How resilient profit margins are silencing doubters

Stocks pulled back last week with the S&P 500 shedding 1.3% to close at 4,457.49. The index is now up 16.1% year to date, up 24.6% from its October 12 closing low of 3,577.03, and down 7.1% from its January 3, 2022 record closing high of 4,796.56.

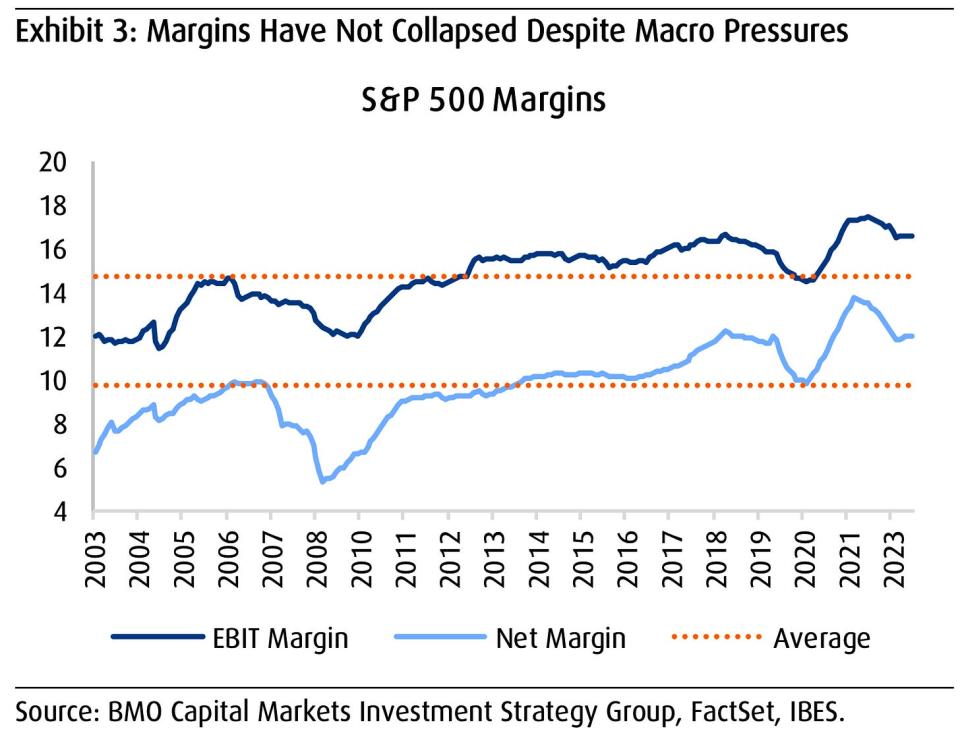

Recent market gains can be attributed to the outlook for earnings growth. And some of that expected earnings growth can be attributed to what’s arguably the most unexpected development in the corporate world over the past two years: The resilience of profit margins.

As inflation rates surged in 2021, analysts were convinced rising costs would crush profit margins.

But the opposite happened as profit margins actually rose to record levels. During this period, many companies were able to pass higher costs to their customers through higher prices. Combined with improved operating efficiencies, this dynamic led to record profits. It was a reminder that it’s "dangerous to underestimate Corporate America."

Surprising to some, high profit margins persisted. And after a modest dip in recent quarters, profit margin expansion resumed in Q2.

"For much of the year, many believed that the combination of high inflation and rising interest rates would lead to a significant deterioration of earnings growth due to the pressure that both were perceived to have on profit margins," BMO Capital’s Brian Belski wrote on Tuesday. "[W]hile EBIT and net margins are certainly lower, they remain well above-average."

In addition to benefiting from strong pricing, corporations haven’t seen interest costs spike despite higher interest rates. This is because many companies refinanced their debt in recent years, locking in low interest rates for years to come.

By the way, this isn’t just an S&P 500 phenomenon. As Bloomberg’s Matthew Boesler recently reported: "After-tax profits for nonfinancial firms rose 4.5% in the second quarter, a Bureau of Economic Analysis report on gross domestic product showed. Measured as a share of gross value added — a proxy for aggregate profit margins — they rose to 14.3% from 13.8%."

So, what’s next for margins?

As is often the case, there isn’t a clear consensus on the outlook for margins.

"Margins have proved surprisingly resilient this year, benefiting from the decision by many corporates to prioritize price increases over volume growth," BNP’s Viktor Hjort wrote in a note circulated on Thursday. "This ability can be frustrated as inflation begins to trend lower, unless it can be compensated for by faster real growth."

This prioritization of "price increases over volume growth" has become a key controversial issue in the inflation discourse as it implies consumers could be getting their goods and services for cheaper. In some cases, analysts have used terms like "excuseflation" and "greedflation" to characterize how corporations maintained high pricing for the sake of keeping margins high.

As such, there’s a thinking out there that if high inflation helped expand profit margins, then low inflation should eventually lead to contracting margins.

But not everyone is convinced margins are sure to contract — even with inflation cooling. In fact, the Wall Street consensus is for margins to continue to expand in the coming quarters.

Among other things, analysts expect companies to benefit from productivity gains yielded from operational changes made in recent years.

"From here, efficiency gains — which have been non-existent for the last 10 years — via new tools like AI and robotics could create an even more labor light benchmark, a key positive for S&P 500 margins," BofA’s Savita Subramanian argued on Thursday.

She shared this eye-catching showing how revenue per worker has been improving.

To be clear, it’ll be some time before we can clearly confirm any tangible benefits from the deployment of AI. For now, we can at least say companies are acting aggressively to integrate AI technology as reflected by the booming businesses of AI providers like Nvidia.

We’ll have to wait to see whether or not corporations are able to maintain or improve their already high margins.

That said, it’s hard to rule out the possibility that businesses will succeed on this front, especially considering the degree to which they’ve surprised to the upside in recent years.

Reviewing the macro crosscurrents

There were a few notable data points and macroeconomic developments from last week to consider:

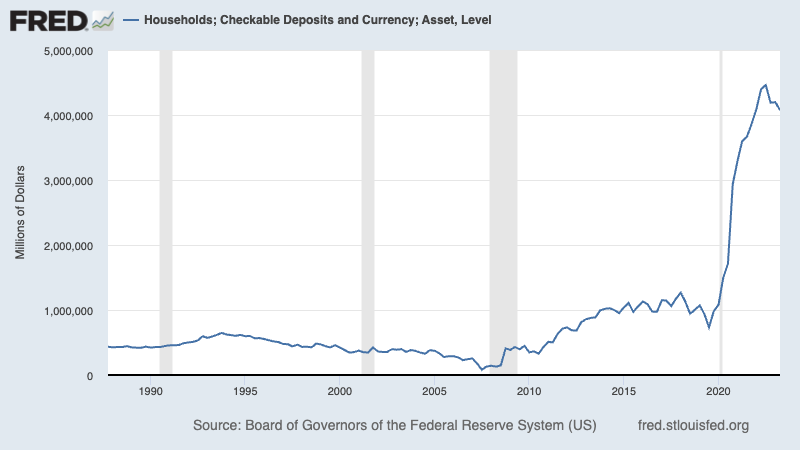

Money in the bank. According to Federal Reserve data, households held $4.07 trillion in cash as checkable deposits and currency in Q2, well above prepandemic levels.

For much of the economic recovery, economists have highlighted excess savings as an economic tailwind. However, it’s become difficult to define and measure excess savings. The good news is deposit data confirm that household continue to sit on a lot of cash.

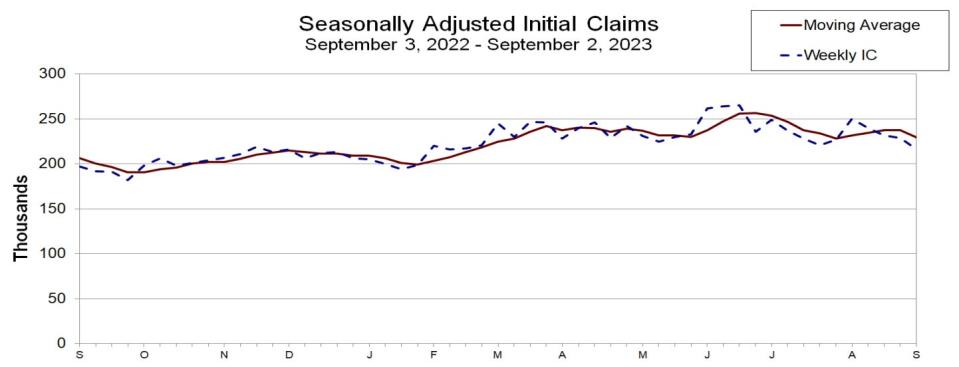

Unemployment claims tick down. Initial claims for unemployment benefits fell to 216,000 during the week ending September 2, down from 228,000 the week prior. While this is up from the September low of 182,000, it continues to trend at levels associated with economic growth.

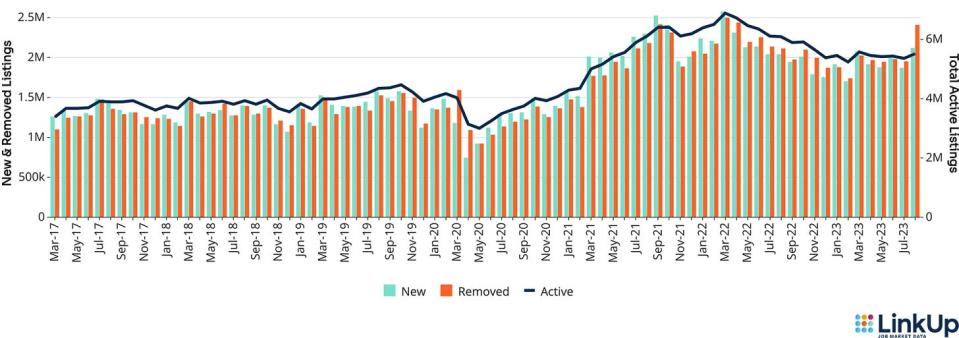

Is the labor market heating up again? August data from LinkUp suggest the demand for labor may be picking up again. From LinkUp: "With Labor Day and the anticipation surrounding the new school year behind us, we've analyzed LinkUp's U.S. job data for August. Overall, active job listings increased by 3.0% and newly created job listings increased by 13.6%. Looking at the majority of industries and occupations, both experienced growth."

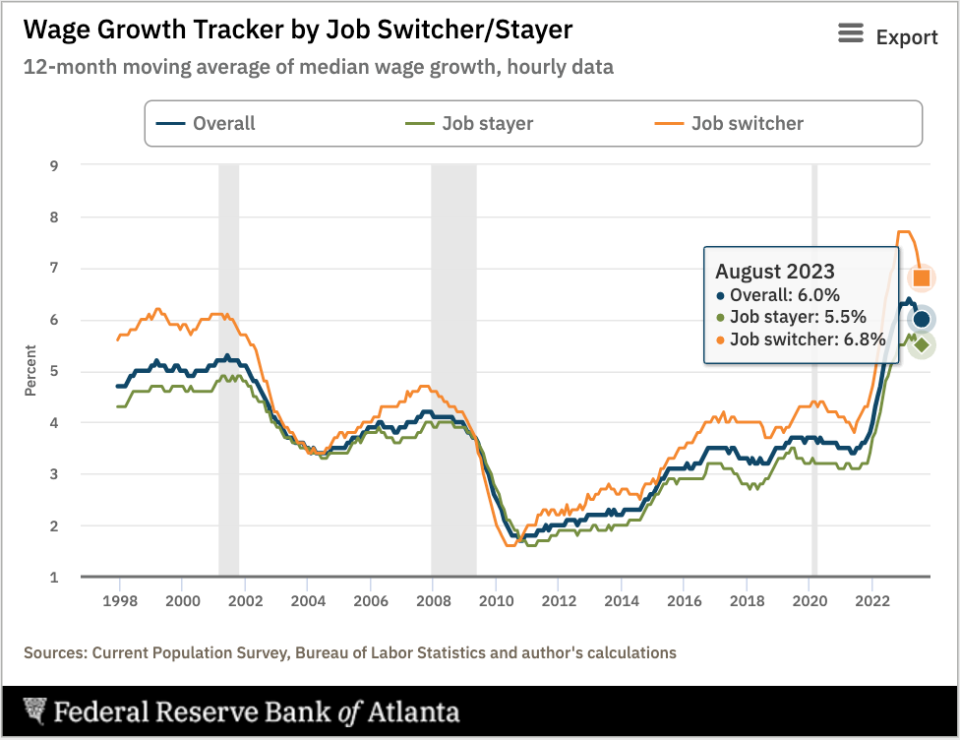

Job switchers lose pay advantage. According to the Atlanta Fed’s wage growth tracker, the gap wage growth between those who switch jobs and those who stay at their jobs continues to close. Job switchers saw 6.8% wage growth in the 12 months ending in August, whereas job stayers saw 5.5% growth during the period.

Student loan borrowers are paying. From BofA (via Carl Quintanilla): "…the premature spike in [student loan] repayments in August suggests that borrowers were largely prepared… and have probably made the required adjustments… good news… means that there is less downside risk to spending…"

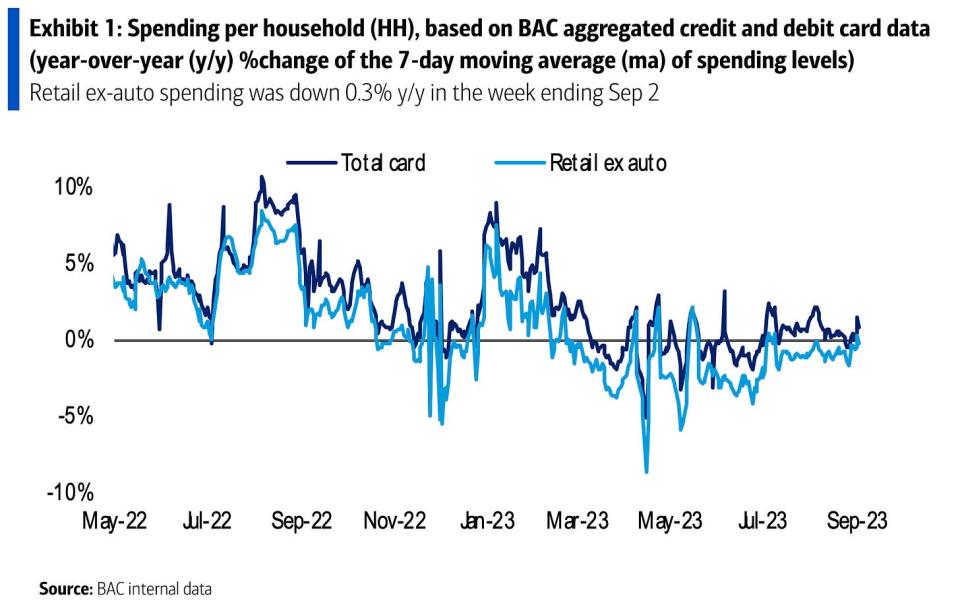

Spending is up, according to card data. From Bank of America: "Total card spending per HH was up 0.7% y/y in the week ending Sep 2, according to BAC aggregated credit and debit card data. The latest data have been boosted by a shift in the timing of Labor Day weekend."

From JPMorgan Chase: "As of 03 Sep 2023, our Chase Consumer Card spending data (unadjusted) was 1.7% above the same day last year. Based on the Chase Consumer Card data through 03 Sep 2023, our estimate of the US Census August control measure of retail sales m/m is -0.38%"

Supply chain pressures ease further. The New York Fed’s Global Supply Chain Pressure Index— a composite of various supply chain indicators — ticked up in August, but remains below levels seen even before the pandemic. It's way down from its December 2021 supply chain crisis high.

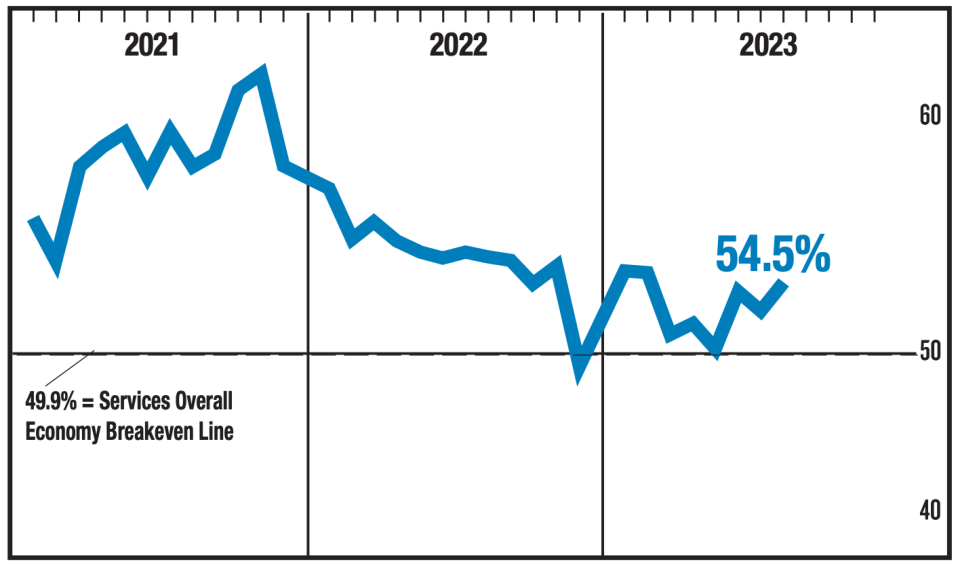

Services surveys send mixed signals. The ISM’s August Services PMI signaled accelerating growth in the sector. Business activity, new orders, and employment were among the key categories showing acceleration.

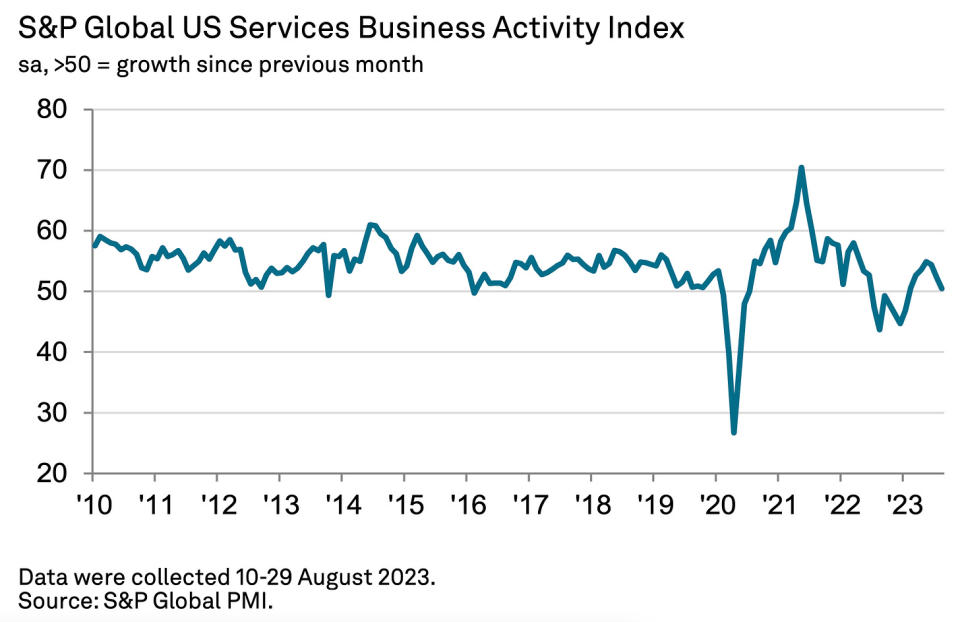

However, S&P Global’s August Services PMI signaled contraction. From the report: "Business activity increased only fractionally and at the slowest pace in the current seven-month sequence of expansion. A weaker rise in output was primarily driven by a renewed contraction in new business, as client demand was reported to have been dampened by interest rate hikes and elevated inflation. The downturn was driven by subdued domestic demand, as new export orders continued to increase. As a result of the drop in new business and growing evidence of spare capacity, firms expanded their staffing numbers at the slowest pace in almost a year."

As a general matter, soft survey data tend to be less reliable that hard data

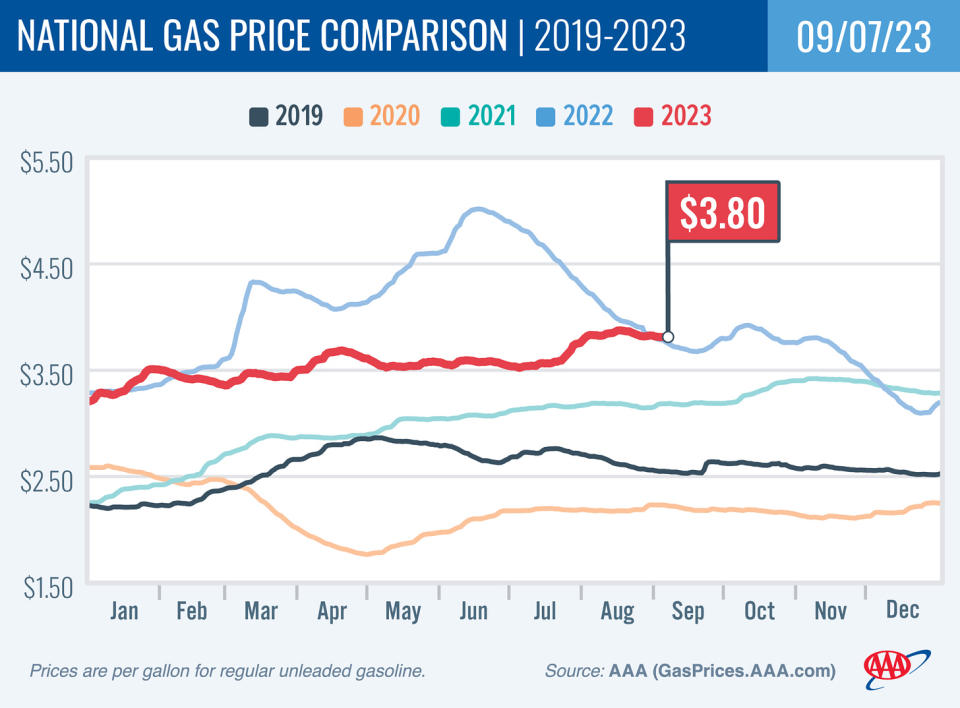

Gas prices are up from a year ago. From AAA: "Today’s national average of $3.80 is two cents less than a month ago but four cents less than a year ago."

Gasoline prices haven’t been this high post-Labor Day since 2012. From Bloomberg: "Gasoline prices are now at the highest seasonal level in more than a decade even as the Labor Day holiday marked the end of the US summer driving season, sparking fears that inflation could accelerate again in a challenge to President Joe Biden’s reelection efforts… Relief at the pump is complicated by a resurgence in the cost of oil, with Brent futures topping $90 a barrel on Tuesday after Saudi Arabia and Russia extended production cuts that have already tightened global supply. Both the global benchmark and West Texas Intermediate futures are at the highest level since November."

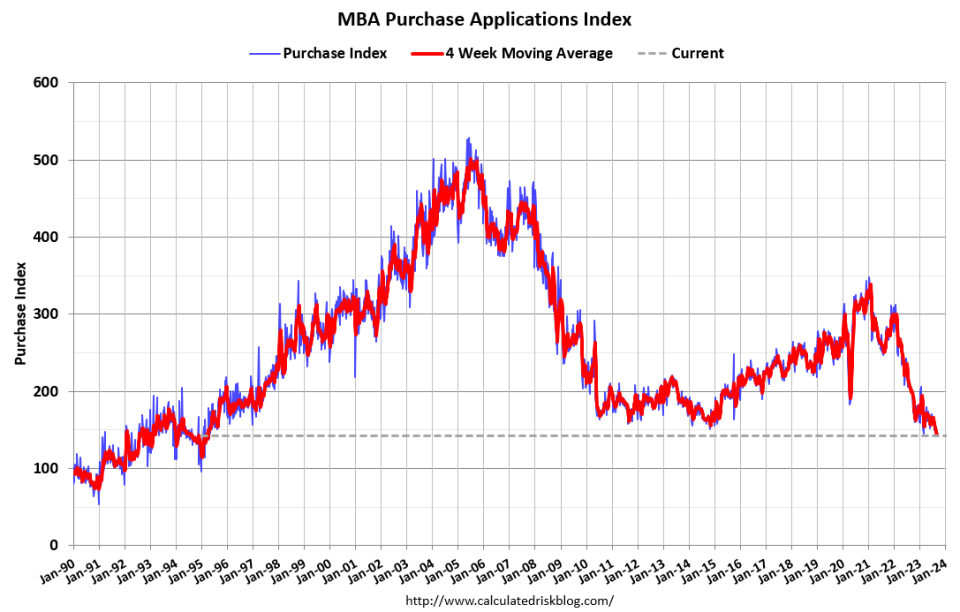

Mortgage applications fall. From Mortgage Bankers Association’s Joel Kan: "Mortgage applications declined to the lowest level since December 1996, despite a drop in mortgage rates. Both purchase and refinance applications fell, with the purchase index hitting a 28-year low, as prospective buyers remain on the sidelines due to low housing inventory and elevated mortgage rates…"

Offices are very empty. From Kastle Systems: "Office occupancy remained nearly the same this past week, rising just one tenth of a point to 47.3%, according to Kastle’s 10-city Back to Work Barometer. This has been a consistent trend throughout the month. The most popular day continues to be Tuesday, which hit 55.7% this past week. Friday was the weekly low at 31.5%. Six of the 10 tracked cities experienced increases the past week, including Dallas and Houston, Texas, which both rose two tenths of a point to 54.2% and 61% occupancy, respectively. Los Angeles and San Jose, Calif. both moved 2.7 points, with Los Angeles rising to 49% and San Jose dipping to 36.1% occupancy."

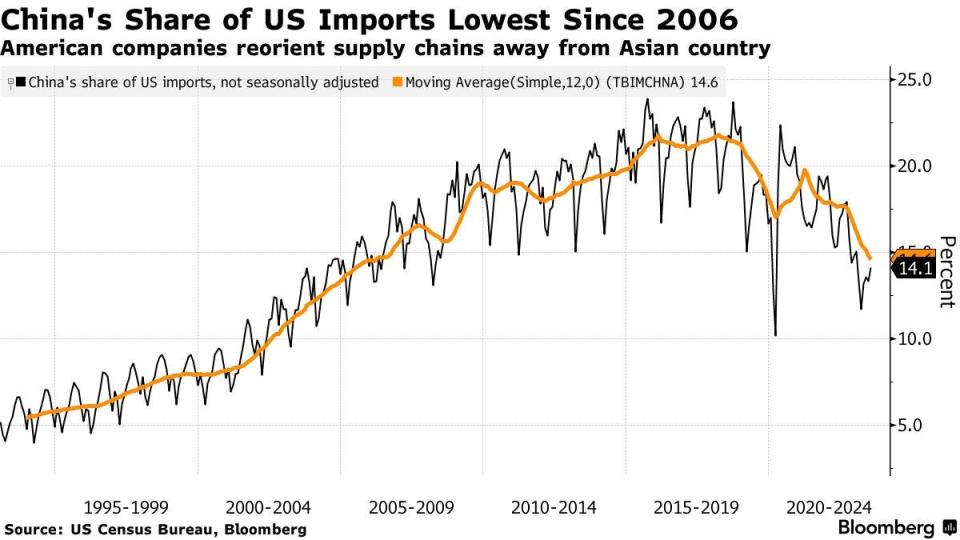

China accounts for a shrinking share of U.S. imports. From Bloomberg: "China’s share of US goods imports fell to the lowest level since 2006 in the 12 months through July, according to a new report by the US Census Bureau. The share of imported merchandise coming from China was 14.6% on average over that period, the data published Wednesday showed. That’s down from a peak of 21.8% in the 12 months through March 2018, just before former US President Donald Trump ramped up a trade war with the Asian country."

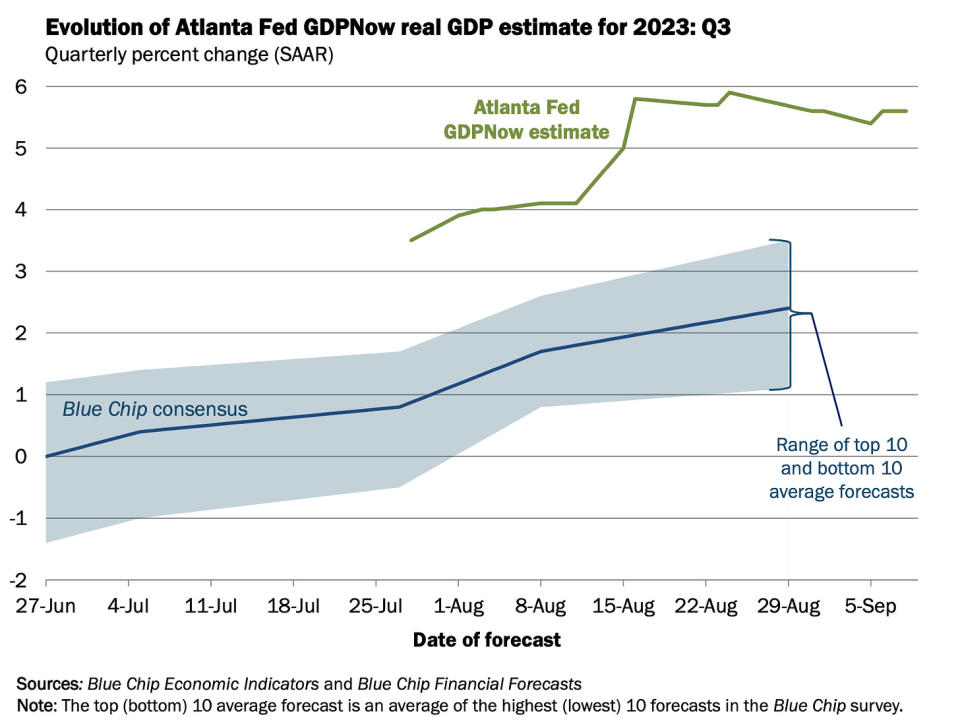

Near-term GDP growth estimates remain positive. The Atlanta Fed’s GDPNow model sees real GDP growth climbing at a 5.6% rate in Q3.

Putting it all together

We continue to get evidence that we could see a bullish "Goldilocks" soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

The Federal Reserve has taken on a less hawkish tone, acknowledging on February 1 that "for the first time that the disinflationary process has started." At its June 14 policy meeting, the Fed kept rates unchanged, ending a streak of 10 consecutive rate hikes. While the central bank lifted rates again on July 26, most economists agree that the final rate hike of the cycle is near.

In any case, inflation still has to come down more before the Fed is comfortable with price levels. So we should expect the central bank to keep monetary policy tight, which means we should be prepared for tight financial conditions (e.g. higher interest rates, tighter lending standards, and lower stock valuations) to linger.

All of this means monetary policy will be unfriendly to markets for the time being, and the risk the economy slips into a recession will be relatively elevated.

At the same time, we also know that stocks are discounting mechanisms, meaning that prices will have bottomed before the Fed signals a major dovish turn in monetary policy.

Also, it’s important to remember that while recession risks may be elevated, consumers are coming from a very strong financial position. Unemployed people are getting jobs. Those with jobs are getting raises. And many still have excess savings to tap into. Indeed, strong spending data confirms this financial resilience. So it’s too early to sound the alarm from a consumption perspective.

At this point, any downturn is unlikely to turn into economic calamity given that the financial health of consumers and businesses remains very strong.

And as always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. While markets have had a pretty rough couple of years, the long-run outlook for stocks remains positive.

Note: A version of this post first appeared on TKer.co.

Yahoo Finance

Yahoo Finance