Home Depot (HD) Stock Falls as Q1 Earnings & Sales Decline Y/Y

The Home Depot, Inc. HD has reported dismal first-quarter fiscal 2023 results, with the top and bottom lines declining year over year. Earnings surpassed the Zacks Consensus Estimate, while sales missed the same. Results have been impacted by a more broad-based pressure across the business, driven by softened demand versus expectations. A deflation in lumber prices and unfavorable weather have also hurt the results.

Home Depot's earnings of $3.82 per share declined 6.6% from $4.09 registered in the year-ago quarter. The bottom line beat the Zacks Consensus Estimate of $3.80 but missed our estimate of $3.86.

Net sales declined 4.2% to $37,257 million from $38,908 million in the year-ago quarter. The metric also missed the Zacks Consensus Estimate of $38,510 million and our estimate of $38,796.9 million. Lower-than-expected sales mainly resulted from lumber deflation and adverse weather conditions, primarily in the Western division, which was impacted by extreme weather in California.

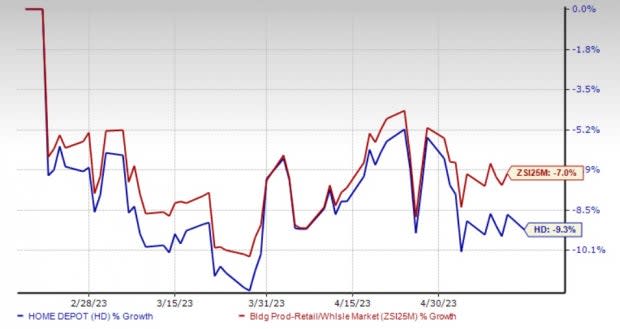

Driven by the soft performance, Home Depot’s shares declined 4.75% in the pre-market trading session on May 16, 2023. The Zacks Rank #3 (Hold) company’s shares have lost 9.3% in the past three months compared with the industry's decline of 7%.

Image Source: Zacks Investment Research

Home Depot's comparable sales fell 4.5% in the reported quarter. The company’s comparable sales in the United States declined 4.6%. Comps were impacted by a decline in customer transactions, partly offset by a rise in average ticket. Customer transactions declined 4.8% year over year, while the average ticket rose 0.2%. Sales per retail square foot were down 4.7%.

In dollar terms, the gross profit dipped 4.5% to $12,557 million from $13,145 million in the year-ago quarter. The operating income fell 6.4% year over year to $5,929 million.

Selling, general and administrative expenses of $6,355 million declined 3.9% from the $6,610 million reported in the year-ago quarter.

The Home Depot, Inc. Price, Consensus and EPS Surprise

The Home Depot, Inc. price-consensus-eps-surprise-chart | The Home Depot, Inc. Quote

Other Updates

Home Depot ended first-quarter fiscal 2023 with cash and cash equivalents of $1,260 million, long-term debt (excluding current installments) of $40,915 million, and shareholders' equity of $362 million. In first-quarter fiscal 2023, the company generated $5,614 million of net cash from operations.

Fiscal 2023 View

Driven by the impacts of lumber deflation and weather on first-quarter fiscal 2023 results, as well as expectations of softened consumer demand, Home Depot lowered its sales and earnings view for fiscal 2023.

Home Depot anticipates sales and comparable sales to decline 2-5% year over year in fiscal 2023, compared with the prior mentioned view of flat year-over-year results. The operating margin rate is estimated at 14-14.3% compared with the 14.5% mentioned earlier.

The company expects an effective tax rate of 24.5% in fiscal 2023. Interest expenses are likely to be $1.8 billion in fiscal 2023. HD estimates earnings per share to move down 7-13% year over year in fiscal 2023 versus a mid-single-digit decline stated earlier.

Solid Retail Bets

Some better-ranked stocks are Tecnoglass TGLS, Builders FirstSource BLDR and Fastenal FAST.

Tecnoglass, which engages in manufacturing and selling architectural glass and windows and aluminum products for the residential and commercial construction industries, sports a Zacks Rank #1 (Strong Buy). TGLS has a trailing four-quarter earnings surprise of 22.7%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Tecnoglass’ current financial-year sales and earnings per share (EPS) suggests growth of 18.11% and 23.8%, respectively, from the year-ago period’s reported figures.

Builders FirstSource, the largest supplier of building materials, manufactured components and construction services, presently carries a Zacks Rank #2 (Buy). BLDR has a trailing four-quarter earnings surprise of 68.3%, on average.

The Zacks Consensus Estimate for Builders FirstSource’s current-year sales and EPS suggests declines of 29.5% and 50.4%, respectively, from the year-ago period’s reported numbers.

Fastenal, a national wholesale distributor of industrial and construction supplies, currently carries a Zacks Rank of 2. FAST delivered an earnings surprise of 3.2% in the last reported quarter.

The Zacks Consensus Estimate for Fastenal’s current financial-year sales and EPS suggests growth of 5.4% and 4.8%, respectively, from the year-ago reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fastenal Company (FAST) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

Builders FirstSource, Inc. (BLDR) : Free Stock Analysis Report

Tecnoglass Inc. (TGLS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance