Imagine Holding Ballard Power Systems (TSE:BLDP) Shares While The Price Zoomed 462% Higher

We think that it's fair to say that the possibility of finding fantastic multi-year winners is what motivates many investors. Not every pick can be a winner, but when you pick the right stock, you can win big. One such superstar is Ballard Power Systems Inc. (TSE:BLDP), which saw its share price soar 462% in three years. On top of that, the share price is up 65% in about a quarter.

Check out our latest analysis for Ballard Power Systems

Ballard Power Systems wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last three years Ballard Power Systems has grown its revenue at 2.5% annually. Considering the company is losing money, we think that rate of revenue growth is uninspiring. Therefore, we're a little surprised to see the share price gain has been so strong, at 78% per year, compound, over three years. A win is a win, even if the revenue growth doesn't really explain it, in our view). The company will need to continue to execute on its business strategy to justify this rise.

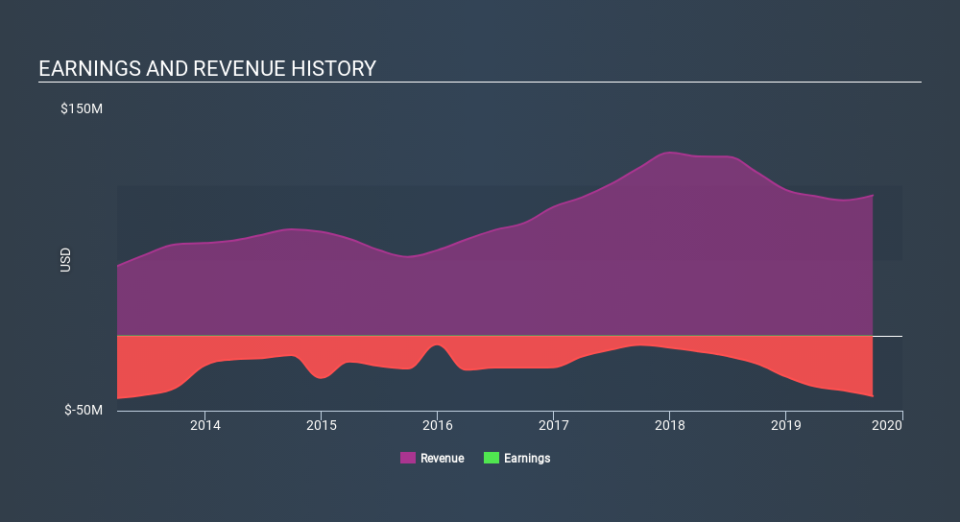

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think Ballard Power Systems will earn in the future (free profit forecasts).

A Different Perspective

It's nice to see that Ballard Power Systems shareholders have received a total shareholder return of 218% over the last year. That's better than the annualised return of 37% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Ballard Power Systems better, we need to consider many other factors. Take risks, for example - Ballard Power Systems has 2 warning signs we think you should be aware of.

But note: Ballard Power Systems may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance