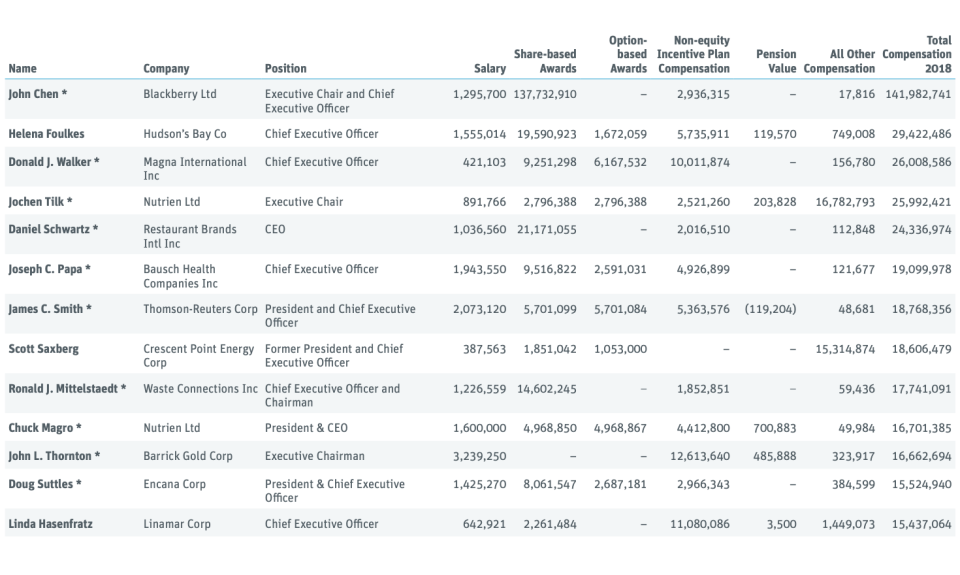

How CEOs made their millions in 2018

It’s hardly a secret that CEOs of publicly traded companies make big bucks.

A new report from the Canadian Centre for Policy Alternatives shows how top bosses make all that dough.

According to the most recent data, only 10 per cent of the top 100 CEOs’ pay comes from their salaries and 8 per cent from pensions.

That means around 80 per cent comes from bonuses, usually tied to the company’s stock, even though CEOs don’t always directly affect share prices.

“A bull run might pull a stock up even if the company is not doing great,” said David Macdonald, senior economist at the CCPA, in the report.

“Or, the stock could be dragged down, along with those of competitors in the same sector, by events unrelated to performance.”

It doesn’t really matter

But CEOs get the big paydays either way.

“Complicated formulas virtually guarantee that CEOs get almost all their variable pay irrespective of their company’s stock performance,” said Macdonald.

“These and other factors make stock-based compensation difficult to rationalize.”

John Chen, BlackBerry’s (BB.TO) CEO, tops the list for 2018 with total compensation of $141,982,741 that year. But since Chen took the reins in 2013, the company’s share price is down around 40 per cent.

The average pay among the top 100 CEOs is $11.8 million — an 18 per cent jump from the previous year. Meanwhile, Canadians got a 2.6 per cent average raise to $52,061.

Because CEOs pay tax on only 50 per cent of the value of stock options based compensation, they get to keep a lot more of what they earn. The federal Liberals considered changing the tax rules last year, but did not follow through.

Not just CEOs

Big payouts aren’t limited to CEOs. Some companies are spending millions on chief financial officers and other C-suite employees even as they lose money.

“Shopify, for example, pays its executives an eye-watering $36 million a year, yet its average loss over the past five years was $46 million,” said Macdonald.

“Blackberry’s C-suite is the most expensive on the TSX/S&P Composite Index, even while its average losses over the past five years amount to $352 million a year.”

Jessy Bains is a senior reporter at Yahoo Finance Canada. Follow him on Twitter @jessysbains.

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance