Hillman Solutions Corp (HLMN) Reports Narrowed Net Loss in Q4, Strong Cash Flow for Fiscal 2023

Net Sales: Q4 net sales slightly down by 0.8% year-over-year, but up 3.8% on a comparable 13-week basis.

Net Loss: Q4 net loss improved to $(10.1) million from $(13.9) million in the prior year quarter.

Adjusted EBITDA: Increased to $54.4 million in Q4, and $219.4 million for the full year.

Free Cash Flow: Substantial growth to $172.3 million for the full year, compared to $49.4 million in the prior year.

Debt Reduction: Gross debt reduced to $761 million, down from $919 million at the end of 2022.

Liquidity: Improved with approximately $285 million available, including cash and credit facilities.

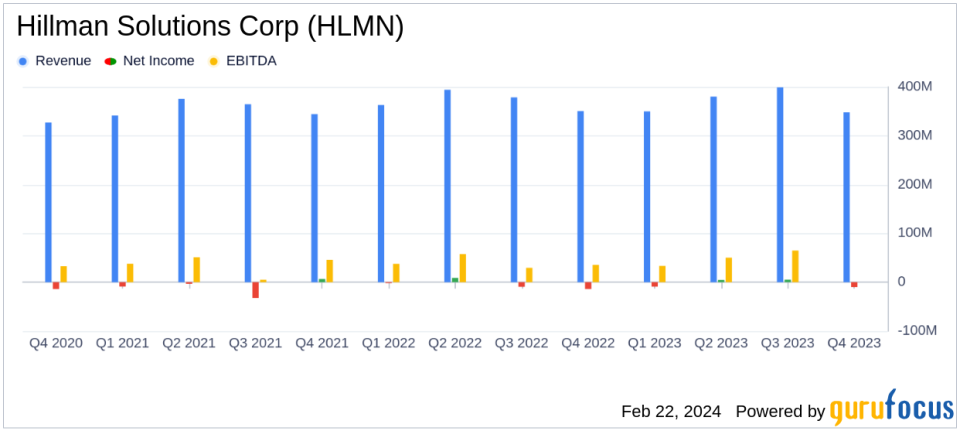

On February 22, 2024, Hillman Solutions Corp (NASDAQ:HLMN), a leading provider of hardware products and merchandising solutions, released its 8-K filing, detailing the financial results for the fourth quarter and full fiscal year of 2023. The company, which serves a diverse retail market including hardware stores, home centers, and mass merchants across North America, reported a slight decrease in net sales for the fourth quarter, with a 0.8% drop to $347.8 million compared to the previous year. However, when adjusted for the extra week in 2022, sales actually increased by 3.8%. The full-year net sales also saw a marginal decrease of 0.7% to $1.48 billion.

Hillman's net loss for the fourth quarter improved, totaling $(10.1) million, or $(0.05) per diluted share, compared to a net loss of $(13.9) million, or $(0.07) per diluted share, in the prior year quarter. The full-year net loss also improved to $(9.6) million from $(16.4) million in the previous year. Adjusted EBITDA for the quarter increased to $54.4 million from $45.0 million in the prior year quarter, and the full-year adjusted EBITDA rose to $219.4 million from $210.2 million.

One of the most notable achievements for Hillman in 2023 was the significant increase in free cash flow, which totaled $172.3 million for the year, a substantial improvement from $49.4 million in the prior year. This strong cash flow performance enabled the company to reduce its gross debt from $919 million at the end of 2022 to $761 million at the end of 2023. The company's net debt to trailing twelve-month Adjusted EBITDA ratio also improved to 3.3x from 4.2x at the end of 2022.

Management's Perspective

Chairman, President, and CEO Doug Cahill expressed pride in the company's operational achievements, highlighting the reduction of debt by $160 million and inventory by $100 million while maintaining high fill rates for customers. Cahill also noted the acquisition of Koch Industries, a leading provider of rope and chain, as a strategic expansion into a new product category. Looking ahead to 2024, Hillman anticipates continued operational efficiency, margin expansion, and normalized cash flows following a record year in 2023.

"2023 was a remarkable operational year for the Hillman team," commented Doug Cahill. "We were also able to execute new business wins with some of our biggest customers which helped offset the macro environment."

The company provided guidance for the full year 2024, projecting net sales between $1.475 to $1.555 billion, Adjusted EBITDA of $230 to $240 million, and free cash flow of $100 to $120 million.

Financial Statements Overview

The condensed consolidated statement of net income shows the detailed figures behind the net loss improvement, with a decrease in cost of sales and a slight increase in income from operations. The balance sheet reflects a stronger liquidity position with increased cash and equivalents and a reduction in long-term debt. The statement of cash flows underscores the company's operational efficiency, with a significant increase in net cash provided by operating activities.

Hillman Solutions Corp's performance in 2023, particularly the improved net loss and strong free cash flow, is indicative of the company's resilience and strategic management in a challenging economic environment. The reduction in debt and improved liquidity position the company well for future growth and operational efficiency. As Hillman celebrates its 60th year in business in 2024, investors and stakeholders have reasons to be optimistic about the company's direction and financial health.

For a more detailed analysis of Hillman Solutions Corp's financial results and future outlook, visit GuruFocus.com for comprehensive reports and investment insights.

Explore the complete 8-K earnings release (here) from Hillman Solutions Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance