Imagine Owning Unico American (NASDAQ:UNAM) And Wondering If The 44% Share Price Slide Is Justified

For many, the main point of investing is to generate higher returns than the overall market. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in Unico American Corporation (NASDAQ:UNAM), since the last five years saw the share price fall 44%. It's up 1.9% in the last seven days.

Check out our latest analysis for Unico American

Unico American isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last half decade, Unico American saw its revenue increase by 1.3% per year. That's far from impressive given all the money it is losing. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 11% (annualized) in the same time frame. The key question is whether the company can make it to profitability, and beyond, without trouble. Shareholders will want the company to approach profitability if it can't grow revenue any faster.

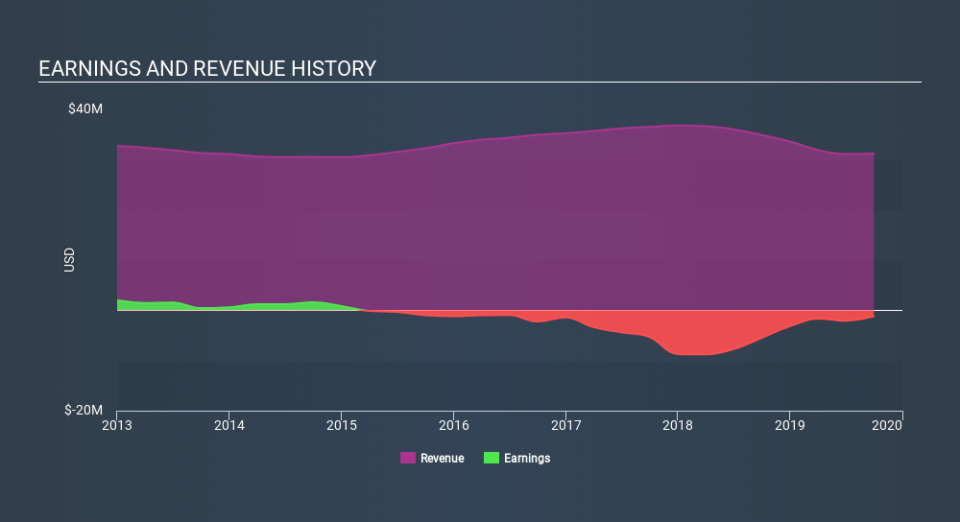

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Unico American shareholders are up 9.6% for the year. But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 11% endured over half a decade. So this might be a sign the business has turned its fortunes around. If you would like to research Unico American in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course Unico American may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance