Imagine Owning Astron Connect (CVE:AST) And Trying To Stomach The 80% Share Price Drop

Even the best investor on earth makes unsuccessful investments. But serious investors should think long and hard about avoiding extreme losses. So spare a thought for the long term shareholders of Astron Connect Inc. (CVE:AST); the share price is down a whopping 80% in the last twelve months. That'd be a striking reminder about the importance of diversification. We wouldn't rush to judgement on Astron Connect because we don't have a long term history to look at. Furthermore, it's down 50% in about a quarter. That's not much fun for holders.

See our latest analysis for Astron Connect

Because Astron Connect is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Astron Connect grew its revenue by 1059% over the last year. That's a strong result which is better than most other loss making companies. So the hefty 80% share price crash makes us think the company has somehow offended market participants. There's clearly something unusual going on here such as an acquisition that hasn't delivered expected profits. What is clear is that the market is not judging the company on its revenue growth right now. Of course, markets do over-react so share price drop may be too harsh.

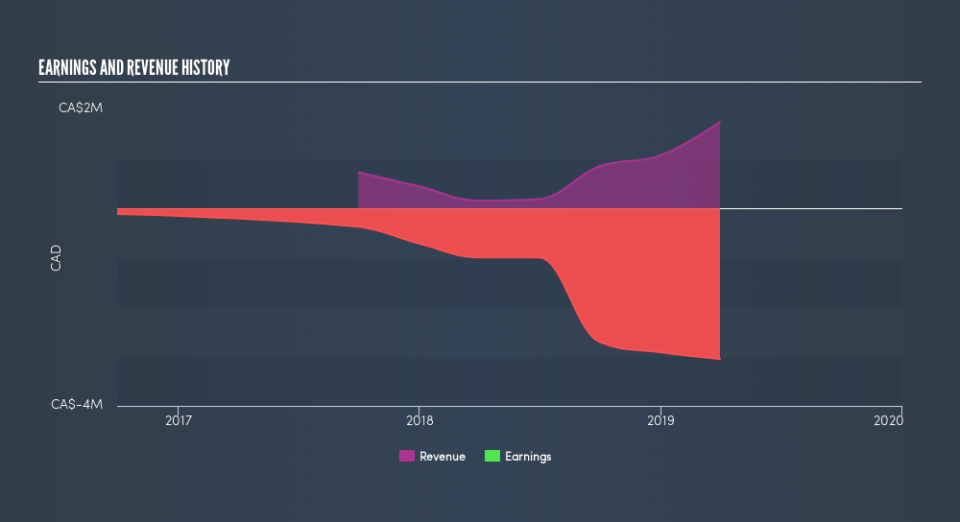

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Astron Connect's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Astron Connect shareholders are down 80% for the year, even worse than the market loss of 0.5%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. The share price decline has continued throughout the most recent three months, down 50%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. You could get a better understanding of Astron Connect's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course Astron Connect may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance