Hormel Foods (NYSE:HRL) Is Due To Pay A Dividend Of $0.2825

Hormel Foods Corporation (NYSE:HRL) has announced that it will pay a dividend of $0.2825 per share on the 15th of May. Based on this payment, the dividend yield will be 3.2%, which is fairly typical for the industry.

Check out our latest analysis for Hormel Foods

Hormel Foods' Payment Has Solid Earnings Coverage

Solid dividend yields are great, but they only really help us if the payment is sustainable. Before this announcement, Hormel Foods was paying out 76% of earnings, but a comparatively small 64% of free cash flows. Since the dividend is just paying out cash to shareholders, we care more about the cash payout ratio from which we can see plenty is being left over for reinvestment in the business.

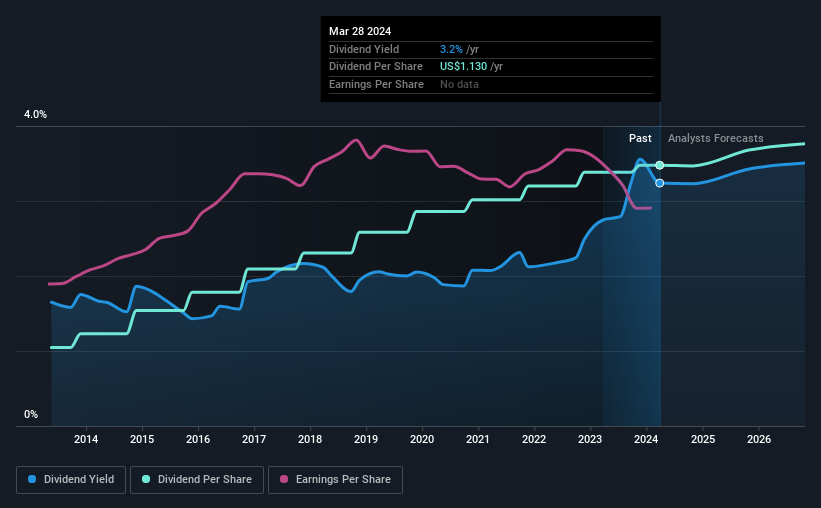

Over the next year, EPS is forecast to expand by 33.6%. Assuming the dividend continues along the course it has been charting recently, our estimates show the payout ratio being 64% which brings it into quite a comfortable range.

Hormel Foods Has A Solid Track Record

The company has an extended history of paying stable dividends. Since 2014, the annual payment back then was $0.34, compared to the most recent full-year payment of $1.13. This means that it has been growing its distributions at 13% per annum over that time. We can see that payments have shown some very nice upward momentum without faltering, which provides some reassurance that future payments will also be reliable.

The Dividend's Growth Prospects Are Limited

The company's investors will be pleased to have been receiving dividend income for some time. Let's not jump to conclusions as things might not be as good as they appear on the surface. Over the past five years, it looks as though Hormel Foods' EPS has declined at around 4.1% a year. If the company is making less over time, it naturally follows that it will also have to pay out less in dividends. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

Our Thoughts On Hormel Foods' Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The company has been bring in plenty of cash to cover the dividend, but we don't necessarily think that makes it a great dividend stock. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Given that earnings are not growing, the dividend does not look nearly so attractive. Businesses can change though, and we think it would make sense to see what analysts are forecasting for the company. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance