HSBC-Royal Bank of Canada (RY) Deal Gets Competition Bureau Nod

In a significant development for the Canadian banking sector, the Competition Bureau has given its nod to Royal Bank of Canada's RY planned acquisition of HSBC Holdings’ HSBC Canadian unit, HSBC Bank Canada. This will pave the way for one of the country's biggest banking mergers.

The C$13.5 billion ($10 billion) deal, announced in November 2022, had been under scrutiny for its potential impact on competition. The Bureau's findings, outlined in a report to the Minister of Finance, suggest that the merger is unlikely to substantially lessen or prevent competition under the Competition Act.

The last time a merger of this magnitude was attempted in Canada was in the early 1990s when RY sought to acquire Bank of Montreal BMO, but the deal was blocked by regulators. In February 2023, BMO completed the acquisition of Bank of the West, BNP Paribas SA’s U.S. banking unit. Following the integration, BMO will have more than 1,000 branches in 32 states across the United States.

While the Bureau acknowledged the loss of rivalry between Canada's largest bank, RY, and the seventh-largest, HSBC Canada, it emphasized that HSBC Canada's competitive impact was limited compared with other financial institutions. HSBC's unit had achieved limited market penetration in most financial services, a factor that weighed in favor of the merger's approval.

Despite this favorable outcome, the Bureau highlighted that Canada's financial services markets remain concentrated, with the top five banks dominating the sector. High barriers to entry and expansion in many of these markets persist, and certain conditions may facilitate coordinated behavior among firms. These points underscore the ongoing need for vigilance in maintaining a competitive landscape within Canada's banking industry.

Royal Bank of Canada views the Competition Bureau's opinion as a crucial step toward regulatory approval, recognizing the significance of this milestone in the acquisition process. They are committed to collaborating with reviews by the Office of the Superintendent of Financial Institutions and Canada's finance ministry.

The acquisition is expected to bolster RY's position in a market where the top six banks control around 80% of banking assets. The deal is expected to close in the first quarter of 2024. HSBC is projecting a pre-tax gain of $5.7 billion.

The positive regulatory view signals the evolving dynamics in Canada's highly regulated banking landscape as banks seek growth opportunities and expansion, including into the United States. As the acquisition progresses, it serves as a testament to the resilience and adaptability of the Canadian banking sector in an ever-evolving financial landscape.

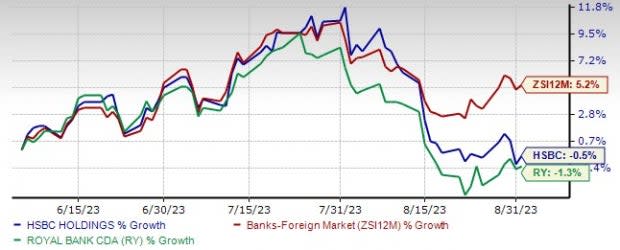

Over the past three months, shares of HSBC and RY on NYSE have lost 0.5% and 1.3%, respectively, against the industry’s growth of 5.2%.

Three-Month Price Performance

Image Source: Zacks Investment Research

Currently, HSBC sports a Zacks Rank #1 (Strong Buy) and Royal Bank of Canada has a Zacks Rank of 3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Disclaimer: This article has been written with the assistance of Generative AI. However, the author has reviewed, revised, supplemented, and rewritten parts of this content to ensure its originality and the precision of the incorporated information.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank Of Montreal (BMO) : Free Stock Analysis Report

Royal Bank Of Canada (RY) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance