High Insider Ownership Growth Companies On US Exchange For June 2024

As the U.S. markets continue to exhibit resilience, with tech stocks like Nvidia leading the charge and indices like the S&P 500 and Nasdaq achieving record closes, investors are keenly observing market dynamics. In such an environment, growth companies with high insider ownership can be particularly compelling, as substantial insider stakes often align management’s interests with those of shareholders, potentially enhancing trust and long-term value in times of economic optimism driven by technological advancements.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Celsius Holdings (NasdaqCM:CELH) | 10.5% | 21.5% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15% | 84.1% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 101.9% |

We'll examine a selection from our screener results.

Liquidia

Simply Wall St Growth Rating: ★★★★★☆

Overview: Liquidia Corporation is a biopharmaceutical company based in the United States, focusing on the development, manufacturing, and commercialization of products aimed at addressing unmet patient needs, with a market capitalization of approximately $1.02 billion.

Operations: The company generates revenue primarily through its pharmaceuticals segment, totaling $15.97 million.

Insider Ownership: 11.2%

Revenue Growth Forecast: 37.8% p.a.

Liquidia, a growth-oriented company with high insider ownership, is currently trading at 59.8% below its estimated fair value and is expected to become profitable within the next three years. Forecasted to grow earnings by 66.26% annually and revenue by 37.8% annually, Liquidia outpaces the U.S. market's average growth rates significantly. Recent legal victories further solidify its pathway to launching YUTREPIA™ for pulmonary hypertension, despite ongoing litigation which does not yet impede its FDA approval process.

Get an in-depth perspective on Liquidia's performance by reading our analyst estimates report here.

Upon reviewing our latest valuation report, Liquidia's share price might be too optimistic.

Genius Sports

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genius Sports Limited specializes in providing technology-driven products and services to the sports, sports betting, and sports media industries, with a market capitalization of approximately $1.10 billion.

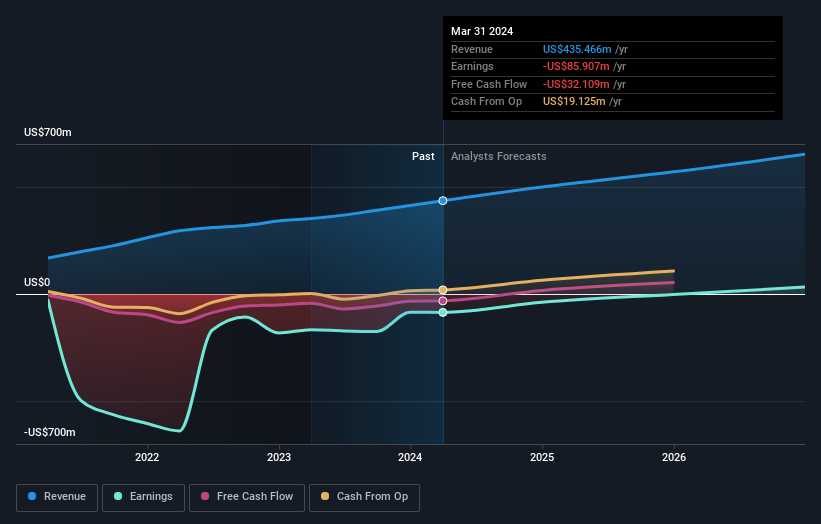

Operations: The company generates revenue primarily from data processing, which amounted to $435.47 million.

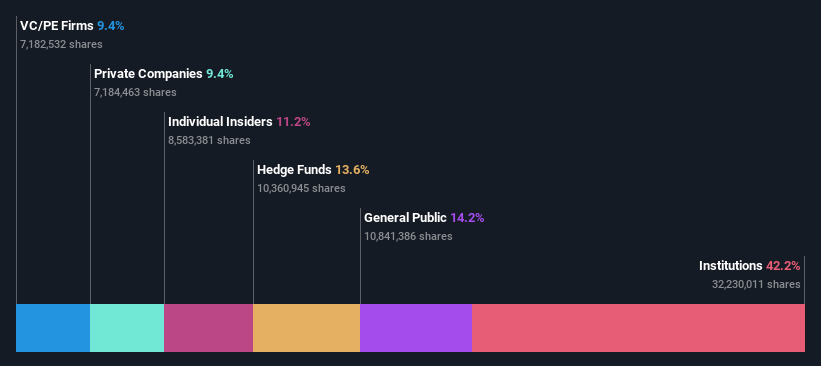

Insider Ownership: 11.8%

Revenue Growth Forecast: 13.5% p.a.

Genius Sports, a growth company with high insider ownership, is trading significantly below its estimated fair value. Analysts predict a substantial 74.4% increase in stock price. Expected to become profitable within three years, GENI's revenue and earnings growth forecasts outpace the U.S. market average, despite a recent net loss in Q1 2024. However, shareholder dilution over the past year and low forecasted return on equity could temper investor enthusiasm.

Similarweb

Simply Wall St Growth Rating: ★★★★★☆

Overview: Similarweb Ltd. offers cloud-based digital intelligence solutions globally, with a market capitalization of approximately $619.21 million.

Operations: The company generates its revenue primarily from the online financial information providers segment, totaling $224.25 million.

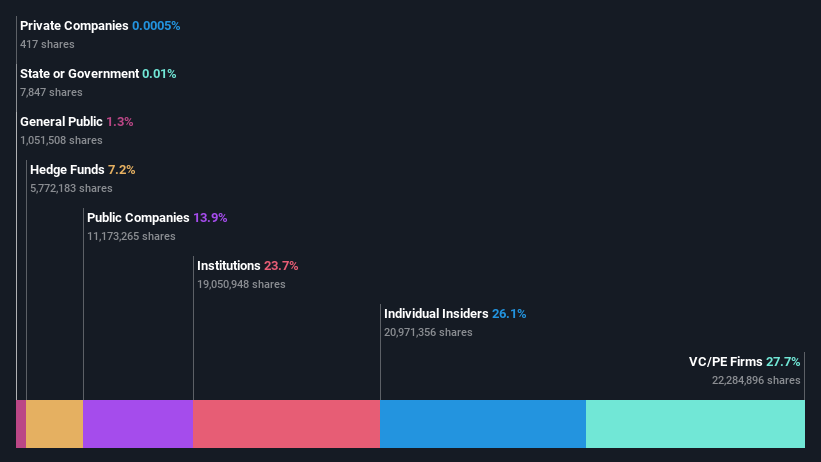

Insider Ownership: 26.1%

Revenue Growth Forecast: 13.5% p.a.

Similarweb, characterized by high insider ownership, is poised for significant growth with revenue expected to outpace the U.S. market. Analyst consensus suggests a potential 38.7% increase in stock price. The company's return on equity is projected to be very high within three years, aligning with its transition to profitability during the same period. Recent collaborations, like with Dstillery, leverage Similarweb’s robust data analytics capabilities, enhancing its market position despite trading below fair value and facing shareholder dilution last year.

Seize The Opportunity

Explore the 182 names from our Fast Growing US Companies With High Insider Ownership screener here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqCM:LQDA NYSE:GENI and NYSE:SMWB.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance