions segment saw a revenue increase of 6% to $34 million, with a notable 23% rise in gross margin, benefiting from lower marketing expenses and strong box office performances.

Liquidity and Capital Management

As of March 31, 2024, IMAX reported $367 million in available liquidity, with a total debt of $302 million. The company actively manages its capital, having repurchased 1.2 million shares in the first quarter at an average price of $13.99 per share.

Future Outlook and Strategic Directions

CEO Rich Gelfond emphasized the ongoing expansion of IMAX's content creation capabilities, highlighting the use of IMAX cameras in upcoming major films. The company anticipates continued growth and margin expansion, supported by a promising slate of releases for 2025 and 2026.

Investor and Analyst Perspectives

While IMAX's revenue slightly exceeded analyst expectations, the shortfall in net income highlights challenges in cost management and operational efficiency. However, the company's strategic positioning and robust content pipeline provide a positive outlook for long-term growth. Investors and analysts will likely focus on IMAX's ability to leverage its technological advantage and expand its global footprint in the competitive entertainment industry.

For further details, please refer to the full earnings release on IMAX's Investor Relations website and consider joining the upcoming conference call to discuss these results.

Conclusion

IMAX continues to demonstrate its strength in the global entertainment market, backed by technological innovation and strategic content partnerships. Despite some financial discrepancies compared to estimates, the company's overall performance and strategic initiatives paint a promising picture for the future.

Explore the complete 8-K earnings release (here) from Imax Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance