IBM's Q1 Earnings: A Close Alignment with Analyst Projections Amid Strategic Moves

Revenue: Reported at $14.5 billion, a 1% increase year-over-year, meeting the estimated $14.546 billion.

Net Income: Reached $1.6 billion, surpassing the estimated $1.478 billion.

Earnings Per Share (EPS): Achieved $1.69, exceeding the estimated $1.60 per share.

Gross Profit Margin: Improved to 53.5%, up from 52.7% the previous year.

Free Cash Flow: Increased by $0.6 billion to $1.9 billion.

Software Revenue: Grew by 5% to $5.9 billion, driven by strong performance in hybrid platform and solutions.

Strategic Acquisition: Announced intent to acquire HashiCorp, Inc. for $35 per share, enhancing hybrid cloud capabilities.

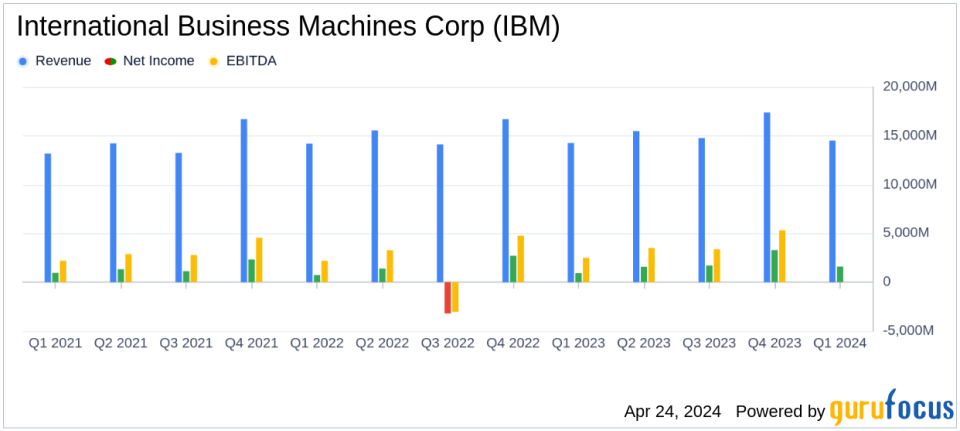

On April 24, 2024, International Business Machines Corp (NYSE:IBM) disclosed its first-quarter earnings, revealing a performance closely aligned with market expectations. The detailed earnings can be explored in their recent 8-K filing. IBM reported a revenue of $14.5 billion, matching analyst estimates of $14.546 billion, and earnings per share (EPS) of $1.69, slightly above the forecasted $1.60. This performance underscores the company's robust strategy in hybrid cloud and AI sectors.

IBM, a global leader in IT services and consulting, operates in 175 countries and serves 95% of all Fortune 500 companies. The company's significant influence is evident as it handles 90% of all credit card transactions worldwide and 50% of all wireless connections. IBM's strategic focus on hybrid cloud and AI innovations continues to drive its business forward, as reflected in the recent announcement of its intent to acquire HashiCorp, Inc., aiming to enhance its hybrid cloud platform capabilities.

Financial Highlights and Strategic Developments

The first quarter saw IBM achieving a slight revenue increase of 1% year-over-year, with significant contributions from its software segment, which grew by 5%. This growth is attributed to strong performance in hybrid platforms and solutions, particularly from Red Hat and Automation sectors. However, the infrastructure segment experienced a slight decline, emphasizing the shifting focus of IBM's business towards high-margin, high-growth areas.

The proposed acquisition of HashiCorp at $35 per share, totaling an enterprise value of $6.4 billion, marks a strategic expansion aimed at strengthening IBM's position in the hybrid cloud market. This acquisition is expected to close by the end of 2024, subject to customary closing conditions and approvals.

Operational Efficiency and Market Challenges

IBM's operational efficiency is evident from its improved gross profit margin, which increased to 53.5% from 52.7% in the previous year. The company also reported a robust cash flow, with net cash from operating activities rising to $4.2 billion, up from $3.8 billion year-over-year. Such financial health enables IBM to invest in growth opportunities while returning value to shareholders through dividends, which amounted to $1.5 billion in the first quarter.

Despite these positive outcomes, IBM faces challenges, including potential economic downturns and client budget constraints, which could impact its project-based business segments like consulting and infrastructure services. Moreover, the ongoing need to innovate in a competitive technology landscape requires continuous investment in R&D, which stood at $1.8 billion for the quarter.

Looking Ahead

For the full year 2024, IBM remains optimistic, expecting revenue growth in line with its mid-single digit model and projecting about $12 billion in free cash flow. This outlook is supported by IBM's strategic initiatives, including its acquisition plans and focus on high-growth areas like AI and cloud computing.

In conclusion, IBM's first-quarter results demonstrate a stable financial trajectory and strategic foresight in navigating the complexities of the global tech market. Investors and stakeholders might find reassurance in IBM's consistent performance and strategic acquisitions, positioning it well for future growth amidst evolving market demands.

Explore the complete 8-K earnings release (here) from International Business Machines Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance