High Insider Ownership Growth Companies On US Exchange June 2024

As of June 2024, the U.S. stock market presents a mixed landscape, with major indices like the Nasdaq and S&P 500 experiencing slight declines amid a broader semiconductor slump. In this environment, identifying growth companies with high insider ownership can offer investors potential stability, as these insiders often have a vested interest in the company's long-term success.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Duolingo (NasdaqGS:DUOL) | 15% | 48% |

Celsius Holdings (NasdaqCM:CELH) | 10.5% | 21.5% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.9% | 84.1% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 101.9% |

Underneath we present a selection of stocks filtered out by our screen.

Morningstar

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Morningstar, Inc. offers independent investment research and insights primarily in the United States and Asia, with a market capitalization of approximately $12.45 billion.

Operations: The company generates its revenue primarily from the online financial information providers segment, totaling approximately $2.10 billion.

Insider Ownership: 36.6%

Morningstar, Inc. has demonstrated a robust turnaround with its earnings growing by 1167.3% over the past year, and it continues to show promise with an expected annual profit growth rate of 20.7%, outpacing the US market's forecast of 14.8%. Despite this, revenue growth predictions are more modest at 9.3% annually, slightly above the market expectation of 8.6%. Insider activity has been balanced, with more purchases than sales in recent months, although not in significant volumes. The firm recently affirmed its quarterly dividend at US$0.405 per share.

Guild Holdings

Simply Wall St Growth Rating: ★★★★★☆

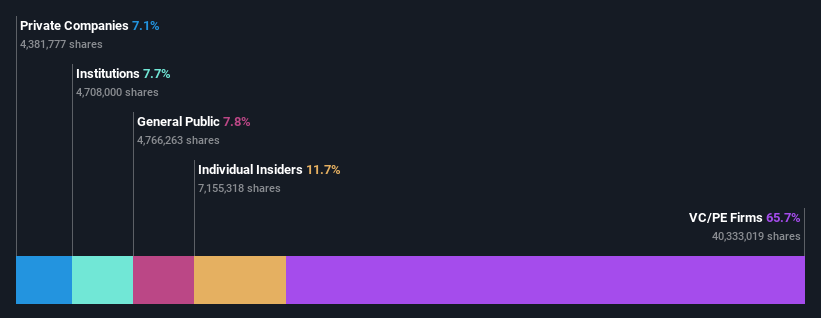

Overview: Guild Holdings Company, operating in the United States, focuses on originating, selling, and servicing residential mortgage loans with a market capitalization of approximately $925.07 million.

Operations: The company's revenue is primarily generated from two segments: originating loans, which brought in $555.18 million, and servicing loans, contributing $190.68 million.

Insider Ownership: 11.7%

Guild Holdings has shown a significant recovery, with recent earnings turning from a loss to a net income of US$28.5 million. Expected to grow earnings by 49% annually, it surpasses the US market forecast of 14.8%. Despite high growth forecasts, profit margins have declined from last year and interest coverage remains weak. Insider transactions have been positive, with more buying than selling recently. The company also announced a special dividend and continued its share buyback program.

Mach Natural Resources

Simply Wall St Growth Rating: ★★★★☆☆

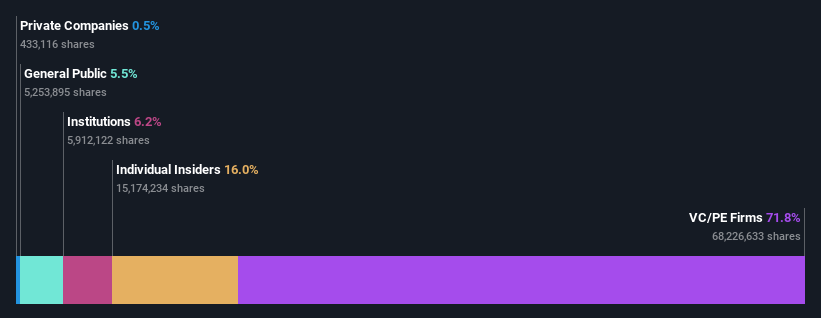

Overview: Mach Natural Resources LP is an independent upstream oil and gas company that specializes in acquiring, developing, and producing oil and natural gas reserves primarily in the Anadarko Basin region of Western Oklahoma, Southern Kansas, and the Texas panhandle, with a market capitalization of approximately $1.81 billion.

Operations: The company generates its revenue primarily from the exploration and production of oil and gas, totaling $758.38 million.

Insider Ownership: 15.1%

Mach Natural Resources has a complex financial landscape marked by robust insider buying trends and a significant forecasted annual earnings growth of 45.4%, outpacing the US market average. However, the company grapples with high debt levels and poor profit margins, which have declined from the previous year. Recent activities include reaffirmed earnings guidance for 2024 and decreased quarterly dividends, reflecting operational adjustments amid fluctuating financial performance.

Seize The Opportunity

Discover the full array of 185 Fast Growing US Companies With High Insider Ownership right here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:MORN NYSE:GHLD and NYSE:MNR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance