High Insider Ownership Growth Stocks On TSX To Watch In June 2024

As Canada navigates a complex economic landscape marked by cautious interest rate cuts and uneven consumer sentiment, the Toronto Stock Exchange (TSX) continues to showcase resilience with sectors experiencing varying degrees of growth. In this context, stocks with high insider ownership can be particularly intriguing, as they often indicate a strong alignment between company management and shareholder interests, potentially offering stability amidst market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

Vox Royalty (TSX:VOXR) | 12.3% | 58.7% |

Payfare (TSX:PAY) | 15% | 46.7% |

goeasy (TSX:GSY) | 21.5% | 15.8% |

Propel Holdings (TSX:PRL) | 40% | 36.4% |

Aritzia (TSX:ATZ) | 19.1% | 51.2% |

Aya Gold & Silver (TSX:AYA) | 10.2% | 51.6% |

Ivanhoe Mines (TSX:IVN) | 13.1% | 66.3% |

Magna Mining (TSXV:NICU) | 10.6% | 95.1% |

Artemis Gold (TSXV:ARTG) | 31.8% | 48.8% |

Almonty Industries (TSX:AII) | 12.3% | 105% |

We'll examine a selection from our screener results.

goeasy

Simply Wall St Growth Rating: ★★★★★☆

Overview: goeasy Ltd. operates in Canada, offering non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands with a market capitalization of CA$3.14 billion.

Operations: The company generates revenue through its easyhome and easyfinancial segments, with CA$153.99 million and CA$1.17 billion respectively.

Insider Ownership: 21.5%

Earnings Growth Forecast: 15.8% p.a.

goeasy Ltd., a growth-oriented company with high insider ownership, recently appointed Patrick Ens to bolster its leadership amid expanding operations. Despite a slight dip in quarterly sales to CA$24.74 million, revenue surged to CA$357.11 million due to robust financial performance, with net income rising to CA$58.94 million. The firm's revenue is expected to grow at 32.4% annually, outpacing the Canadian market forecast of 7.2%. However, despite substantial insider purchases over three months indicating confidence, concerns about debt coverage and dividend sustainability persist due to inadequate cash flow coverage.

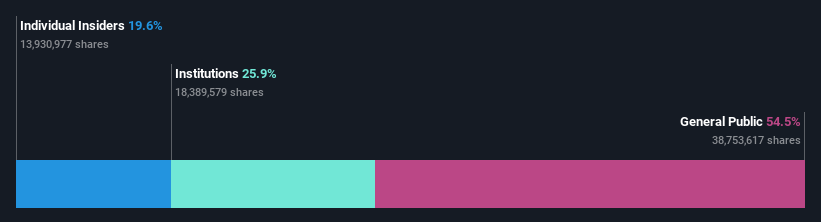

Savaria

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Savaria Corporation operates in providing accessibility solutions for the elderly and physically challenged across Canada, the United States, Europe, and internationally, with a market capitalization of approximately CA$1.27 billion.

Operations: The company generates revenue primarily from its Patient Care segment, which amounted to CA$183.82 million.

Insider Ownership: 19.6%

Earnings Growth Forecast: 24.9% p.a.

Savaria, recognized for its substantial insider ownership and growth potential, is trading at a significant discount to its estimated fair value. Analysts predict a notable 24.9% annual earnings growth over the next three years, surpassing the Canadian market's growth rate. Recent insider buying trends underscore confidence in the company's prospects. Additionally, Savaria maintains a steady dividend payout, with recent affirmations reinforcing its commitment to shareholder returns amidst leadership enhancements and robust quarterly earnings performance.

Dive into the specifics of Savaria here with our thorough growth forecast report.

The valuation report we've compiled suggests that Savaria's current price could be quite moderate.

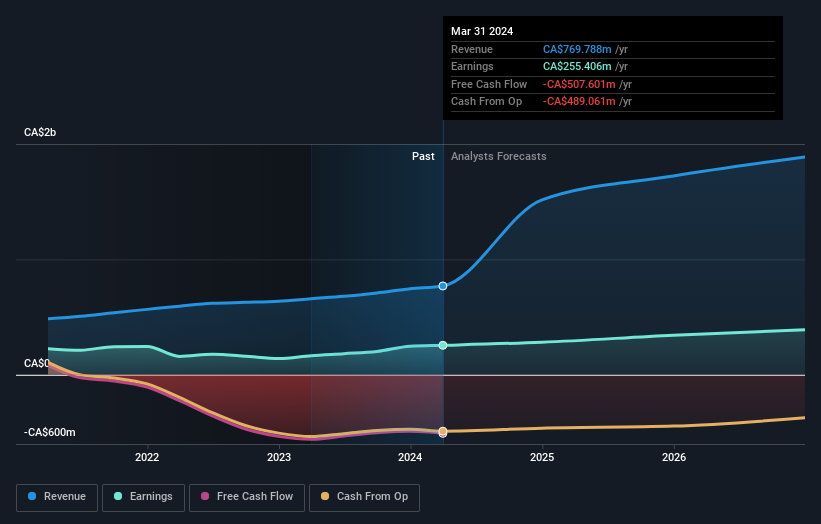

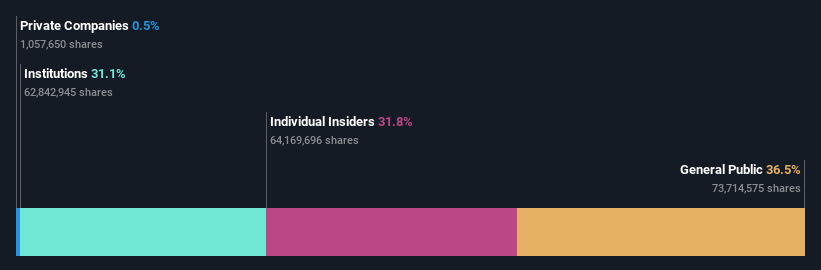

Artemis Gold

Simply Wall St Growth Rating: ★★★★★☆

Overview: Artemis Gold Inc. is a gold development company that specializes in identifying, acquiring, and developing gold properties, with a market capitalization of approximately CA$2.05 billion.

Operations: The company specializes in the gold sector, focusing exclusively on the development and potential future revenues from its gold properties.

Insider Ownership: 31.8%

Earnings Growth Forecast: 48.8% p.a.

Artemis Gold, with high insider ownership, is navigating a challenging phase marked by a significant net loss of CA$6.65 million in Q1 2024 but remains on track with its Blackwater Mine project. The company's revenue is expected to grow at 52.5% annually, outpacing the Canadian market average significantly. Construction progress and insider transactions reflect confidence, despite recent share dilution and less than CA$1m in current revenue. Artemis is trading well below its fair value estimate, hinting at potential undervaluation amidst ongoing developments.

Summing It All Up

Click here to access our complete index of 29 Fast Growing TSX Companies With High Insider Ownership.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSX:GSY TSX:SIS and TSXV:ARTG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance