HSBC, BNP Paribas (BNPQY) May Face Fines for Naked Short Selling

HSBC Holdings plc HSBC and BNP Paribas SA BNPQY are likely to face fines for financial misconduct under the recommendation of South Korea’s financial watchdog. The nation’s Financial Supervisory Service (“FSS”) has made a recommendation to the Securities and Futures Commission under the regulator Financial Services Commission (“FSC”) to impose a fine of at least 10 billion won on each of the two firms for “naked short selling,” per people familiar with the matter.

The practice of naked short-selling, in which investors short-sell shares without first borrowing them or determining that they can be borrowed, is illegal in South Korea.

One of the sources, who requested anonymity, said that a five-member commission led by FSC vice chairman, Kim So-young, discussed the fines yesterday in a meeting. However, no conclusion could be drawn on the matter.

The source has said that the commission is planning to finalize the fine as soon as possible. However, the final amount of the fine can change during discussions later on.

A FSS spokesperson declined to comment on the matter. Also, HSBC and BNPQY have not responded to e-mailed requests for comment.

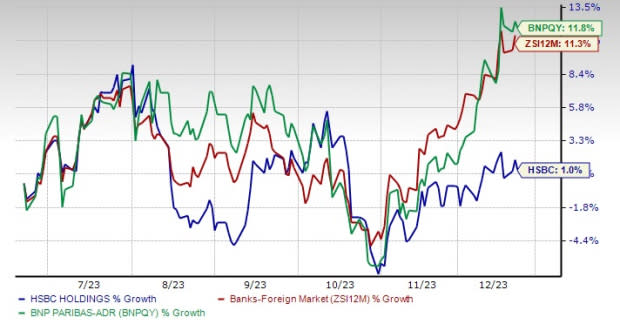

Over the past six months, shares of HSBC and BNPQY have gained 1% and 11.8%, respectively. The industry to which the stocks belong has rallied 11.3%.

Image Source: Zacks Investment Research

Currently, HSBC carries a Zacks Rank #3 (Hold), while BNPQY has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Notably, this August, BNPQY faced a fine for non-adherence to record keeping.

In a move aimed at curbing the improper use of secure messaging apps for business communications, U.S. regulators levied $549 million in penalties against Wells Fargo WFC and several other financial institutions.

The crackdown was led by the Securities and Exchange Commission (“SEC”) and the Commodity Futures Trading Commission (“CFTC”), who underline the significance of keeping accurate records of employee communications in the financial industry.

The SEC's action revealed a pattern of “widespread and longstanding failures” in record-keeping by 11 firms, resulting in charges and fines aggregating to $289 million. Then again, the CFTC imposed a fine of $260 million on four banks for failing to adhere to the agency's record-keeping requirements.

WFC incurred the highest penalty among the firms targeted, amounting to $200 million. French banks BNPQY and Societe Generale were each fined $110 million, while the Bank of Montreal faced a $60-million penalty. The SEC also imposed fines on Japan-based firms Mizuho Securities and SMBC Nikko Securities, as well as boutique investment banks like Houlihan Lokey, Moelis & Company, and Wedbush Securities.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

BNP Paribas SA (BNPQY) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance