Hub Group Inc (HUBG) First Quarter 2024 Earnings: Surpasses EPS Estimates Amidst Market Challenges

Earnings Per Share (EPS): Reported at $0.44, surpassing the estimated $0.39.

Revenue: Totaled $999.5 million for the quarter, falling short of the estimated $1050.23 million.

Net Income: Achieved $27.05 million, exceeding the forecast of $24.99 million.

Operating Income: Recorded at $37.14 million, representing 3.7% of revenue, a decrease from 6.8% in the previous year.

Capital Expenditures: Amounted to $18 million, focused on expanding the tractor fleet and warehouse capabilities.

Stock Activities: Included a 2-for-1 stock split, $26 million in share repurchases, and the initiation of a quarterly dividend of $0.125 per share.

2024 Outlook: Anticipates EPS to range between $1.80 and $2.25 with projected revenue between $4.3 billion and $4.7 billion.

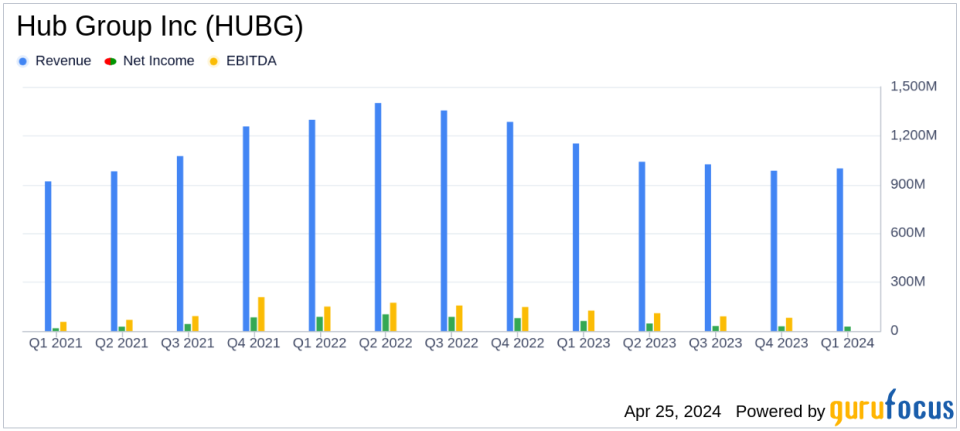

On April 25, 2024, Hub Group Inc (NASDAQ:HUBG) disclosed its financial results for the first quarter of 2024, revealing a diluted earnings per share (EPS) of $0.44, which notably surpasses the analyst's estimate of $0.39. The company reported a quarterly revenue of $1.0 billion, aligning closely with expectations. The details of these results were outlined in Hub Group's recent 8-K filing.

About Hub Group Inc

Hub Group stands as a prominent player in the transportation sector, primarily known for its rail intermodal service, which constitutes about 60% of its revenue. The company's operations are divided into intermodal and transportation solutions, logistics, including asset-light truck brokerage, and dedicated truckload shipping units. Hub Group is recognized for its strategic acquisitions which enhance its service offerings in brokerage, last-mile delivery, and dedicated sectors.

Q1 Performance Highlights and Challenges

The first quarter of 2024 saw Hub Group achieving a net income of $27 million, a decrease from the previous year's $62 million. This decline was primarily due to the impacts of a severe January winter storm, reduced volumes in its Intermodal and Transportation Solutions (ITS) and brokerage segments, and lower fuel revenue. However, these were partially offset by the positive contributions from the recent Final Mile acquisition, which added $64 million to the quarter's revenue.

Operating income for the quarter was reported at $37 million, or 3.7% of revenue, a decrease from the previous year's 6.8%. Despite these challenges, the company has been proactive in managing costs and enhancing operating efficiency, which is evident from the reduced expenses in transportation and warehousing as a percentage of revenue.

Strategic Moves and Financial Health

Hub Group has continued to focus on strategic initiatives such as the Final Mile acquisition, which is already exceeding expectations. The company also returned value to shareholders through a 2-for-1 stock split, the purchase of $26 million in HUBG shares, and the initiation of a quarterly cash dividend of $0.125 per share. As of March 31, 2024, Hub Group reported having $195 million in cash and cash equivalents.

Outlook and Future Projections

Looking forward, Hub Group projects its 2024 diluted EPS to be in the range of $1.80 to $2.25, with expected revenue between $4.3 billion and $4.7 billion. The company anticipates continued investment in its operations, with capital expenditures estimated to be between $45 million and $65 million for the full year.

Hub Group's adaptability in managing operational challenges while strategically positioning itself for future growth provides a compelling narrative for investors, particularly in the volatile transportation industry. As the company navigates through the complexities of market conditions and expansion efforts, its focus on cost management and business diversification is expected to drive long-term shareholder value.

Conclusion

Despite the mixed financial outcomes in the first quarter of 2024, Hub Group's strategic acquisitions and efficient capital management underscore its resilience and commitment to growth. Investors and stakeholders may look forward to the company's continued progress in optimizing its operations and enhancing its financial standing in upcoming quarters.

Explore the complete 8-K earnings release (here) from Hub Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance