Can You Imagine How Palo Alto Networks's (NYSE:PANW) Shareholders Feel About The 81% Share Price Increase?

Stock pickers are generally looking for stocks that will outperform the broader market. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. To wit, the Palo Alto Networks share price has climbed 81% in five years, easily topping the market return of 52% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 10% in the last year.

Check out our latest analysis for Palo Alto Networks

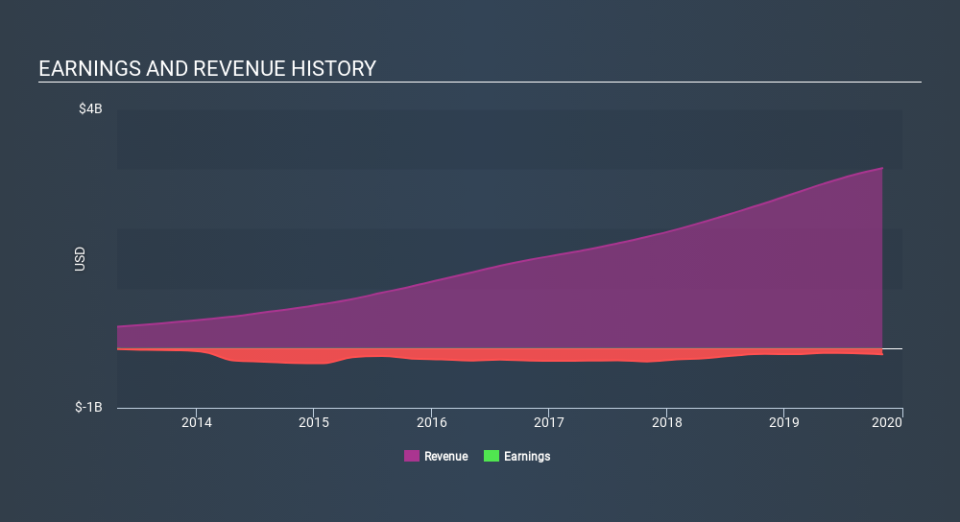

Because Palo Alto Networks made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

For the last half decade, Palo Alto Networks can boast revenue growth at a rate of 27% per year. Even measured against other revenue-focussed companies, that's a good result. It's good to see that the stock has 13%, but not entirely surprising given revenue shows strong growth. If the strong revenue growth continues, we'd expect the share price to follow, in time. Opportunity lies where the market hasn't fully priced growth in the underlying business.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Palo Alto Networks shareholders are up 10% for the year. Unfortunately this falls short of the market return. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 13% over five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. It's always interesting to track share price performance over the longer term. But to understand Palo Alto Networks better, we need to consider many other factors. Take risks, for example - Palo Alto Networks has 1 warning sign we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance