IHS Markit (INFO) to Report Q3 Earnings: What's in Store?

IHS Markit Ltd. INFO is scheduled to release third-quarter fiscal 2019 results on Sep 24, before the bell.

Shares of the company have gained 23.5% over the past year, outperforming the industry’s rise of 18.7%.

How Things Are Shaping Up

The Zacks Consensus Estimate for revenues in the to-be-reported quarter is pegged at $1.13 billion, indicating year-over-year growth of 12.8%. The expected growth is likely to be driven by strength across all four segments - Resources, Transportation, CMS and Financial Services.

The consensus estimate for the Resources segment stands at $224 million, indicating year-over-year growth of 5.7%. Strong performance across downstream pricing, chemicals and CERAWeek are likely to drive this expected growth.

The consensus mark for the Transportation segment stands at $323 million, suggesting year-over-year growth of 8.8%. Strong performance across auto, aerospace and defense and, maritime and trade businesses should drive the segments growth.

The CMS segment is expected to deliver year-over-year growth of 5.1% in the to-be-reported quarter driven by strength in the product design business.

The Financial Services segment revenues are expected to grow 23.4% year over year on the back of strength in WSO services and digital solutions, and strong performance of Ipreo.

In second-quarter fiscal 2019, total revenues of $1.14 billion increased 12.6% on a year-over-year basis.

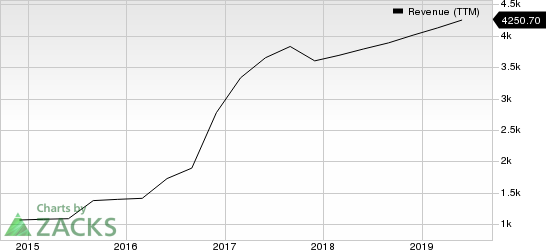

IHS Markit Ltd. Revenue (TTM)

IHS Markit Ltd. revenue-ttm | IHS Markit Ltd. Quote

The consensus mark for earnings per share in the to-be-reported quarter is pegged at 63 cents, indicating year-over-year growth of 8.6%. The expected growth is likely to be driven by streamlining of internal processes, prudent investments in technology and product.

In second-quarter fiscal 2019, adjusted earnings per share of 71 cents increased 16.4% year over year.

What Our Model Says

According to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates if it also has a positive Earnings ESP. Zacks Rank #4 (Sell) or 5 (Strong Sell) stocks are best avoided, especially if they have a negative Earnings ESP. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

IHS Markit has an Earnings ESP of 0.00% and a Zacks Rank #3, a combination that makes surprise prediction difficult.

Stocks to Consider

Some better-ranked stocks in the broader Zacks Business Services sector are S&P Global SPGI, Nielsen NLSN and Charles River Associates CRAI, each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term expected earnings (three to five years) growth rate for S&P Global, Nielsen and Charles River is 10%, 12% and 13%, respectively.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nielsen Holdings Plc (NLSN) : Free Stock Analysis Report

IHS Markit Ltd. (INFO) : Free Stock Analysis Report

S&P Global Inc. (SPGI) : Free Stock Analysis Report

Charles River Associates (CRAI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance