Hopes Of Economic Recovery Boost Sterling

The pound sterling has remained generally strong against most other major currencies although it’s still lower than recent highs. The UK is one of several major economies to have entered a mild technical recession although inflation has remained higher. This article summarises the context of the latest British job report and monthly GDP data before looking briefly at the charts of GBPUSD and GBPJPY.

One of the main fundamental reasons for positivity on the pound is the expectation that the Bank of England (‘the BoE’) will start cutting rates later than the Federal Reserve (‘the Fed’) and the European Central Bank (‘the ECB’). Despite significant progress on inflation by all three central banks, the rate of inflation remains above target in both countries and the eurozone. However, the long-awaited recession came much later and much less strongly than had been expected last year and in 2022:

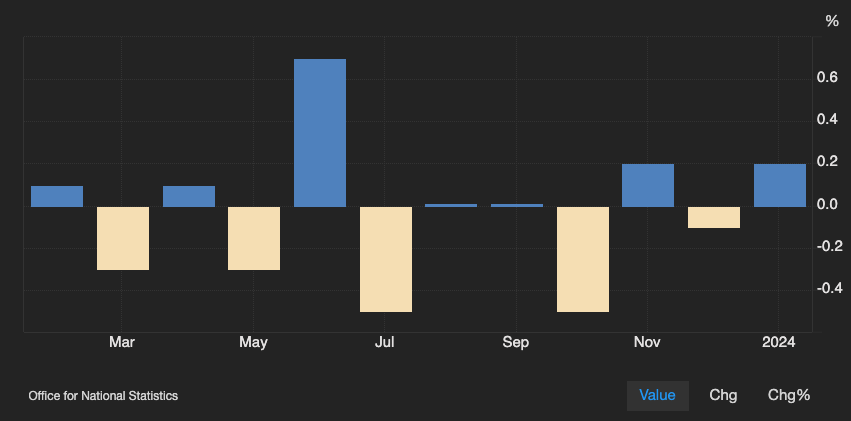

Growth of 0.2% in the UK in January – in line with the consensus – came primarily from higher retail spending. In the three months to January, the British economy shrank by a negligible 0.1%, while preliminary data for the fourth quarter showed a decline of 0.3% in GDP. That the current recession is much less severe than expected so far and took much longer to arrive has been positive for the pound.

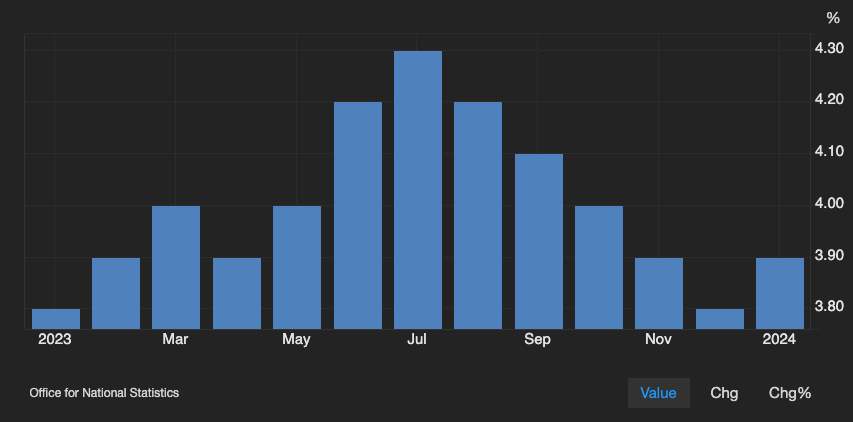

The job market in the UK has also performed reasonably well considering the circumstances over the last few months. Unemployment rose in January but only very slightly:

3.9% unemployment in January is still very close to the post-Covid low of 3.6% reached in August 2022. The number of claimants last month, 16,000, was lower than the expected 20,000, but average hourly earnings for January increased by 0.1% less than the consensus. Necessarily the BoE would like to see a cooling down of the job market before it starts to cut rates, but it’s also understandably keen to avoid exacerbating the recession.

These are some of the reasons for participants pricing in a cut by the BoE in August rather than in June as for the Fed and ECB. The start of the pivot by central banks has been pushed back pretty consistently since the end of last year, though, so it’s likely to see more changes over the next few months.

The focus for the pound is likely to remain on inflation, GDP and jobs in the near future, but further ahead traders also need to monitor this year’s general election. Given Conservative polling recently, an election in May seems increasingly unlikely although it hasn’t been ruled out.

Cable, Daily

Cable briefly broke out of its range around last week’s NFP, moving up to nearly $1.29 before retreating again this week. Expectations that the Fed will cut in June have held in March so far while American inflation for February came in slightly higher than the consensus on Tuesday as widely expected.

Although the golden cross of the 20 and 50 SMAs and the rejection on 12 March suggest a short-term buy signal, the price is very close to overbought based on both the slow stochastic and Bollinger Bands. Even if the price breaches $1.39, $1.40 is a round number and likely to be a strong psychological resistance.

American PPI and Michigan sentiment could have some effect this week, but the critical releases are next week, British inflation and the Fed’s meeting, both on Wednesday, followed by the BoE on Thursday. In the meantime, early February’s high around $1.275 might flip to being a support given the relatively strong upward reaction around there after inflation.

Pound-yen, Daily

Much like cable, the pound has bounced back against the yen in recent days after relatively positive British data. However, Japan’s latest GDP release showed that a technical recession has been averted for now, and there are rumours that the Bank of Japan might even consider tightening policy at its meeting next week. There remains some speculation that Japan’s government or central bank might intervene if the yen continues to lose significant value.

On the chart, the situation seems at first glance more favourable for buyers than cable. The slow stochastic is close to oversold and the price has retracemed more than GBPUSD, while the previous context for most of 2024 so far was an uptrend rather than a sideways trend. A clear break above ¥191.50 seems unlikely in the near future unless next week’s release are notably surprising, but a retest of recent highs might be possible if the bounce continues.

To the downside, ¥186 seems to be an obvious support – this was the area of February’s lows and is the current zone of the 100 SMA. The next key drivers from news are likely to be the Bank of Japan’s meeting early on Tuesday 19 March, British inflation the following day and the BoE on Thursday 21 March.

The opinions in this article are personal to the writer. They do not reflect those of Exness or FX Empire.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance