IHS Markit (INFO) Beats Q3 Earnings Estimates, Lags Revenues

IHS Markit Ltd. INFO reported mixed third-quarter fiscal 2019 results with earnings beating the Zacks Consensus Estimate but revenues missing the same.

Adjusted earnings per share of 67 cents beat the consensus mark by 4 cents and increased 16% on a year-over-year basis. Total revenues came in at $1.11 billion, missing the consensus mark by $16 million but improving 11% from the year-ago quarter.

We observe that shares of IHS Markit have gained 23.3% over the past year, outperforming 19% rally of the industry it belongs to.

Quarter Details

Revenues at the Resources segment totaled $230 million, up 9% year over year, with recurring revenues rising 5% organically. The Transportation segment experienced year-over-year revenue growth of 6% to reach $314.9 million. Recurring revenues at this segment grew 10% organically.

Revenues at the CMS segment amounted to $138.6 million, up 1% year over year, with no organic growth in recurring revenues. Financial services segment’s revenues increased 21% year over year to $428.8 million with 6% organic growth.

Recurring fixed revenues of $799.9 million rose 11% year over year on a reported basis and 7% on an organic basis. Recurring variable revenues of $144.4 million grew 16% year over year on a reported basis and 5% on an organic basis. Non-recurring revenues totaled $168 million, up 6% year over year on a reported basis and 4% on an organic basis.

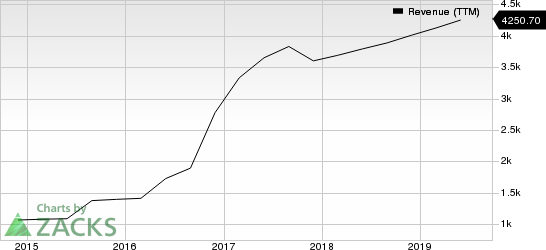

IHS Markit Ltd. Revenue (TTM)

IHS Markit Ltd. revenue-ttm | IHS Markit Ltd. Quote

Adjusted EBITDA of $452.9 million increased 16% from the year-ago quarter. Adjusted EBITDA margin improved 170 points (bps) year over year to 40.7%.

IHS Markit ended the quarter with cash and cash equivalent balance of $124.1 million compared with $109.5 million in the prior quarter. Long-term debt was $5.05 billion compared with $4.9 billion in the previous quarter.

Cash flow from operations and free cash flow amounted to $412.9 million and $342.9 million, respectively, in the quarter. CapEx was $70 million. The company repurchased $200 million of shares in the quarter.

Fiscal 2019 Outlook

IHS Markit expects revenues in the range of $4.40 billion to $4.42 billion, including organic growth of 5% to 6% (including Ipreo). The Zacks Consensus Estimate for revenues is pegged at $4.45 billion. Adjusted EBITDA is expected in the range of $1.75 billion to $1.78 billion. Adjusted EPS is anticipated in the range of $2.52 to $2.57. The Zacks Consensus Estimate is pegged at $2.57.

Zacks Rank & Stocks to Consider

IHS Markit currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader Zacks Business Services sector are Huron Consulting HURN, Charles River Associates CRAI and Fiserv FISV. While Fiserv sports a Zacks Rank #1 (Strong Buy), Huron Consulting and Charles River Associates carry a Zacks Rank #2 (Buy).

Long-term earnings (three to five years) growth rate for Huron Consulting, Charles River Associates and Fiserv is estimated 13.5%, 13% and 12%, respectively. You can see the complete list of today’s Zacks #1 Rank stocks here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

IHS Markit Ltd. (INFO) : Free Stock Analysis Report

Charles River Associates (CRAI) : Free Stock Analysis Report

Huron Consulting Group Inc. (HURN) : Free Stock Analysis Report

Fiserv, Inc. (FISV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance