How financial services can help conquer two of society's biggest fears

Americans workers appear to be secure. The unemployment rate fell to 3.5% in September, a 50-year low. Wage growth has been tepid, but steady.

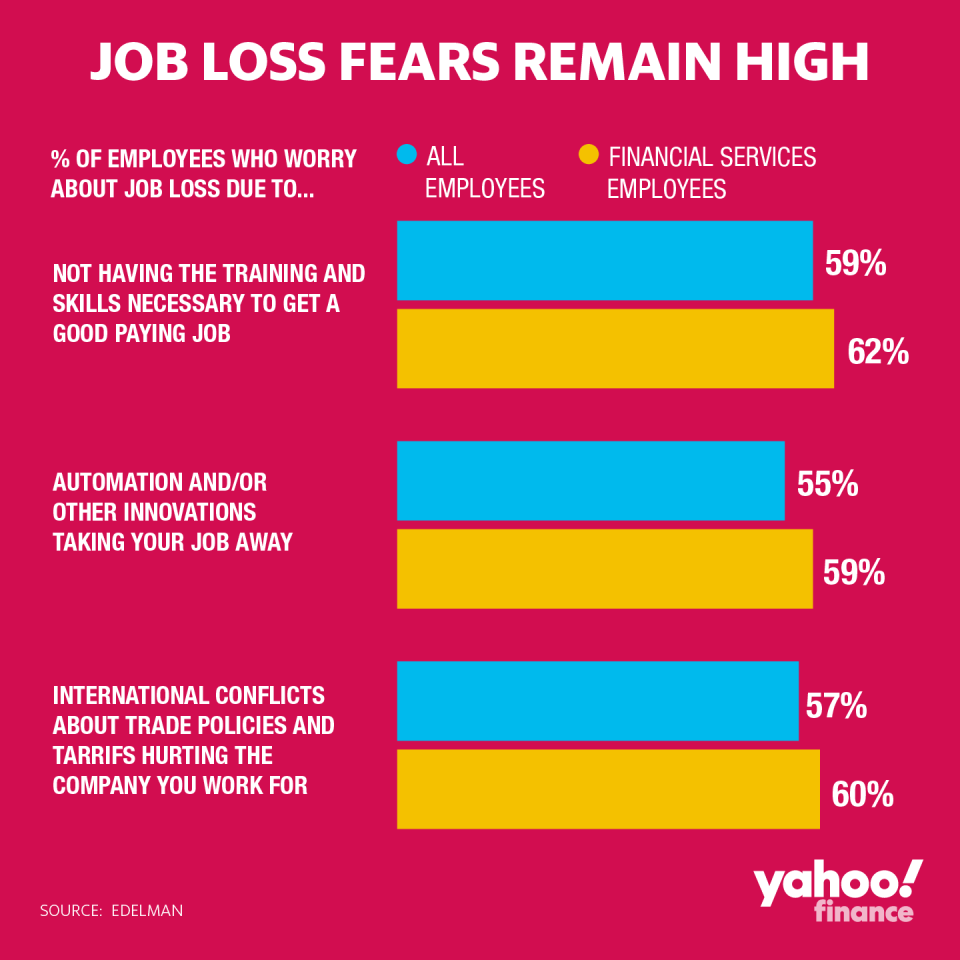

But many workers, both in the U.S. and abroad, don’t feel secure. Their two biggest fears: automation and downward economic mobility, according to research from global communications firm Edelman.

“I believe in the necessity of financial services helping conquer the fears of society,” Richard Edelman, president and CEO, told the Yahoo Finance All Markets Summit. “Four out of five who we survey all over the world actually believe that in 10 years they'll be worse off economically. By two to one, people are afraid of the pace of change because they [think] they're going to lose their jobs to machines.”

Increasing accessibility of financial services and retirement planning plays a large role in helping conquer that fear, said Dan Houston, president, chairman, and CEO of Principal Financial Group. It’s one of the country’s largest asset managers for employee retirement plans as well as individuals, with 33 million customers worldwide and $1.4 trillion in assets under management.

“We need to make sure that we've got products and services and solutions that appeal to all individuals,” said Houston, who spoke on a panel alongside Edelman. He cited Principal’s latest product, which targets savers starting at $1,000.

He also said employers need to help workers stay on top of training: “I think every job in this room, everything that we're doing, is going to require reskilling every three to four to five years. So work with local universities, work with the colleges, work with the junior colleges to have re-education and helping people upgrade their skills.”

Automation is coming for white collar and blue collar jobs

Edelman’s research has found that that kind of training is vital — because employees’ fears of automation, particularly in the financial services industry, are perhaps justified.

“Financial services is going to go through a wave of automation. 25% of jobs are going to be eliminated,” he said. “It's white collar and blue collar. Don't kid yourselves. This is not simply truck drivers. This is happening in retail stores, and it's also happening in back offices all over the country.”

Not only that -- because longevity is increasing, that reskilling cycle, as well as the necessity of robust retirement planning, is even more important.

“If you've got good genes and your parents are living, you know, into their 85s, 90, 95, there's a really good chance that you're going to need to do the same thing. And you know, that means saving anywhere from 15% to 16% of your income over the course of a 40-year working career. And that's if you start right out of school,” said Houston.

But if financial services are going to help conquer the fears of society — and do an effective job preparing people for changes in their financial fortunes — it’s got some work to do.

Edelman’s studies have shown that the public trusts financial services the least among major industries. That’s been a consistent finding since the financial crisis, although it has improved.

“I think every company's going to have to become its own media company, on top of what Yahoo and others do to tell this story-- education, particularly talking to your own employees, getting them to feel as if they have enough information to spread information horizontally. It's a different way of going.”

Julie Hyman is the co-anchor of On the Move on Yahoo Finance.

See full coverage of Yahoo Finance’s All Markets Summit.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance