Will Higher Costs Impact Chipotle's (CMG) Q1 Earnings?

Chipotle Mexican Grill, Inc. CMG is scheduled to report first-quarter 2018 earnings on Apr 25, after market close.

Last quarter, the company’s earnings surpassed the Zacks Consensus Estimate by 1.5%. Moreover, it surpassed estimates in three of the trailing four quarters, with an average beat of 4.8%.

What to Expect?

The Zacks Consensus Estimate for the quarter under review is pegged at $1.53, which is lower than $1.60 in the year-ago quarter. Also, the consensus mark has witnessed a sharp downward revision of 64 cents over the past 90 days. However, analysts polled by Zacks expect revenues of nearly $1,148 million, up 7.4% from the prior-year quarter.

Chipotle has been particularly plagued by negative publicity related to food-borne illnesses, which surfaced toward 2015-end and continued through 2016. Since then, the company has undertaken many safety measures and sales-building initiatives to revive its top line.

Let’s take a look at how the company’s top and bottom lines will shape up in the to-be-reported quarter.

Factors at Play

Strategic Initiatives to Drive Sales

Chipotle’s top line, which witnessed a sharp increase of 7.3% in fourth-quarter 2017, is likely to continue with the momentum in the quarter to be reported. The company’s strong marketing initiatives, ongoing improvements in customer experience, improved digital ordering channels and increased focus on menu innovation are the key growth drivers.

Additionally, Chipotle is continuously trying to recover sales by shifting its strategy from giveaways, discounts and rewards to new menu items, operational excellence and enhancement of guest experience. Toward this end, the company rolled out queso nationally in the third quarter of 2017, following which it witnessed an immediate increase in sales. This uptick is expected to continue in the to-be-reported quarter as well.

In the fourth quarter, the company implemented a menu price increase at an additional 900 restaurants that should help boost the company’s top-line performance. In addition, management is designing a new beverage program for Chipotle, which includes a complete redesign of the beverages it serves and how they are merchandised to customers.

Furthermore, Chipotle’s focus on developing new food safety protocols is impressive. These protocols include DNA-based testing of several ingredients coupled with changes to food preparation and food handling practices. The company’s enhanced focus on making better food accessible to everyone should also drive traffic in the first quarter.

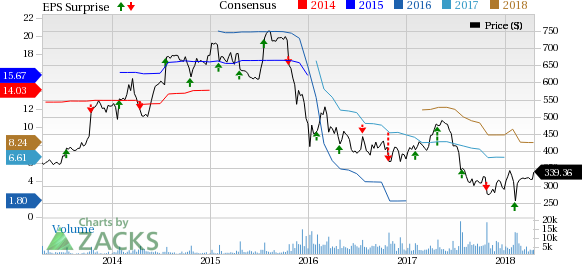

Chipotle Mexican Grill, Inc. Price, Consensus and EPS Surprise

Chipotle Mexican Grill, Inc. Price, Consensus and EPS Surprise | Chipotle Mexican Grill, Inc. Quote

Higher Costs

Chipotle is making efforts to connect with its customers in order to retrieve their trust and loyalty as well as bring them back to its stores. Although these initiatives are backed by high marketing and promo expenses, the same might hurt the company’s profitability. Moreover, implementation of food safety practices has increased the amount of labor required to prepare and serve food. This, in turn, raises labor costs, which could possibly weigh on the profit margin. In the first quarter, Chipotle expects other operating expenses to be nearly 15% of sales.

What Does the Zacks Model Say?

Our proven model shows that Chipotle is likely to beat estimates this quarter. This is because a stock needs to have both — a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP — for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Chipotle has an Eanings ESP of +0.79% and a Zacks Rank #3, which make us reasonably confident of an earnings beat.

Other Stocks Poised to Beat Earnings Estimates

Here are a few stocks from the restaurant space that investors may consider, as our model shows that they have the right combination of elements to post an earnings beat this quarter:

Domino's Pizza, Inc. DPZ has an Earnings ESP of +0.38% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Brinker International, Inc. EAT has an Earnings ESP of +1.66% and a Zacks Rank of 3.

Wingstop Inc. WING has an Earnings ESP of +3.80% and a Zacks Rank #3.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chipotle Mexican Grill, Inc. (CMG) : Free Stock Analysis Report

Domino's Pizza Inc (DPZ) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report

Brinker International, Inc. (EAT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance