i3 Verticals (IIIV) to Reduce Debt Through New Divestiture

i3 Verticals IIIV recently entered into a definitive agreement to sell its merchant of record payments business to Payroc WorldAccess, LLC, in an all-cash deal worth $440 million. The proceedings from the transaction will provide i3 Verticals with a substantial infusion of liquidity that will help it meet immediate financial needs.

This merchant of record payment business dealt with traditional merchant processing and automated clearing house processing. The business also focuses on simplifying the transactions of devices running on Europay, Mastercard MA and Visa V.

IIIV’s merchant of record payments business uses application programming interfaces (“API”) to simplify transaction processes. These APIs eliminated the need for Payment card industry and payment application data security standard certifications for transactions carried out through Europay, Mastercard and Visa-compliant devices.

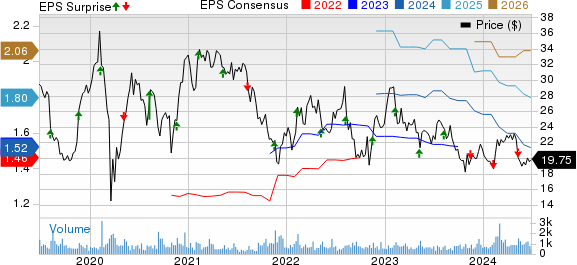

i3 Verticals, Inc. Price, Consensus and EPS Surprise

i3 Verticals, Inc. price-consensus-eps-surprise-chart | i3 Verticals, Inc. Quote

Rationale Behind the Divestiture

i3 Verticals intends to use the proceeds to reduce its debt burden, including most or all of its 2023 Senior Secured Credit Facility. Furthermore, the debt reduction will lower IIIV's borrowing rates under the facility by 1%, thereby increasing its borrowing capability to execute mergers and acquisitions in the future.

As of Mar 31, 2024, i3 Verticals had a long-term debt (excluding current portion and debt issuance costs) of $343.4 million while had cash and equivalents of $3.1 million.

Additionally, the divestiture of the merchant of record payments business will help i3 Verticals to laser focus on its three core businesses — Public Sector, Education and Healthcare. As part of the deal, the company has retained its payment facilitation platform and its ability to attach payments to its software solutions.

Conclusion

The sale of the merchant of record payment business marks a significant step in i3 Verticals' strategic evolution. By divesting this non-core segment, the company can sharpen its focus on core competencies, enhance financial flexibility and strengthen its competitive positioning. This move is expected to drive long-term growth and create greater value for shareholders.

However, i3 Verticals has been facing significant challenges due to delayed projects in backlog. These delays are creating a ripple effect, hampering the company’s growth prospects and affecting its overall financial performance. Softening IT spending amid the ongoing uncertain macroeconomic environment may negatively impact its revenues in the near term.

Moreover, i3 Verticals has been witnessing decelerating revenue and earnings growth for the past couple of fiscals, which remain a major concern. In the last reported quarter, its revenues increased 0.7% while non-GAAP earnings declined 10.5% on a year-over-year basis.

The Zacks Consensus Estimate for fiscal 2024 revenues is pegged at $386.2 million, indicating a year-over-year increase of 4.3%. Notably, i3 Verticals had registered 16% year-over-year growth in fiscal 2023 revenues.

Additionally, the consensus mark for fiscal 2024 earnings has been revised downward by a penny to $1.52 per share in the past 30 days. This indicates break-even growth when compared with fiscal 2023 earnings.

I3 Verticals' year-to-date (YTD) share price performance has been marked by significant volatility, reflecting broader market fluctuations and company-specific developments. The stock has lost 6.7% YTD, while the Zacks Internet Software Industry and Zacks Computer and Technology sector have jumped 14.1% and 24.5%, respectively.

Currently, i3 Verticals carries a Zacks Rank #5 (Strong Sell).

Stock to Condider

A better-ranked stock from the broader technology sector is NVIDIA NVDA, which sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for NVIDIA’s second-quarter fiscal 2025 earnings has been revised 6 cents upward to 63 cents per share over the past 60 days. Shares of NVDA have skyrocketed 155.2% YTD.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mastercard Incorporated (MA) : Free Stock Analysis Report

Visa Inc. (V) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

i3 Verticals, Inc. (IIIV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance