High Insider Ownership Growth Stocks On US Exchange In June 2024

As of June 2024, the U.S. stock market continues to demonstrate resilience, with major indices like the S&P 500 and Nasdaq achieving record closes amid a burgeoning interest in AI technologies and their impact on sectors such as semiconductors. In this climate, growth companies with high insider ownership are particularly noteworthy, as significant insider stakes can signal confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Celsius Holdings (NasdaqCM:CELH) | 10.5% | 21.5% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15% | 84.1% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 101.9% |

We'll examine a selection from our screener results.

Bowman Consulting Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bowman Consulting Group Ltd. operates in the United States, offering a variety of solutions including real estate, energy, infrastructure, and environmental management with a market capitalization of approximately $553.67 million.

Operations: The company generates $365.06 million from providing engineering and related professional services.

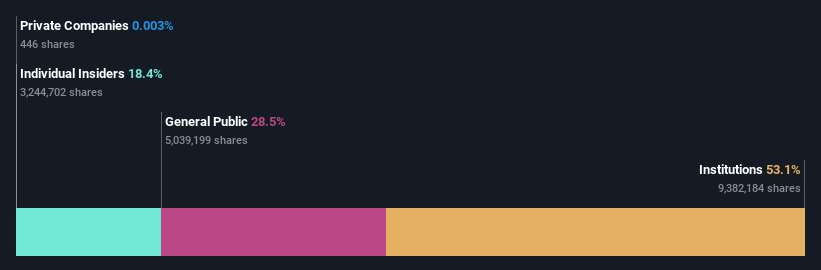

Insider Ownership: 18.5%

Earnings Growth Forecast: 150.4% p.a.

Bowman Consulting Group Ltd., a growth-oriented company with substantial insider transactions, is forecasted to achieve profitability within three years, outpacing average market expectations. Despite recent significant insider selling, the firm's stock is considered undervalued at 37.6% below its estimated fair value. Analyst consensus suggests a potential price increase of 37.2%. Additionally, Bowman has secured a major contract with the Arizona Department of Transportation, enhancing its public sector footprint and demonstrating strategic growth in new markets.

Himax Technologies

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Himax Technologies, Inc. is a fabless semiconductor company that specializes in display imaging processing technologies with operations across China, Taiwan, the Philippines, Korea, Japan, Europe, and the United States, boasting a market cap of approximately $1.17 billion.

Operations: The company generates its revenue through the provision of display imaging processing technologies across various regions including China, Taiwan, the Philippines, Korea, Japan, Europe, and the United States.

Insider Ownership: 29.1%

Earnings Growth Forecast: 30.6% p.a.

Himax Technologies, a company with significant growth potential and high insider ownership, is trading below the semiconductor industry average with a Price-To-Earnings ratio of 26.9x. Despite lower profit margins this year compared to last, Himax's earnings are expected to grow by 30.6% annually, outpacing the US market forecast of 14.8%. Recent strategic collaborations, like integrating WiseEye™ AI with NVIDIA TAO and E Ink for smart retail solutions, underscore its innovation trajectory and commitment to maintaining competitive edge in AI-driven applications.

PDF Solutions

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PDF Solutions, Inc. offers software and intellectual property products for integrated circuit designs, along with electrical measurement hardware tools and professional services across the United States, China, Japan, and other international markets, with a market cap of approximately $1.31 billion.

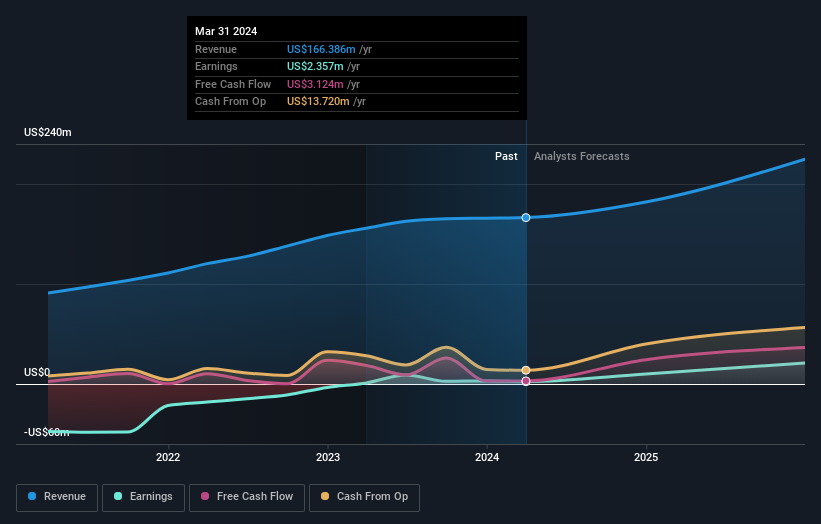

Operations: The company generates revenue primarily from its Software & Programming segment, which amounted to $166.39 million.

Insider Ownership: 17.4%

Earnings Growth Forecast: 95.6% p.a.

PDF Solutions, despite a recent net loss of US$0.393 million, is poised for substantial growth with earnings expected to increase by 95.6% annually over the next three years, outperforming the US market forecast of 14.8%. Revenue is also projected to rise by 20% in the second half of 2024 compared to last year. However, there has been significant insider selling in the past three months, which could raise concerns about long-term confidence among insiders.

Taking Advantage

Click this link to deep-dive into the 182 companies within our Fast Growing US Companies With High Insider Ownership screener.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGM:BWMN NasdaqGS:HIMX and NasdaqGS:PDFS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance