Hudson Technologies (NASDAQ:HDSN): Strongest Q1 Results from the Specialty Equipment Distributors Group

Earnings results often indicate what direction a company will take in the months ahead. With Q1 now behind us, let’s have a look at Hudson Technologies (NASDAQ:HDSN) and its peers.

Historically, specialty equipment distributors have boasted deep selection and expertise in sometimes narrow areas like single-use packaging or unique lighting equipment. Additionally, the industry has evolved to include more automated industrial equipment and machinery over the last decade, driving efficiencies and enabling valuable data collection. Specialty equipment distributors whose offerings keep up with these trends can take share in a still-fragmented market, but like the broader industrials sector, this space is at the whim of economic cycles that impact the capital spending and manufacturing propelling industry volumes.

The 9 specialty equipment distributors stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 0.8%. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, and specialty equipment distributors stocks have had a rough stretch, with share prices down 13.1% on average since the previous earnings results.

Best Q1: Hudson Technologies (NASDAQ:HDSN)

Founded in 1991, Hudson Technologies (NASDAQ:HDSN) specializes in refrigerant services and solutions, providing refrigerant sales, reclamation, and recycling.

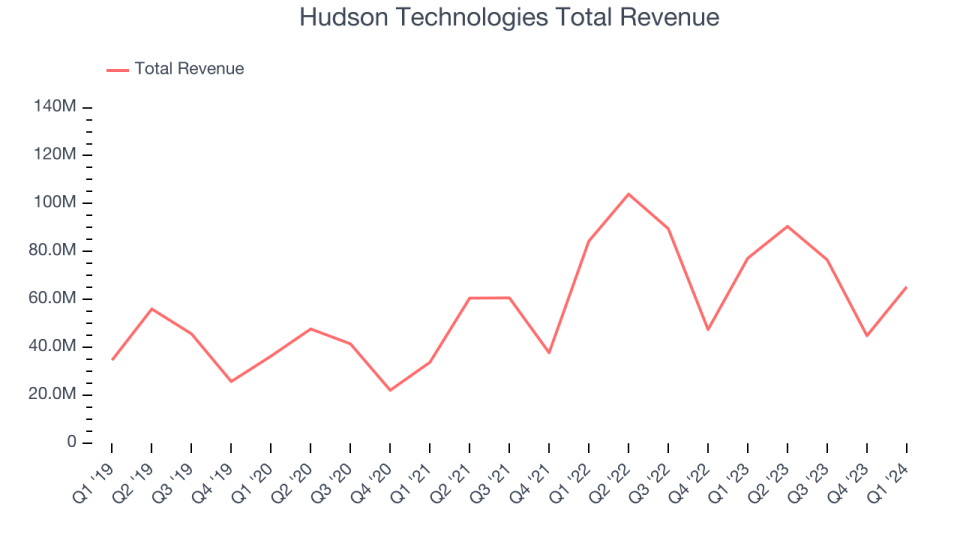

Hudson Technologies reported revenues of $65.25 million, down 15.5% year on year, topping analysts' expectations by 7.5%. It was an exceptional quarter for the company with revenue and EPS exceeding expectations.

Brian F. Coleman, President and Chief Executive Officer of Hudson Technologies commented, “Our 2024 selling season has kicked off largely as we expected, with our first quarter revenues reflecting a difficult comparison to the first quarter of 2023, which reflected higher sale prices for certain refrigerants as well as higher volume from our DLA contract. During the first quarter of 2024, the industry saw pricing for certain refrigerants decline by approximately 20% as compared to pricing levels in the first quarter of 2023.

Hudson Technologies achieved the biggest analyst estimates beat of the whole group. The stock is down 12.6% since the results and currently trades at $8.55.

Is now the time to buy Hudson Technologies? Access our full analysis of the earnings results here, it's free.

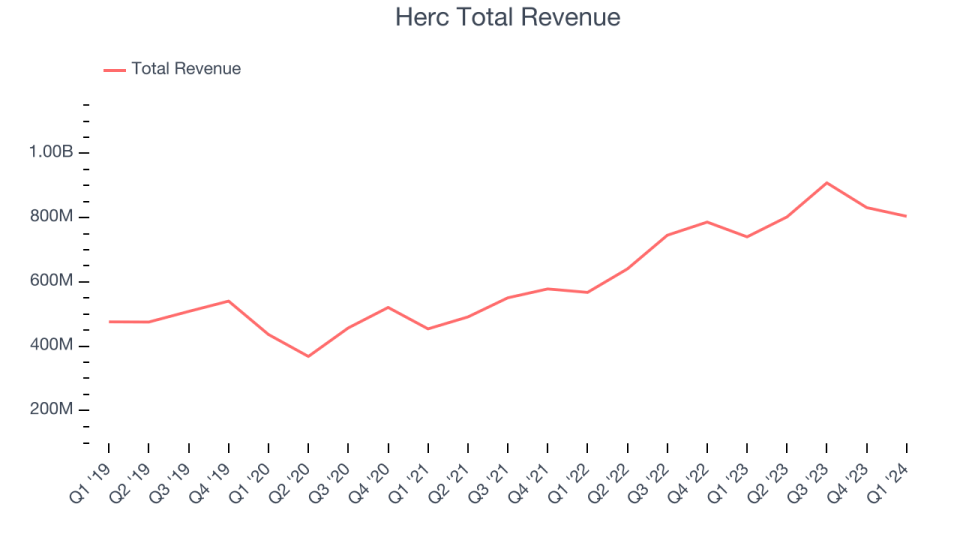

Herc (NYSE:HRI)

Formerly a subsidiary of Hertz Corporation and with a logo that still bears some similarities to its former parent, Herc Holdings (NYSE:HRI) provides equipment rental and related services to a wide range of industries.

Herc reported revenues of $804 million, up 8.6% year on year, outperforming analysts' expectations by 2.4%. It was an exceptional quarter for the company, with a decent beat of analysts' earnings estimates.

The stock is down 11.7% since the results and currently trades at $131.01.

Is now the time to buy Herc? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Karat Packaging (NASDAQ:KRT)

Founded as Lollicup, Karat Packaging (NASDAQ: KRT) distributes and manufactures environmentally-friendly disposable foodservice packaging solutions.

Karat Packaging reported revenues of $95.61 million, down 0.2% year on year, falling short of analysts' expectations by 4.2%. It was a weak quarter for the company with a miss of analysts' earnings estimates.

The stock is down 3.5% since the results and currently trades at $27.88.

Read our full analysis of Karat Packaging's results here.

Richardson Electronics (NASDAQ:RELL)

Founded in 1947, Richardson Electronics (NASDAQ:RELL) is a distributor of power grid and microwave tubes as well as consumables related to those products.

Richardson Electronics reported revenues of $52.38 million, down 25.6% year on year, falling short of analysts' expectations by 6.5%. It was a mixed quarter for the company, with EPS exceeding analysts' estimates despite the topline miss.

Richardson Electronics had the slowest revenue growth among its peers. The stock is up 27.9% since the results and currently trades at $11.94.

Read our full, actionable report on Richardson Electronics here, it's free.

Alta (NYSE:ALTG)

Founded in 1984, Alta Equipment Group (NYSE:ALTG) is a provider of industrial and construction equipment and services across the Midwest and Northeast United States.

Alta reported revenues of $441.6 million, up 5% year on year, surpassing analysts' expectations by 5%. It was a weaker quarter for the company, with a miss of analysts' earnings estimates.

The stock is down 30% since the results and currently trades at $8.11.

Read our full, actionable report on Alta here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance