Can You Imagine How Elated HyreCar's (NASDAQ:HYRE) Shareholders Feel About Its 434% Share Price Gain?

HyreCar Inc. (NASDAQ:HYRE) shareholders have seen the share price descend 28% over the month. But that doesn't change the fact that the returns over the last year have been spectacular. In that time, shareholders have had the pleasure of a 434% boost to the share price. Arguably, the recent fall is to be expected after such a strong rise. While winners often keep winning, it can pay to be cautious after a strong rise.

See our latest analysis for HyreCar

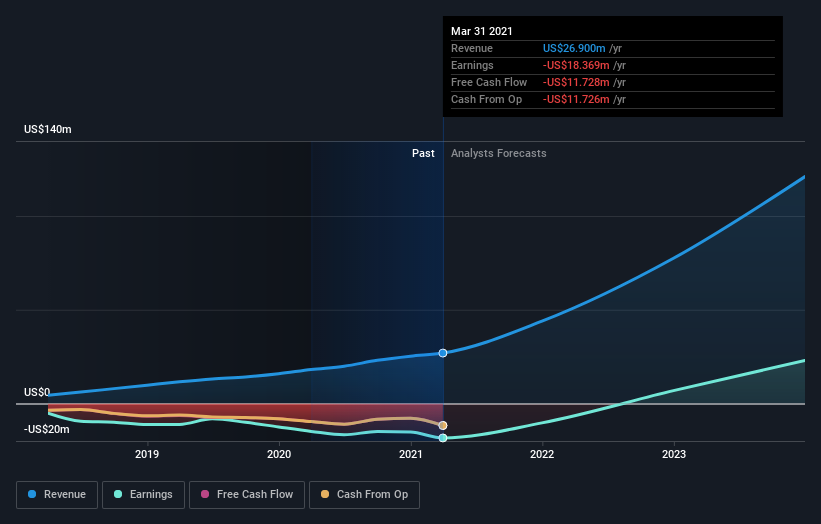

Because HyreCar made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

HyreCar grew its revenue by 48% last year. That's well above most other pre-profit companies. But the share price has really rocketed in response gaining 434% as previously mentioned. Even the most bullish shareholders might be thinking that the share price might drop back a bit, after a gain like that. But if the share price does moderate a bit, there might be an opportunity for high growth investors.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free report showing analyst forecasts should help you form a view on HyreCar

A Different Perspective

It's nice to see that HyreCar shareholders have gained 434% (in total) over the last year. That's better than the annualized TSR of 69% over the last three years. Given the track record of solid returns over varying time frames, it might be worth putting HyreCar on your watchlist. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - HyreCar has 3 warning signs we think you should be aware of.

We will like HyreCar better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance