Can You Imagine How AltaGas' (TSE:ALA) Shareholders Feel About The 44% Share Price Increase?

It's always best to build a diverse portfolio of shares, since any stock business could lag the broader market. But the goal is to pick stocks that do better than average. AltaGas Ltd. (TSE:ALA) has done well over the last year, with the stock price up 44% beating the market return of 39% (not including dividends). In contrast, the longer term returns are negative, since the share price is 16% lower than it was three years ago.

Check out our latest analysis for AltaGas

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over the last twelve months, AltaGas actually shrank its EPS by 37%.

Given the share price gain, we doubt the market is measuring progress with EPS. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

We note that the most recent dividend payment is higher than the payment a year ago, so that may have assisted the share price. It could be that the company is reaching maturity and dividend investors are buying for the yield, pushing the price up in the process.

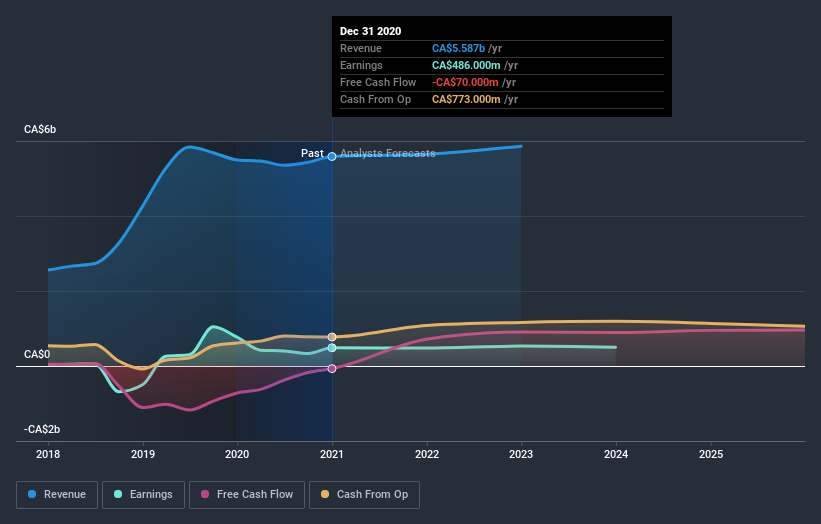

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

AltaGas is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think AltaGas will earn in the future (free analyst consensus estimates)

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of AltaGas, it has a TSR of 52% for the last year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that AltaGas shareholders have received a total shareholder return of 52% over one year. That's including the dividend. There's no doubt those recent returns are much better than the TSR loss of 0.4% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand AltaGas better, we need to consider many other factors. For instance, we've identified 4 warning signs for AltaGas (1 can't be ignored) that you should be aware of.

But note: AltaGas may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance