The Home Depot Inc's Dividend Analysis

Exploring the Sustainability and Growth of Home Depot's Dividends

Introduction to The Home Depot Inc's Latest Dividend Announcement

The Home Depot Inc (NYSE:HD) recently declared a dividend of $2.25 per share, scheduled for payment on June 13, 2024, with the ex-dividend date on May 30, 2024. This announcement has drawn attention to the company's consistent dividend history, current yield, and growth rates. Utilizing data from GuruFocus, we will delve into the dividend performance of The Home Depot Inc and evaluate its future sustainability.

Overview of The Home Depot Inc

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

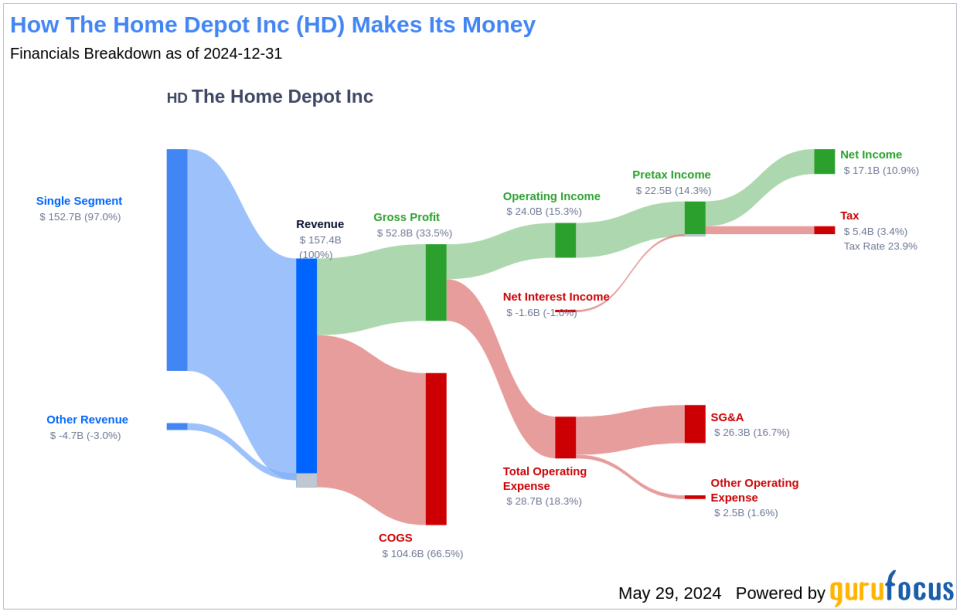

As the world's largest home improvement specialty retailer, The Home Depot Inc operates over 2,300 warehouse-format stores across the United States, Canada, and Mexico. The stores offer a vast range of building materials, home improvement products, and services such as installation and equipment rentals. Significant acquisitions such as Interline Brands and HD Supply have broadened The Home Depot Inc's market reach into the maintenance, repair, and operations sector, enhancing its product offerings and service capabilities.

The Home Depot Inc's Dividend Track Record

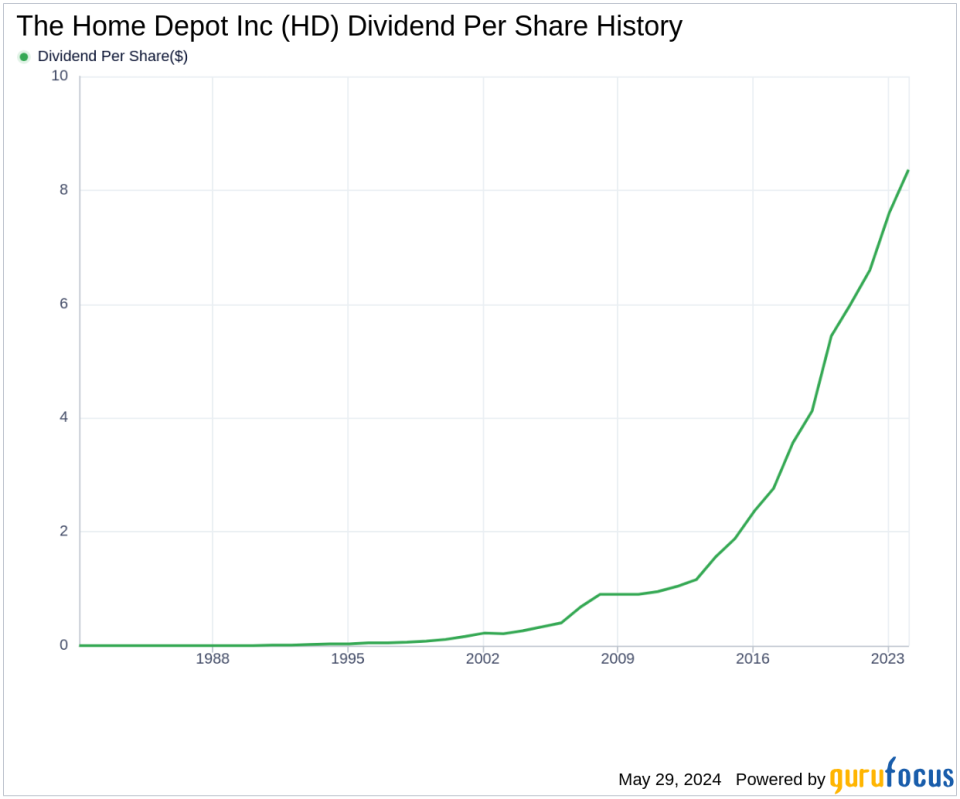

Since 1987, The Home Depot Inc has upheld a steady record of dividend payments, distributed quarterly. Remarkably, the company has increased its dividend annually since 2003, earning it the status of a dividend achiever. This title is reserved for companies that have consistently raised their dividends for at least 21 consecutive years.

Analyzing Dividend Yield and Growth

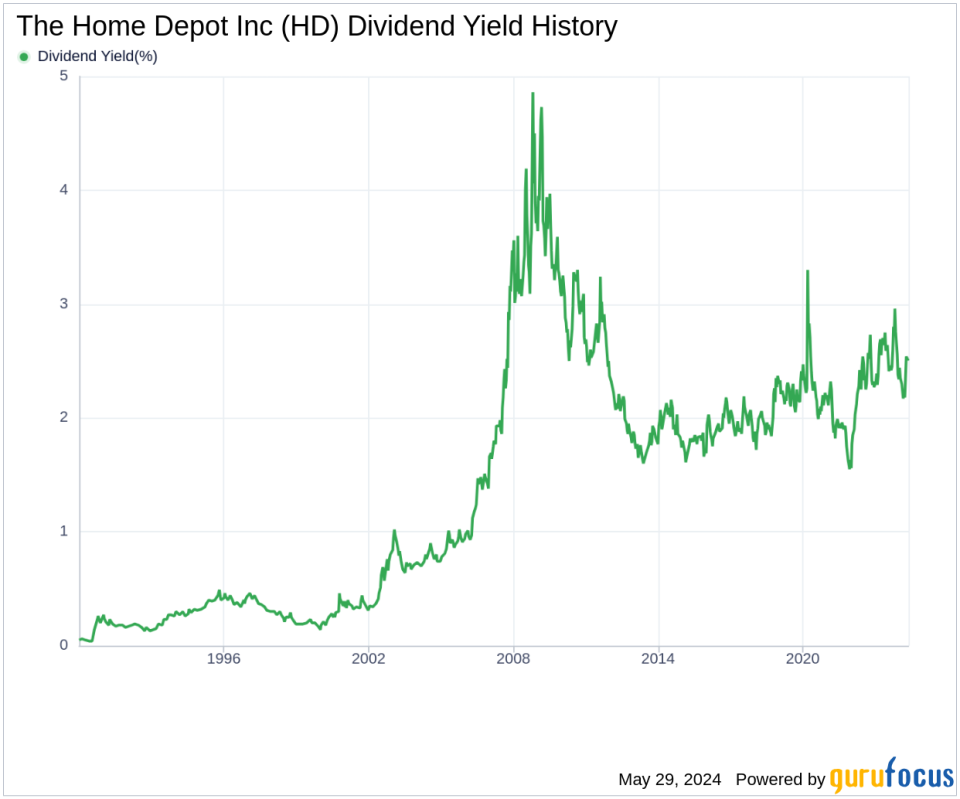

The Home Depot Inc currently boasts a trailing dividend yield of 2.59% and a forward dividend yield of 2.73%, indicating anticipated increases in dividend payments over the next year. Over the past three, five, and ten years, the annual dividend growth rates have been 11.70%, 14.20%, and 18.90% respectively, demonstrating robust long-term growth. The 5-year yield on cost for The Home Depot Inc stock is approximately 5.03%.

Evaluating Dividend Sustainability

The sustainability of dividends is often gauged by the dividend payout ratio, which for The Home Depot Inc stands at 0.57 as of April 30, 2024. This ratio indicates a healthy balance between money distributed as dividends and funds retained for growth. The Home Depot Inc's profitability rank is 9 out of 10, reflecting strong earnings capabilities, further supported by consistent positive net income over the past decade.

Future Growth Prospects

For dividends to be sustainable, a company must exhibit solid growth metrics. The Home Depot Inc's growth rank is 9 out of 10, suggesting promising growth relative to its competitors. Key growth indicators such as revenue per share and 3-year revenue growth rate of 7.50% annually outperform 55.84% of global competitors. Additionally, the 3-year EPS growth rate and 5-year EBITDA growth rate are 8.20% and 11.60% respectively, outperforming many global competitors.

Conclusion

The analysis of The Home Depot Inc's dividend payments, growth rates, payout ratio, and overall financial health suggests a strong outlook for dividend sustainability. Investors seeking to explore more high-dividend yield opportunities can utilize tools like the High Dividend Yield Screener available for GuruFocus Premium users.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance