Hilton (HLT) Q3 Earnings Miss Estimates, Revenues Surpass

Hilton Worldwide Holdings Inc. HLT reported third-quarter 2021 results, with earnings missing the Zacks Consensus Estimate and revenues beating the same. However, the top and bottom line increased on a year-over-year basis. Global recovery from the COVID-19 pandemic along with upward trend in travel and tourism contributed to the company’s performance.

In this regard, Christopher J. Nassetta, president & CEO of Hilton, stated, "We are pleased with our third quarter results which continue to reflect recovery from the adverse impact of the COVID-19 pandemic. Leisure travel remained strong and business travel continued to pick up during the quarter. We continue to expand our global footprint driven by the power of our industry-leading brand portfolio.”

As of Sep 30, 2021, 99% of Hilton's global hotel properties were open, while nearly 88 hotels had temporarily suspended operations due to the coronavirus crisis. The company anticipates to open nearly all of its system-wide hotels by 2021-end.

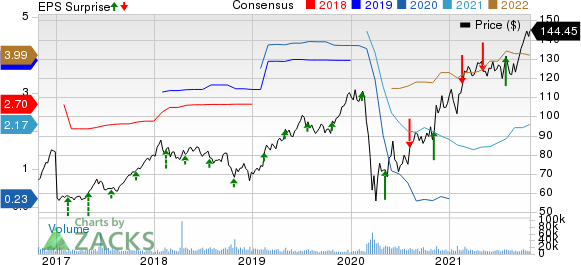

Hilton Worldwide Holdings Inc. Price, Consensus and EPS Surprise

Hilton Worldwide Holdings Inc. price-consensus-eps-surprise-chart | Hilton Worldwide Holdings Inc. Quote

Q3 in Detail

Hilton reported adjusted earnings per share (EPS) of 78 cents, missing the Zacks Consensus Estimate of 80 cents. In the prior-year quarter, the company had reported adjusted earnings per share of 6 cents.

Quarterly revenues of $1,749 million beat the consensus mark of $1,694 million. Moreover, the top line surged 87.5% from the year-ago quarter’s levels.

RevPAR and Adjusted EBITDA

In the quarter under review, system-wide comparable revenue per available room (RevPAR) increased 98.7% year over year (on a currency-neutral basis) owing to an increase in occupancy and average daily rate (ADR). However, RevPAR is down 18.8% compared with 2019 levels.

During the quarter, fee revenues increased 93% year over year. Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) during the third quarter was $519 million compared with $224 million reported in the prior-year quarter.

Cash & Debt

As of Sep 30, 2021, cash and cash equivalent balance (inclusive of restricted cash) amounted to $1,387 million compared with $1,127 million in the previous quarter. The company reported long-term debt outstanding of $8.9 billion (flat sequentially), excluding deferred financing costs and discounts, with a weighted average interest rate of approximately 4%.

Business Updates

During third-quarter 2021, Hilton opened 96 new hotels. It also achieved net unit growth of nearly 11,200 rooms. During the quarter, the company opened the 500th hotel under its Home2 Suites by Hilton brand. It also announced the opening of three new hotels under LXR Hotels & Resorts.

As of Sep 30, 2021, Hilton's development pipeline comprised nearly 2,620 hotels, with nearly 404,000 rooms across 114 countries and territories — including 27 countries and territories where it currently does not have any running hotels. Moreover, 249,000 rooms in the development pipeline were located outside the United States and 204,000 rooms were under construction. For 2021, the company expects net unit growth in the range of 5-5.5%.

Zacks Rank & Key Picks

Hilton currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the same space are Civeo Corporation CVEO, Wyndham Hotels & Resorts, Inc. WH and Choice Hotels International, Inc. CHH. Civeo sports a Zacks Rank #1, while Wyndham Hotels and Choice Hotels carry a Zacks Rank #2 (Buy).

Civeo has a three-five-year EPS growth rate of 10%.

Wyndham Hotels has a trailing four-quarter earnings surprise of 59.3%, on average.

2021 earnings for Choice Hotels are expected to rise 77%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Choice Hotels International, Inc. (CHH) : Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT) : Free Stock Analysis Report

Civeo Corporation (CVEO) : Free Stock Analysis Report

Wyndham Hotels & Resorts (WH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance