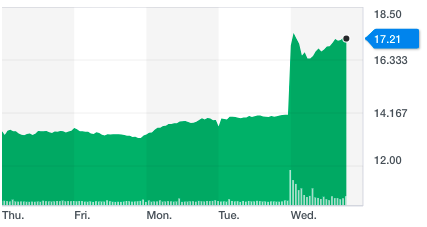

Home Capital shares pop, but naysayers unconvinced

A stronger-than-expected earnings report is making Home Capital’s stock pop. But the alternative mortgage lender with a checkered past may not be completely out of the woods yet.

Once a stock market darling, Home Capital (HCG.TO) nearly went under two years ago before Warren Buffett stepped in with a cash infusion.

Today the company announced it made $32.6 million dollars in the third quarter.

That’s better than the same period last year, when its net income was $30 million dollars. Mortgages jumped 237 per cent.

Chief executive Yousry Bissada says its latest earnings “demonstrate continued progress in all lines of business.” But not everyone is convinced Home Capital has a bright future.

“Nothing has changed at Home Capital, nothing and buying stock at 17 after selling it at 10 is just so Canadian,” high-profiled short-seller Marc Cohodes told Yahoo Finance Canada.

How Home Capital did it

Cohodes has been short Home Capital shares since the fall of 2014 and thinks Canada’s housing market is primed for a bust. Others take issue with how Home Capital boosted its bottom line. Lightwater Partners’ Jerome Hass told Yahoo Finance Canada he has a number of concerns with the report.

“High growth (49 per cent) in commercial mortgages originations, a riskier asset class than residential mortgages,” says Hass. “Much higher growth rates for originations than loan growth (a problem that has plagued HCG for years). Hass also cites low levels of provisions and the way Home Capital is relaying key details about a plan to buy back shares.

“New management has taken a page from the old HCG playbook by not immediately announcing a price for its Substantial Issuer Bid, ” says Hass “This is an efficient way to boost the share price, as short sellers scramble to cover ahead of the SIB (hence today’s move).”

Hass is not currently short Home Capital, but has shorted the stock many times in the past, and is keeping an eye on the company for future short opportunities.

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance