Imagine Owning Nature's Sunshine Products (NASDAQ:NATR) And Wondering If The 33% Share Price Slide Is Justified

While it may not be enough for some shareholders, we think it is good to see the Nature's Sunshine Products, Inc. (NASDAQ:NATR) share price up 11% in a single quarter. But that doesn't change the fact that the returns over the last five years have been less than pleasing. After all, the share price is down 33% in that time, significantly under-performing the market.

View our latest analysis for Nature's Sunshine Products

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Nature's Sunshine Products has made a profit in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics might give us a better handle on how its value is changing over time.

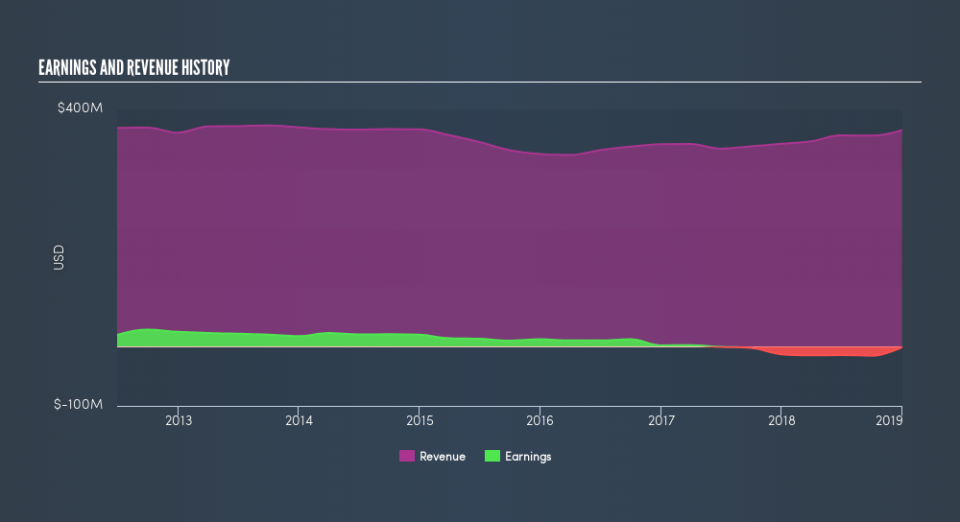

The revenue fall of 0.9% per year for five years is neither good nor terrible. But it's quite possible the market had expected better; a closer look at the revenue trends might explain the pessimism.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Dividend Lost

The value of past dividends are accounted for in the total shareholder return (TSR), but not in the share price return mentioned above. By accounting for the value of dividends paid, the TSR can be seen as a more complete measure of the value a company brings to its shareholders. Over the last 5 years, Nature's Sunshine Products generated a TSR of -18%, which is, of course, better than the share price return. Although the company had to cut dividends, it has paid cash to shareholders in the past.

A Different Perspective

Nature's Sunshine Products shareholders are down 3.0% for the year, but the market itself is up 11%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 4.0% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. Before spending more time on Nature's Sunshine Products it might be wise to click here to see if insiders have been buying or selling shares.

We will like Nature's Sunshine Products better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance