High Insider Ownership Growth Stocks On US Exchanges In June 2024

The United States stock market has shown robust growth, climbing 1.6% in the past week and an impressive 21% over the last year, with earnings expected to grow by 15% annually. In such a thriving market, stocks with high insider ownership can be particularly compelling as they often indicate strong confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Celsius Holdings (NasdaqCM:CELH) | 10.5% | 21.4% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15% | 84.1% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 101.9% |

We're going to check out a few of the best picks from our screener tool.

Alkami Technology

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alkami Technology, Inc. provides cloud-based digital banking solutions in the United States, with a market capitalization of approximately $2.53 billion.

Operations: The company generates its revenue primarily from internet software and services, totaling approximately $280.96 million.

Insider Ownership: 14.5%

Earnings Growth Forecast: 92.1% p.a.

Alkami Technology, a growth-focused firm with significant insider ownership, is navigating through a transformative phase. Recently, the company projected Q2 revenues between US$80.5 million and US$82.0 million and annual revenues reaching up to US$333.0 million by year-end 2024. Despite past shareholder dilution, insider transactions have not been substantial in recent months. Alkami's innovative strides include launching Merlin at the Alkami Co:lab conference—a tool set to enhance digital banking efficiency significantly.

APi Group

Simply Wall St Growth Rating: ★★★★☆☆

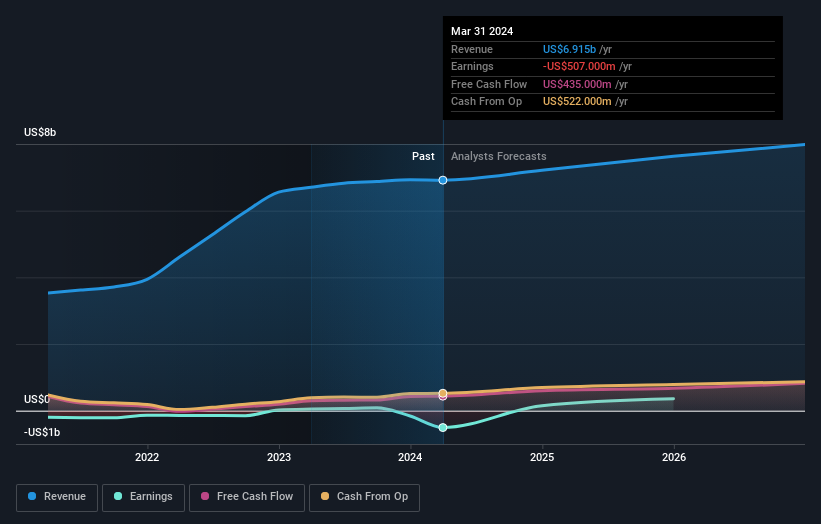

Overview: APi Group Corporation operates globally, offering safety and specialty services with a market capitalization of approximately $10.44 billion.

Operations: The company generates its revenue primarily through two segments: Safety Services, which contributes $4.89 billion, and Specialty Services, including Industrial Services, adding another $2.04 billion.

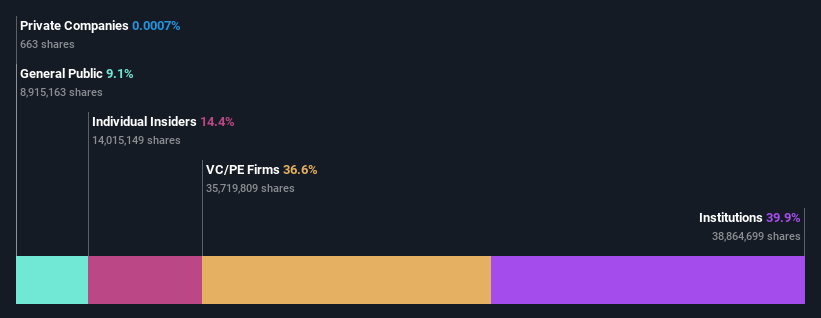

Insider Ownership: 14.8%

Earnings Growth Forecast: 141.4% p.a.

APi Group, amidst a transformative period, recently uplifted its 2024 revenue guidance to between US$7.15 billion and US$7.35 billion. Despite this optimistic outlook and substantial insider ownership, the company's recent financials show mixed results with a notable first-quarter net income increase to US$45 million from US$26 million year-over-year but experienced earnings per share losses. APi's market valuation stands at 43.1% below estimated fair value, suggesting potential undervaluation amidst challenges like shareholder dilution over the past year.

Take a closer look at APi Group's potential here in our earnings growth report.

Our valuation report here indicates APi Group may be undervalued.

Live Oak Bancshares

Simply Wall St Growth Rating: ★★★★☆☆

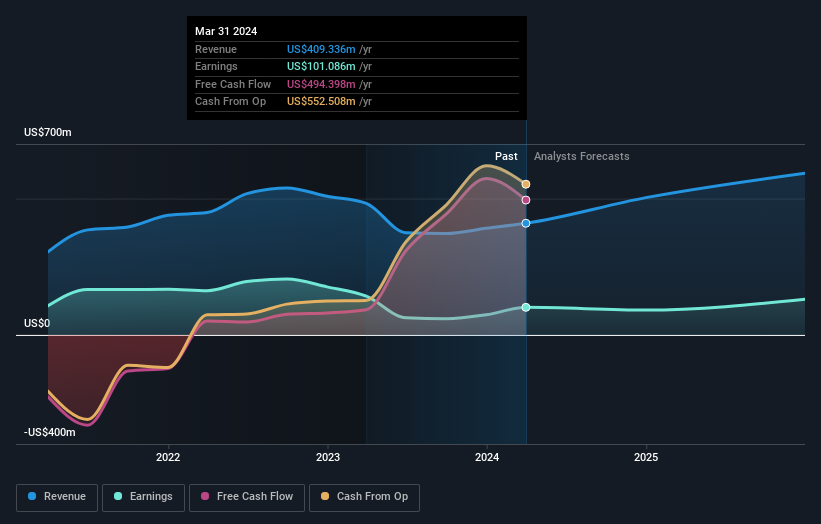

Overview: Live Oak Bancshares, Inc., serving as the bank holding company for Live Oak Banking Company, offers a range of banking products and services across the United States with a market capitalization of approximately $1.46 billion.

Operations: The company generates revenue primarily through its banking segment, contributing $414.49 million, and a smaller fintech segment, which adds $6.77 million.

Insider Ownership: 24.7%

Earnings Growth Forecast: 16.8% p.a.

Live Oak Bancshares has demonstrated strong financial performance with a significant increase in net interest income to US$90.11 million and net income to US$16.55 million for Q1 2024, compared to the previous year. Despite a high level of bad loans at 2.3%, the bank's revenue growth is forecasted at 20.7% annually, outpacing the US market prediction of 8.7%. However, insider transactions have not been substantial in recent months, indicating mixed signals from those closest to company operations.

Seize The Opportunity

Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 179 more companies for you to explore.Click here to unveil our expertly curated list of 182 Fast Growing US Companies With High Insider Ownership.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:ALKT NYSE:APG and NYSE:LOB.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance